Houston, Texas: A Vibrant Metropolis in the Heart of Texas Located in the southeastern region of Texas, Houston is the fourth-largest city in the United States and the most populous city in Texas. Renowned for its diverse population, thriving economy, and rich cultural heritage, Houston offers a unique blend of urban sophistication and southern charm. Let's delve into what makes this city so special and its relevance to the Subsequent Transfer Agreement between LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. in relation to the purchase and sale of mortgage loans. Houston boasts a robust economy, centered around industries such as energy, healthcare, aerospace, and shipping. The city is a global leader in oil and gas, housing numerous energy companies and serving as the headquarters for ExxonMobil, ConocoPhillips, and other major players in the industry. This economic strength paves the way for various financial transactions, including extensive mortgage lending activities and the subsequent transfer of mortgage loans. The Subsequent Transfer Agreement is a legal document that outlines the terms and conditions for the sale and purchase of mortgage loans between LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. In such an agreement, both parties establish the procedures, deadlines, and financial considerations required to transfer ownership of these loans. This agreement ensures a smooth and legally binding transaction, protecting the interests of all involved parties. In Houston, there can be different types of Subsequent Transfer Agreements, each tailored to specific aspects of the mortgage loan transactions. These may include agreements regarding: 1. Loan Origination: This type of agreement focuses on the initial creation and funding of mortgage loans. It defines the roles and responsibilities of each party involved, ensuring the loan's compliance with all applicable regulations and requirements. 2. Loan Servicing: In this agreement, LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. establish the terms for the ongoing management and administration of mortgage loans. It covers aspects such as payments, escrow accounts, customer interactions, and loan modifications. 3. Loan Pooling and Securitization: This type of agreement pertains to the process of bundling numerous mortgage loans together and selling them as mortgage-backed securities (MBS) in the secondary market. It outlines the criteria for selecting eligible loans and the terms for their inclusion in the securities. The Subsequent Transfer Agreement enables LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. to navigate the complex landscape of mortgage loan transactions with clarity and confidence. As Houston serves as one of the key centers for mortgage lending in Texas, this agreement plays a crucial role in facilitating secure and efficient mortgage loan transfers while adhering to legal and regulatory standards. In conclusion, Houston, with its thriving economy and dynamic mortgage market, serves as a critical backdrop for the Subsequent Transfer Agreement between LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. This agreement ensures a smooth and legally compliant transfer of mortgage loans, promoting stability in the local housing market and enabling the continued growth of Houston's financial sector.

Houston Texas Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans

Description

How to fill out Houston Texas Subsequent Transfer Agreement Between MLCC Mortgage Investors, Inc. And Bankers Trust Of CA, N.A. Regarding Consummation For Purchase And Sale Of Mortgage Loans?

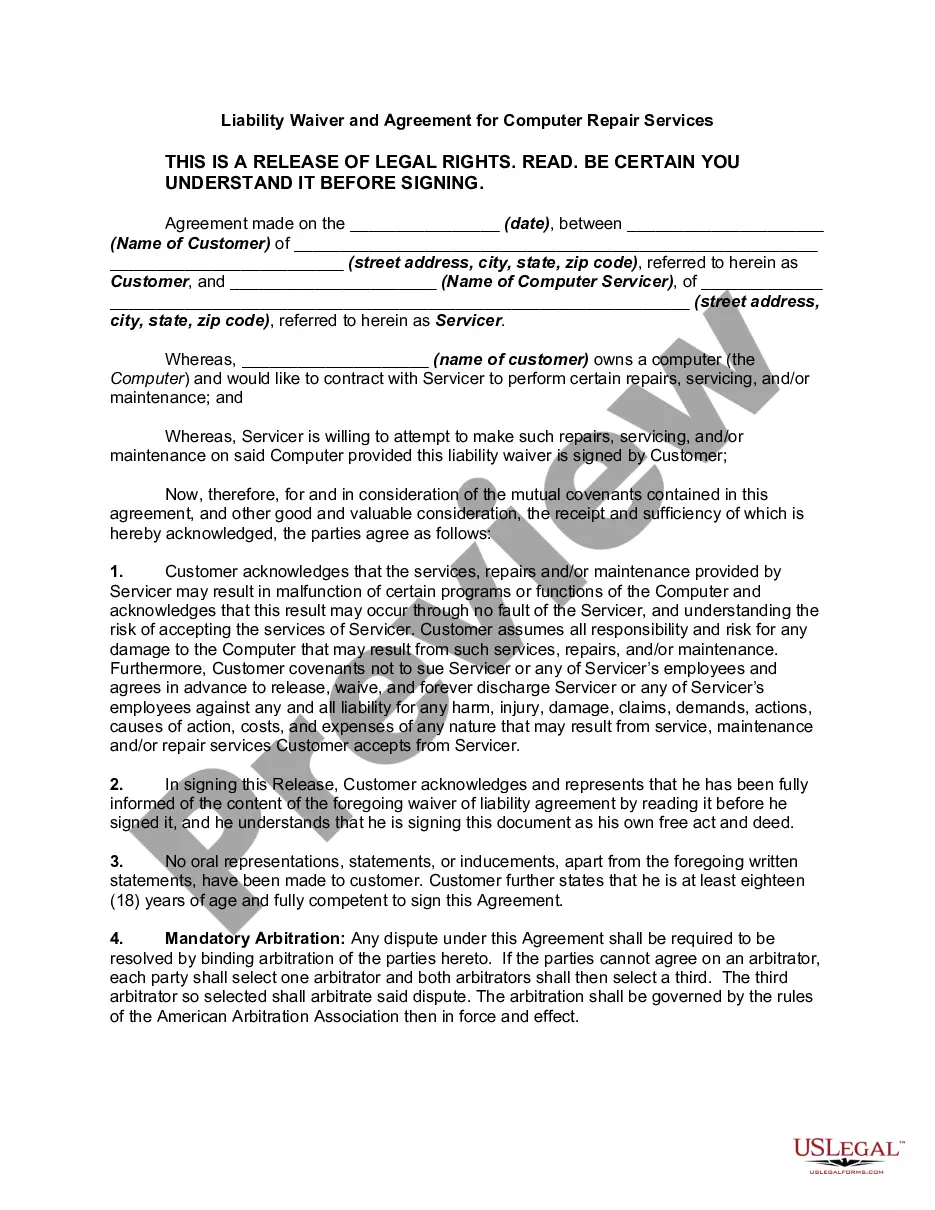

Preparing papers for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Houston Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans without expert assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Houston Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Houston Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans:

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any use case with just a few clicks!