Lima Arizona Subsequent Transfer Agreement between LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. is a legal document that outlines the details and terms of the transfer of mortgage loans between the two parties. This agreement ensures that the consummation for the purchase and sale of these mortgage loans is carried out smoothly and in accordance with the applicable laws and regulations. The Lima Arizona Subsequent Transfer Agreement is an important aspect of the mortgage loan industry, as it allows the transfer of assets between financial institutions while maintaining the necessary legal and financial protections. It serves as a binding contract that ensures clear ownership and responsibility for the loans being transferred. The agreement includes various provisions that define the specifics of the transaction, including the identification of the mortgage loans being transferred, the agreed-upon purchase price, and any conditions or requirements for the transfer to take place. It also outlines the responsibilities of both parties involved, including any necessary documentation or certifications that need to be provided. Keywords: Lima Arizona, Subsequent Transfer Agreement, LCC Mortgage Investors, Inc., Bankers Trust of CA, N.A., purchase and sale of mortgage loans, legal document, transfer of assets, financial institutions, ownership, responsibilities, transaction provisions, purchase price, conditions, requirements, documentation, certifications. Different types of Lima Arizona Subsequent Transfer Agreements between LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for the purchase and sale of mortgage loans may include: 1. Standard Subsequent Transfer Agreement: This is the typical agreement used for the transfer of mortgage loans and includes all necessary provisions and requirements to ensure a smooth transaction. 2. Bulk Transfer Agreement: In cases where a larger batch of mortgage loans is being transferred, a bulk transfer agreement may be utilized. This agreement outlines the specific details of the bulk transfer and any additional considerations or requirements. 3. Partial Transfer Agreement: If only a portion of the mortgage loans held by LCC Mortgage Investors, Inc. is being transferred to Bankers Trust of CA, N.A., a partial transfer agreement can be used. This document specifies which loans are being transferred and the corresponding terms and conditions. 4. Servicing Transfer Agreement: In some cases, the transfer of mortgage loans may also require the transfer of loan servicing responsibilities. A servicing transfer agreement would outline the details of this transfer, including any applicable fees or procedures. It is important to note that the specific types of subsequent transfer agreements may vary depending on the negotiation and agreement between LCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A.

Pima Arizona Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans

Description

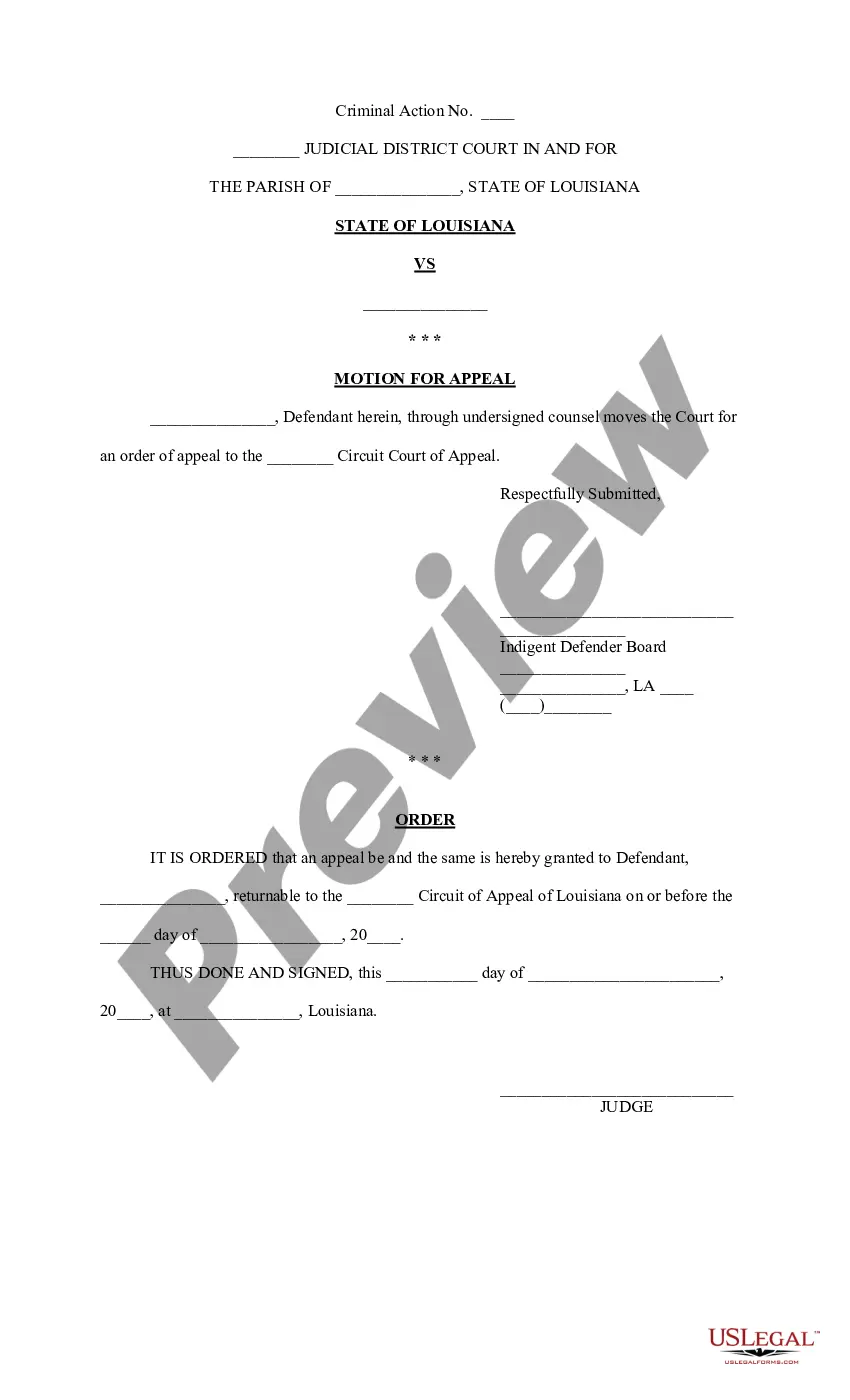

How to fill out Pima Arizona Subsequent Transfer Agreement Between MLCC Mortgage Investors, Inc. And Bankers Trust Of CA, N.A. Regarding Consummation For Purchase And Sale Of Mortgage Loans?

Do you need to quickly create a legally-binding Pima Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans or maybe any other document to manage your personal or business matters? You can select one of the two options: contact a professional to write a valid document for you or create it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive professionally written legal papers without paying unreasonable fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant document templates, including Pima Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans and form packages. We offer documents for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, double-check if the Pima Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans is tailored to your state's or county's regulations.

- In case the document has a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Pima Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the paperwork we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!