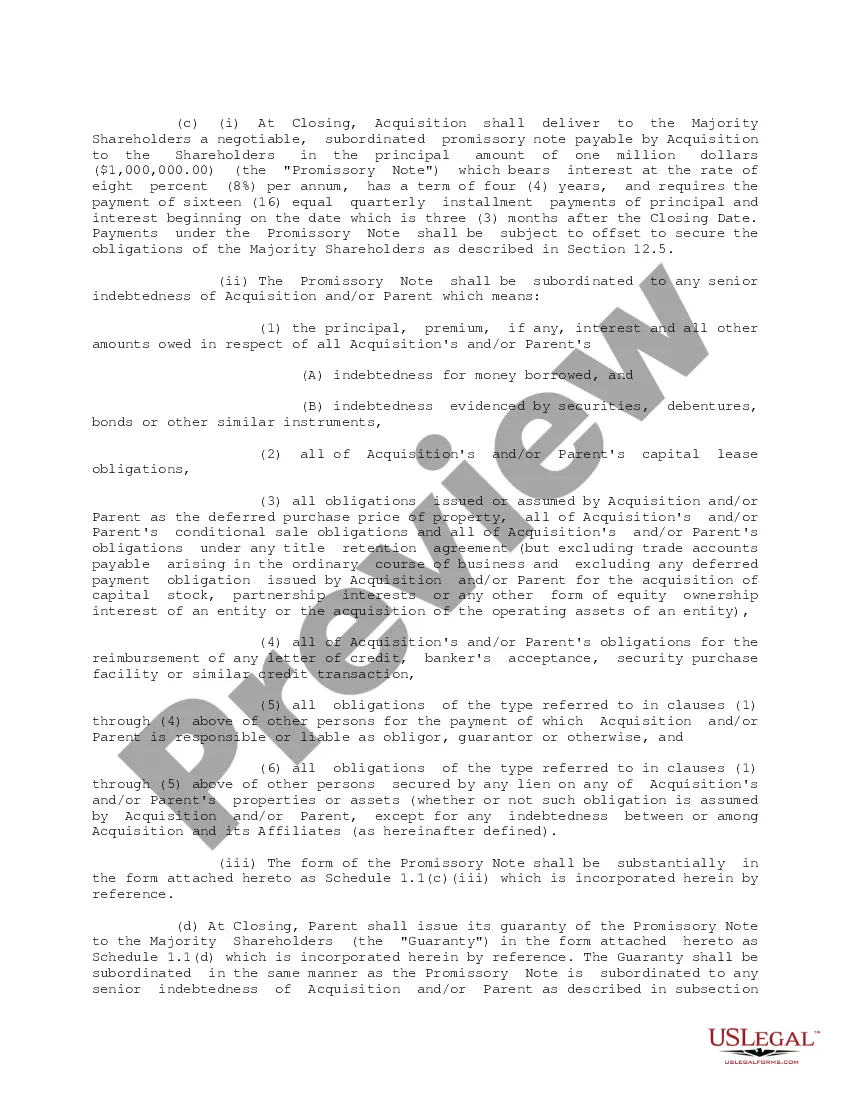

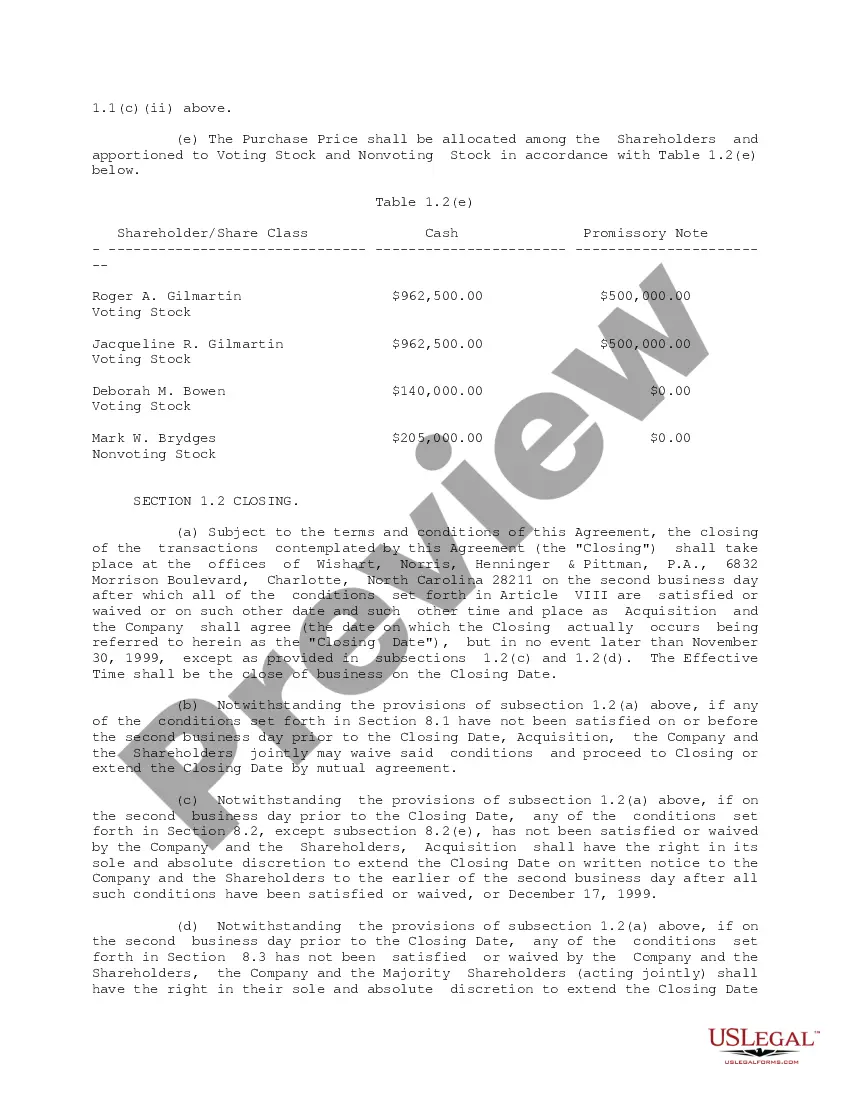

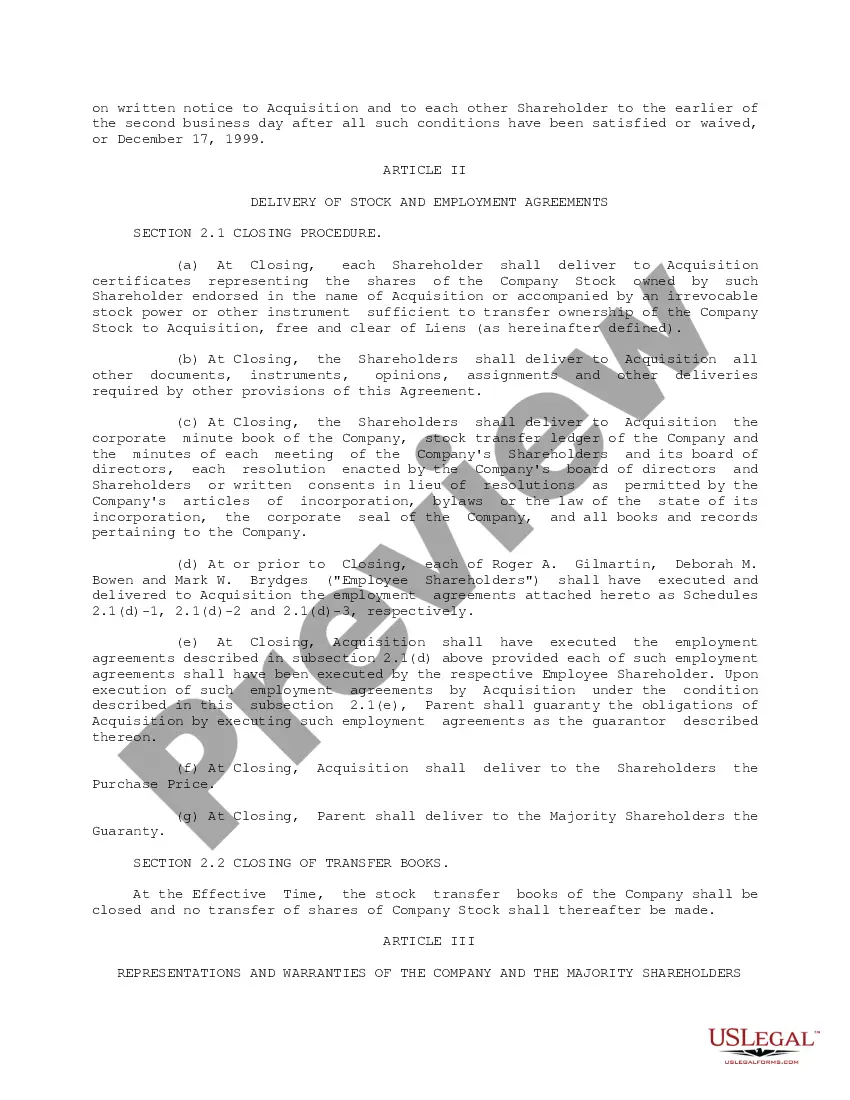

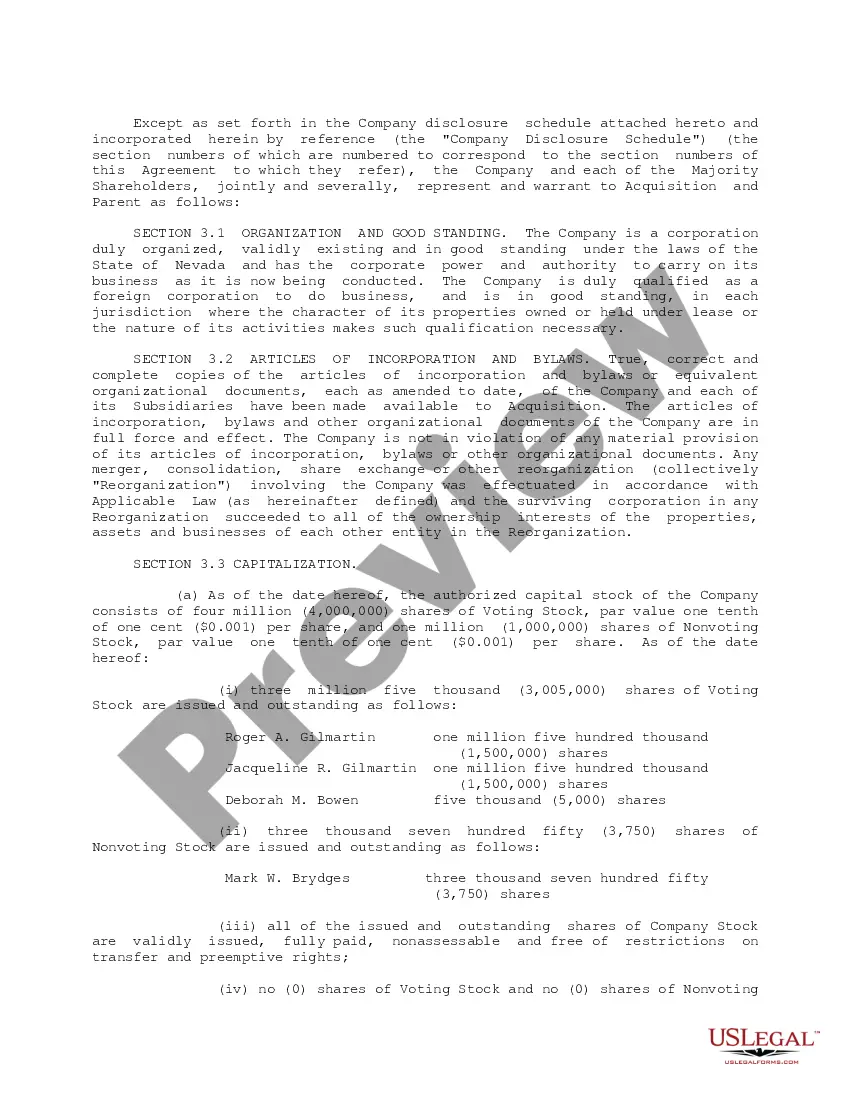

San Diego, California, is a vibrant city located on the Pacific coast of the United States. Known for its beautiful beaches, stunning waterfront views, and year-round mild climate, San Diego is a popular destination for tourists and an attractive place to live. When it comes to business transactions, San Diego serves as a hub for various industries, including technology, biotechnology, defense, tourism, and more. One common type of business agreement in this city is the Purchase and Sale Agreement for the transfer of stock between companies. In this context, we will focus on a specific San Diego California Sample Purchase and Sale Agreement for the Purchase and Sale of stock between three companies: GET Acquisition Corp., Exigent International, Inc., and GET North America Corp. This agreement outlines the terms and conditions under which the stock of one company is being acquired by another. Key terms and relevant keywords that may be present in this agreement include: 1. Purchase and Sale Agreement: This is the overarching agreement that establishes the terms and conditions of the stock purchase and sale transaction. 