The Mecklenburg North Carolina Plan of Merger between Berkshire Energy Resources, Energy East Corporation, and Mountain Merger, LLC is a strategic initiative aimed at combining the resources and expertise of these three prominent energy companies. This merger is expected to create a more competitive and integrated entity that can better serve the energy needs of the region. The plan entails a comprehensive consolidation of operations, assets, and management structures to generate synergies, improve efficiency, and enhance overall performance. By pooling their resources, Berkshire Energy Resources, Energy East Corporation, and Mountain Merger, LLC aim to expand their market reach and capitalize on new growth opportunities. The Mecklenburg North Carolina Plan of Merger will involve the integration of various business segments, including renewable energy generation, transmission, and distribution. This comprehensive approach signifies a commitment to a diversified energy portfolio that will help meet the increasing demand for sustainable and reliable power solutions. Throughout the merger process, the companies will work towards streamlining their operations and eliminating redundancies, ultimately resulting in more cost-effective and eco-friendly energy solutions for customers. This synergy-driven approach will also lead to improved customer service, as the combined entity will leverage the strengths and expertise of all three companies. Different types of Mecklenburg North Carolina Plan of Merger between Berkshire Energy Resources, Energy East Corporation, and Mountain Merger, LLC may include: 1. Functional Merger: This type focuses on consolidating specific business functions and departments within the three companies. By combining these functions, the merged entity will benefit from increased operational efficiency, reduced costs, and improved collaboration. 2. Financial Merger: This type primarily focuses on the financial aspects of the merger, such as shared financial resources, debt restructuring, and optimized financial planning. The merged entity aims to achieve better financial stability and leverage its resources for strategic investments and growth. 3. Technological Merger: This type focuses on integrating and aligning the technological frameworks, platforms, and systems used by each company. By harmonizing these technological aspects, the merged entity can create a cohesive and technologically advanced infrastructure that supports innovation, scalability, and improved service delivery. 4. Market Expansion Merger: This type underscores the intent to explore new markets and expand the reach and customer base of the merged entity. By combining their market expertise and resources, the companies hope to penetrate previously untapped regions and cater to a broader range of energy consumers. In conclusion, the Mecklenburg North Carolina Plan of Merger between Berkshire Energy Resources, Energy East Corporation, and Mountain Merger, LLC represents a significant step towards creating a stronger, more efficient, and customer-centric energy company. Through the integration of various operational, financial, technological, and market aspects, the merged entity aims to enhance its capacity to meet the evolving energy demands of the region.

Mecklenburg North Carolina Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC

Description

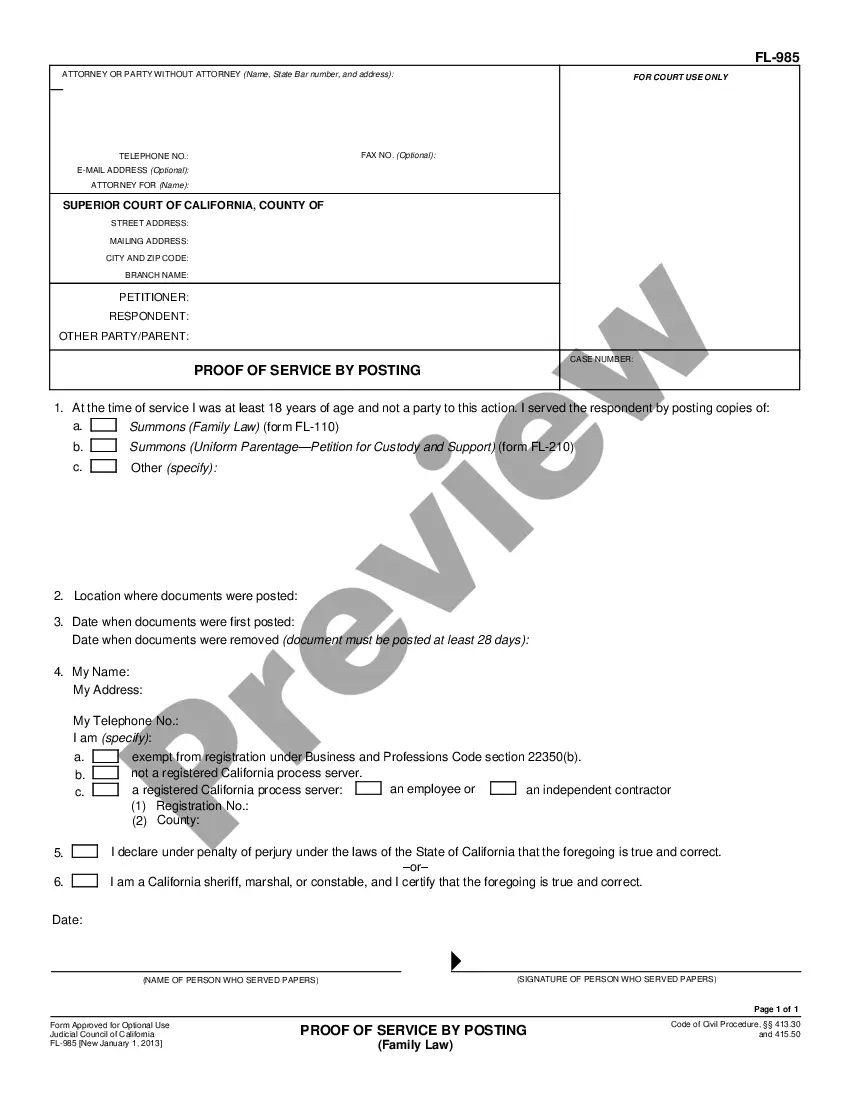

How to fill out Mecklenburg North Carolina Plan Of Merger Between Berkshire Energy Resources, Energy East Corporation And Mountain Merger, LLC?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life scenario, locating a Mecklenburg Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Apart from the Mecklenburg Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC, here you can get any specific document to run your business or individual deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Mecklenburg Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Mecklenburg Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!