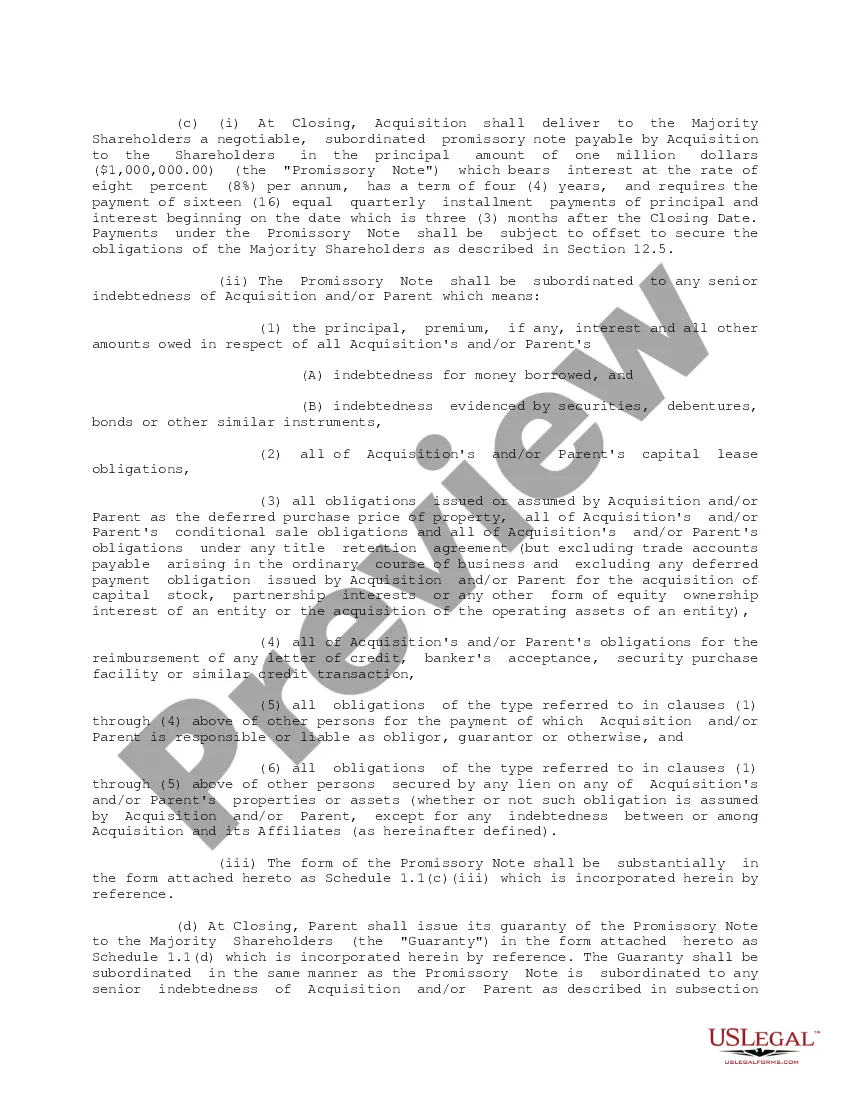

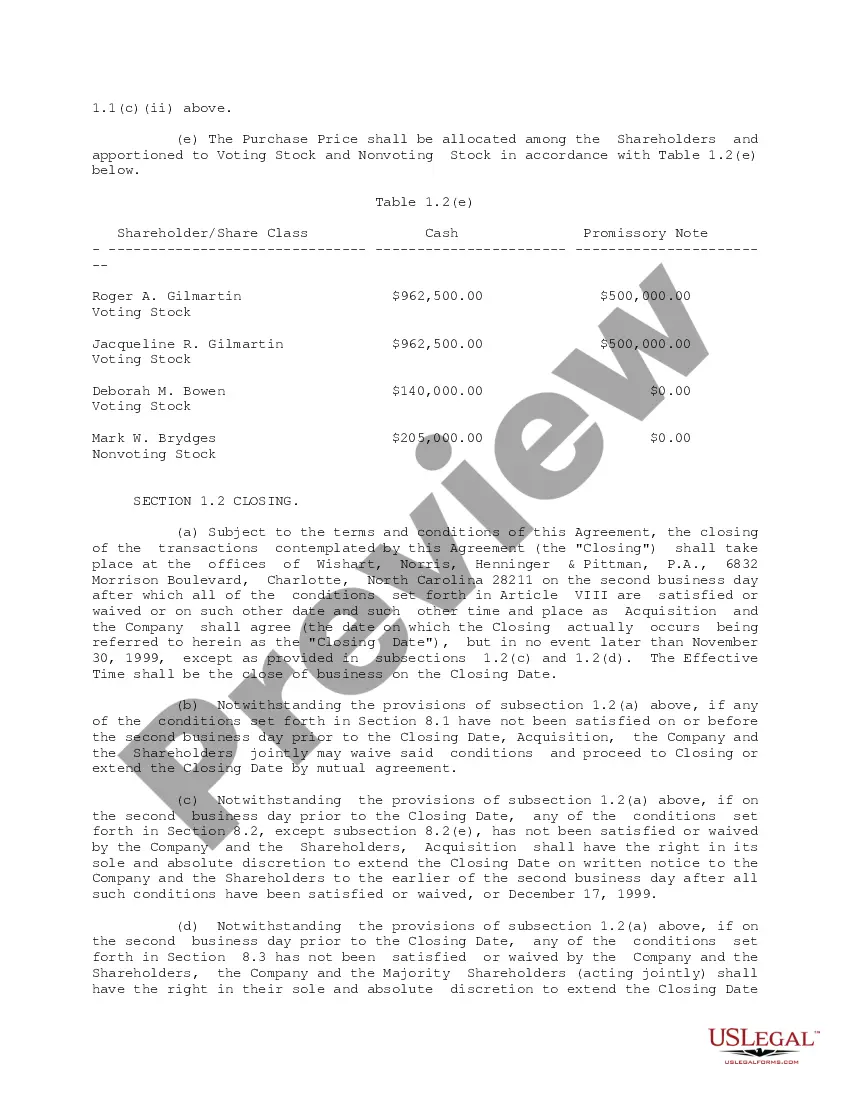

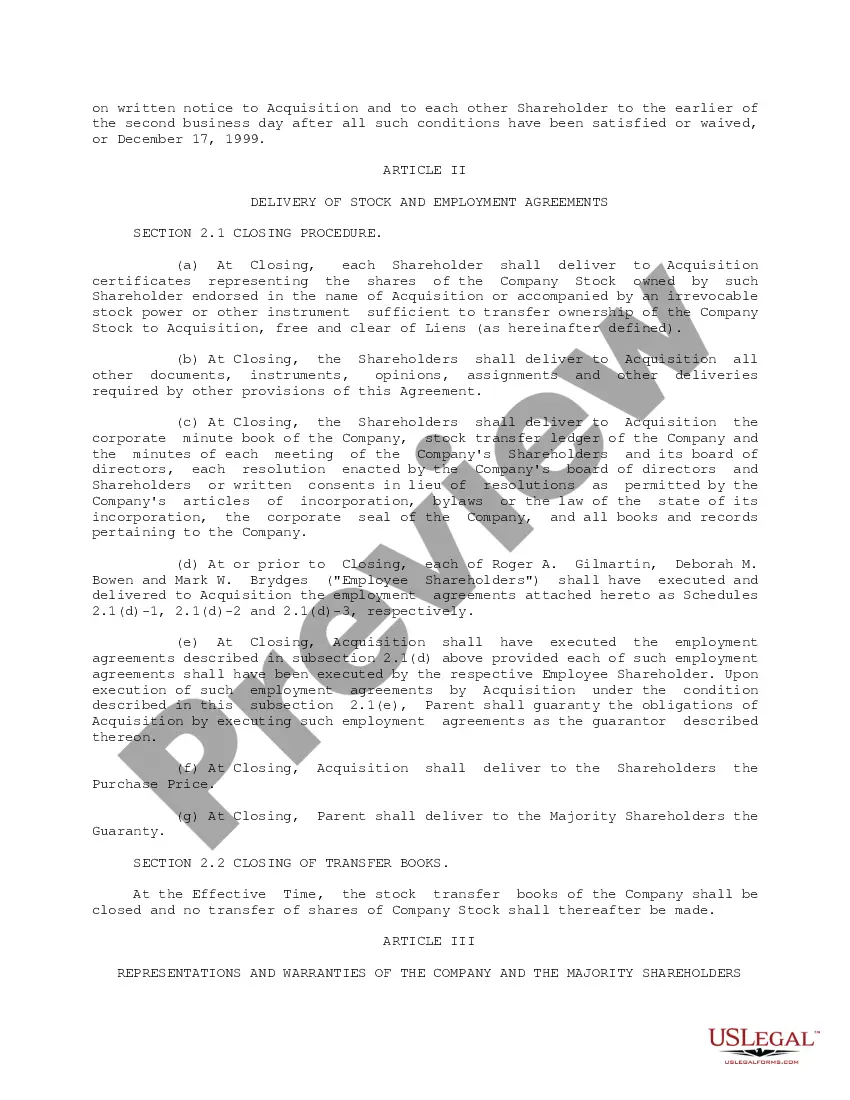

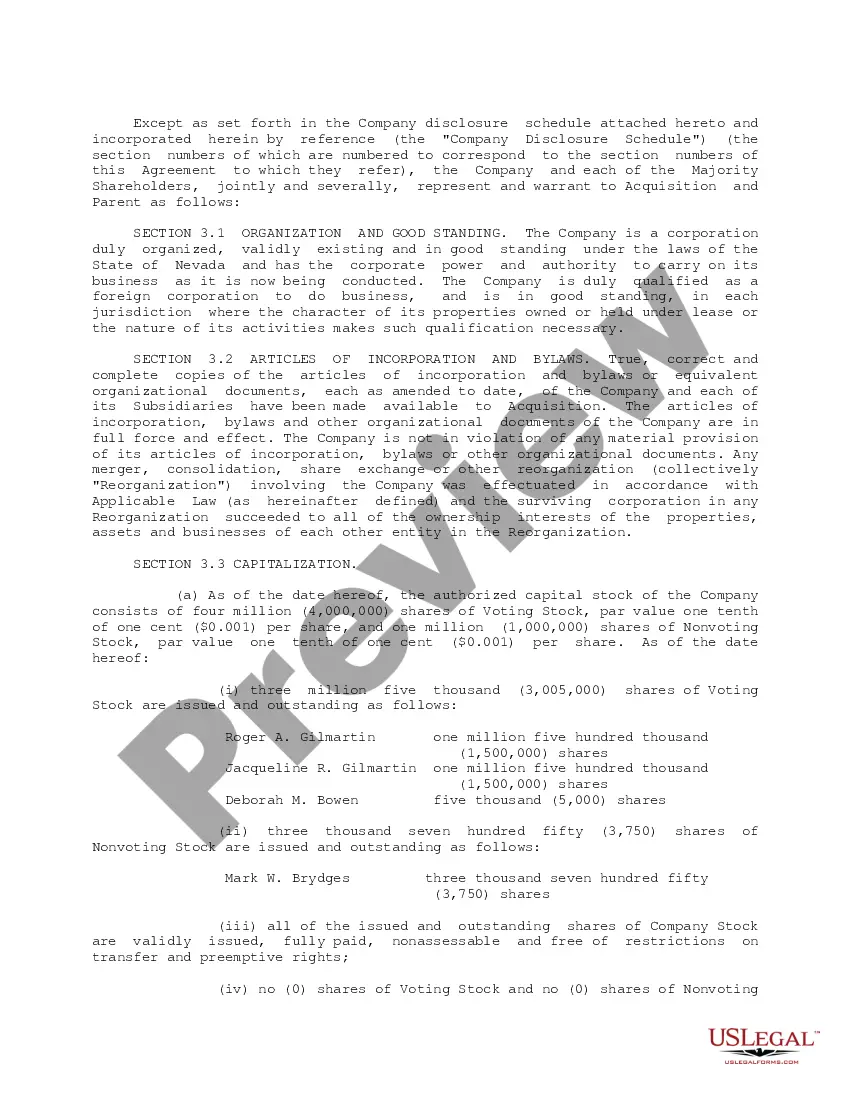

Title: San Antonio Texas Sample Purchase and Sale Agreement for Stock Transfer between GET Acquisition Corp., Exigent International, Inc., and GET North America Corp. Introduction: The following is a detailed description of the San Antonio Texas Sample Purchase and Sale Agreement for the Purchase and Sale of stock. This agreement is entered into by GET Acquisition Corp., Exigent International, Inc., and GET North America Corp. In this transaction, the parties exchange ownership of certain stocks, and the agreement outlines all the terms and conditions to facilitate a smooth transfer. I. Parties Involved: a. GET Acquisition Corp.: This is the buyer or purchaser of the stock in this agreement. b. Exigent International, Inc.: The seller party that possesses the stock to be sold. c. GET North America Corp.: The third-party involved, potentially acting as an intermediary or providing necessary documentation. II. Stock Transfer Details: a. Stock Description: The agreement specifies the nature and type of stock being transferred, including the number of shares, class, series, and any special rights or limitations. b. Purchase Price: The agreed-upon monetary value for the stock being sold, often stated as a per-share price or a total sum. c. Payment Terms: The terms of payment, such as the method and timeline of payment, are clearly defined in the agreement. d. Closing Date: The date on which the stock transfer will be completed and ownership officially changes