2. Stock: Refers to the ownership shares or equity in a company that are being exchanged between GET Acquisition Corp., Exigent International, Inc., and GET North America Corp. 3. Consideration: The agreed-upon value, often in the form of cash, stocks, or a combination, being paid by the acquiring company to the selling company for the purchased stock. 4. Closing Date: The specified date when the stock purchase transaction is finalized, and ownership is transferred. 5. Representations and Warranties: Statements made by both parties regarding the accuracy and completeness of the information provided, ensuring a smooth and transparent transaction. 6. Indemnification: A provision to protect both parties from losses or liabilities arising out of breaches, misrepresentations, or undisclosed information within the stock purchase and sale agreement. 7. Governing Law: The jurisdiction and laws which will govern this agreement, which in this case would likely be the laws of the state of California. 8. Confidentiality: Provisions outlining the non-disclosure of sensitive or proprietary information related to the stock purchase transaction, ensuring the protection of trade secrets and business interests. While the provided information outlines a general framework for a San Diego California Sample Purchase and Sale Agreement for the Purchase and Sale of stock between GET Acquisition Corp., Exigent International, Inc., and GET North America Corp., it is important to note that specific variations may exist based on the unique circumstances and requirements of the transaction. It is always advisable to seek legal counsel to ensure accuracy and compliance with applicable laws and regulations.

San Diego California Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.

Description

How to fill out San Diego California Sample Purchase And Sale Agreement Purchase And Sale Of Stock Between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp.?

If you need to get a trustworthy legal paperwork supplier to find the San Diego Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp., consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can search from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting materials, and dedicated support team make it easy to locate and execute various papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse San Diego Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp., either by a keyword or by the state/county the form is created for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the San Diego Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp. template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less expensive and more reasonably priced. Set up your first company, arrange your advance care planning, create a real estate contract, or execute the San Diego Sample Purchase and Sale Agreement Purchase and Sale of stock between GEC Acquisition Corp., Exigent International, Inc., GEC North America Corp. - all from the convenience of your sofa.

Join US Legal Forms now!