The Houston Texas Plan of Merger between Berkshire Energy Resources, Energy East Corporation, and Mountain Merger, LLC is a significant corporate transaction aiming to combine the resources and expertise of these three entities. This merger plan holds the potential to revolutionize the energy sector by leveraging their strengths and maximizing operational efficiency. Below, we will explore the components and potential benefits of this merger with relevant keywords. 1. Houston Texas: With a vibrant economy and a diverse cultural landscape, Houston, Texas serves as the backdrop for this plan of merger. Known as the "Energy Capital of the World," Houston offers a strategic location for this consolidation of energy-focused companies. 2. Plan of Merger: The plan of merger refers to the comprehensive strategy developed by Berkshire Energy Resources, Energy East Corporation, and Mountain Merger, LLC to combine their assets, operations, and corporate structures. This involves careful legal and financial preparations to execute a smooth transition. 3. Berkshire Energy Resources: Berkshire Energy Resources, an esteemed energy company, holds valuable assets, expertise, and market share. Its inclusion in the merger plan ensures the integration of valuable resources and capabilities into the new entity. 4. Energy East Corporation: Energy East Corporation, a prominent player in the energy industry, brings its own set of complementary assets and diversified operations to the merger. These assets may include power generation facilities, transmission lines, or renewable energy projects. 5. Mountain Merger, LLC: Mountain Merger, LLC, being a part of the merger, adds its unique set of resources and market presence to the newly formed entity. It may possess specialized technologies, exploration rights, or partnerships that enhance the combined entity's competitive advantage. 6. Synergy and Operational Efficiency: One of the primary objectives of this merger is to extract synergistic benefits, resulting in increased operational efficiency. By merging their assets, technologies, and human capital, the three entities can generate cost savings, streamline operations, and maximize profitability. 7. Market Expansion and Diversification: This merger plan offers opportunities for market expansion and diversification. By leveraging each entity's customer base, geographical presence, and expertise, the combined company can access new markets, strengthen existing relationships, and capture a larger market share. 8. Renewable Energy Emphasis: Given the global shift towards renewable energy sources, this merger may place a significant emphasis on developing and expanding renewable energy projects. The combined entity can harness the collective resources and expertise to accelerate the clean energy transition and address environmental challenges. 9. Stakeholder Benefits: The merger plan aims to generate value for shareholders, employees, and community stakeholders. Shareholders may benefit from improved financial performance and potential dividend growth. Employees may gain access to enhanced career opportunities and professional development programs. The communities where the merger entities operate may experience increased philanthropic activities and local economic growth. By focusing on the aforementioned keywords and concepts, one can develop a detailed description of the Houston Texas Plan of Merger between Berkshire Energy Resources, Energy East Corporation, and Mountain Merger, LLC.

Houston Texas Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC

Description

How to fill out Houston Texas Plan Of Merger Between Berkshire Energy Resources, Energy East Corporation And Mountain Merger, LLC?

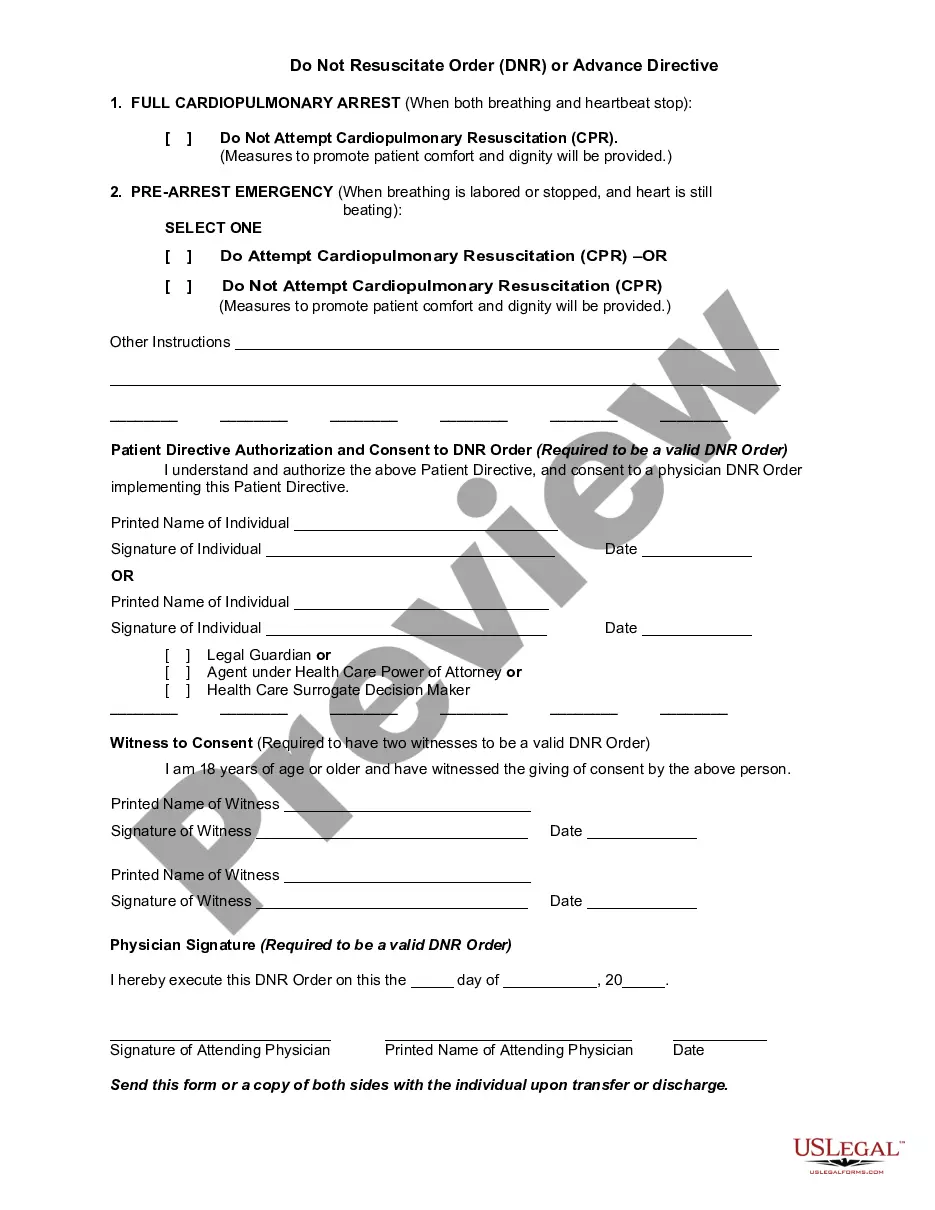

Whether you plan to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Houston Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Houston Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC. Adhere to the guide below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Houston Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!