hands. III. Representations and Warranties: a. Seller's Representations: Exigent International, Inc. provides various assurances regarding their ownership rights, authority to sell, valid stock certificates, and the absence of any legal disputes. b. Buyer's Representations: GET Acquisition Corp. guarantees that it is authorized to enter into the agreement, has the necessary funds to complete the purchase, and will comply with any legal obligations. c. Due Diligence: Both parties commit to conducting due diligence to ensure the accuracy of the statements and representations made. IV. Conditions Precedent: a. Securities and Exchange Commission (SEC) Approvals: If the transfer involves publicly traded stocks, the agreement may require obtaining necessary approvals or complying with regulations set by the SEC. b. Corporate Consents: If any of the parties are corporations, they may need to obtain internal corporate approvals for the stock transfer. c. Third-Party Consents: If the stock subjected to the sale is subject to any third-party agreements (e.g., voting rights, shareholder agreements), the agreement may require obtaining necessary consents. V. Governing Law and Jurisdiction: The agreement should specify the jurisdiction whose laws will govern the execution and interpretation of the agreement, ensuring clarity in case of any disputes. Note: The provided description covers a basic purchase and sale agreement for stock transfer. Specific variations and additional clauses may be included based on the unique requirements of GET Acquisition Corp., Exigent International, Inc., and GET North America Corp. It is advisable to consult legal professionals to draft a comprehensive agreement tailored to your specific circumstances.

San Antonio Texas Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.

Description

How to fill out San Antonio Texas Sample Purchase And Sale Agreement Purchase And Sale Of Stock Between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.?

Creating documents, like San Antonio Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp., to manage your legal matters is a tough and time-consumming task. Many cases require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for various cases and life situations. We ensure each form is compliant with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the San Antonio Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp. template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before downloading San Antonio Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.:

- Ensure that your document is compliant with your state/county since the rules for writing legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the San Antonio Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp. isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our website and get the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment details.

- Your template is good to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

The short answer is yes. Handwritten contracts are slightly impractical when you could just type them up, but they are completely legal if written properly. In fact, they're even preferable to verbal contracts in many ways.

The purchase agreement outlines the buyer's offer price, along with contingencies, financing terms, closing costs, possession date, and more. You must meticulously review the purchase agreement before you sign and turn the document into a legally binding sales contract.

What to include in a business sales contract. Name the parties. Clearly state the names and locations of the buyer and seller.List the assets.Define liabilities.Set sale terms.Include other agreements.Make your sales agreement digital.

Any purchase agreement should include at least the following information: The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

How to Write a Business Purchase Agreement? Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

The Basics of a Business Purchase Agreement Parties. This section appears at the beginning of the purchase agreement and lists the legal names of the seller and buyer, as well as their contact information. Description of Business.Sale.Covenants.Transition.Participation or Absence of Brokers.Closing.Appendices.

Know How to Fill Out the Business Bill of Sale Date of Sale. Buyer's name and address. Seller's name and address. Business name and details, which include: State of incorporation. Address of the business's main headquarters. Assets, shares, personal property and other interests included with the company.

A purchase and sale agreement is different from a purchase agreement in one particular way. Rather than complete the transaction, a purchase and sale agreement will facilitate it while providing clear guidance regarding party responsibility. By signing the contract, you do not agree to buy or sell the house.

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.