The San Antonio Texas Plan of Merger between Berkshire Energy Resources, Energy East Corporation, and Mountain Merger, LLC is a comprehensive agreement outlining the consolidation of these three entities. This merger aims to combine their extensive resources, expertise, and market presence to create a more formidable energy company. By merging, Berkshire Energy Resources, Energy East Corporation, and Mountain Merger, LLC seek to enhance operational efficiency, reduce costs, and capitalize on synergistic opportunities within the energy sector. This merger not only strengthens their market position but also enables them to better serve their customers by offering a wider range of energy solutions. The San Antonio Texas Plan of Merger involves several key components. Firstly, the merger agreement establishes the terms and conditions of the merger, including the exchange ratio of shares and consideration to be provided to each shareholder or entity involved. It also outlines the governance structure of the newly formed merged entity, including the composition of the board of directors and executive management. Additionally, the Plan of Merger specifies the financial aspects of the merger, such as the treatment of assets, liabilities, and equity of the merging companies. It delineates how the valuation of each company will be conducted, taking into account their respective market value, assets, and liabilities. This agreement also addresses any potential tax implications resulting from the merger. Furthermore, the Plan of Merger includes a detailed strategic plan for the merged entity, outlining its mission, vision, and strategic goals. It highlights the anticipated synergies, economies of scale, and competitive advantages that the merger is expected to bring. The plan may also outline specific areas of integration, such as streamlining operations, optimizing supply chain management, and leveraging technological advancements. It is important to note that different types of San Antonio Texas Plan of Merger between Berkshire Energy Resources, Energy East Corporation, and Mountain Merger, LLC may exist based on the specific variations in their respective agreements. These variations may pertain to the exchange ratio, consideration provided, governance structure, or other specific terms unique to the merger transaction. In conclusion, the San Antonio Texas Plan of Merger between Berkshire Energy Resources, Energy East Corporation, and Mountain Merger, LLC is a strategic move aimed at consolidating their strengths, expanding their market presence, and achieving synergistic benefits. This comprehensive agreement encompasses various aspects of the merger, such as financial considerations, governance structure, and strategic planning. The specific types of the plan may vary based on the unique terms and conditions of each merger transaction.

San Antonio Texas Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC

Description

How to fill out San Antonio Texas Plan Of Merger Between Berkshire Energy Resources, Energy East Corporation And Mountain Merger, LLC?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the San Antonio Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the San Antonio Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the San Antonio Plan of Merger between Berkshire Energy Resources, Energy East Corporation and Mountain Merger, LLC:

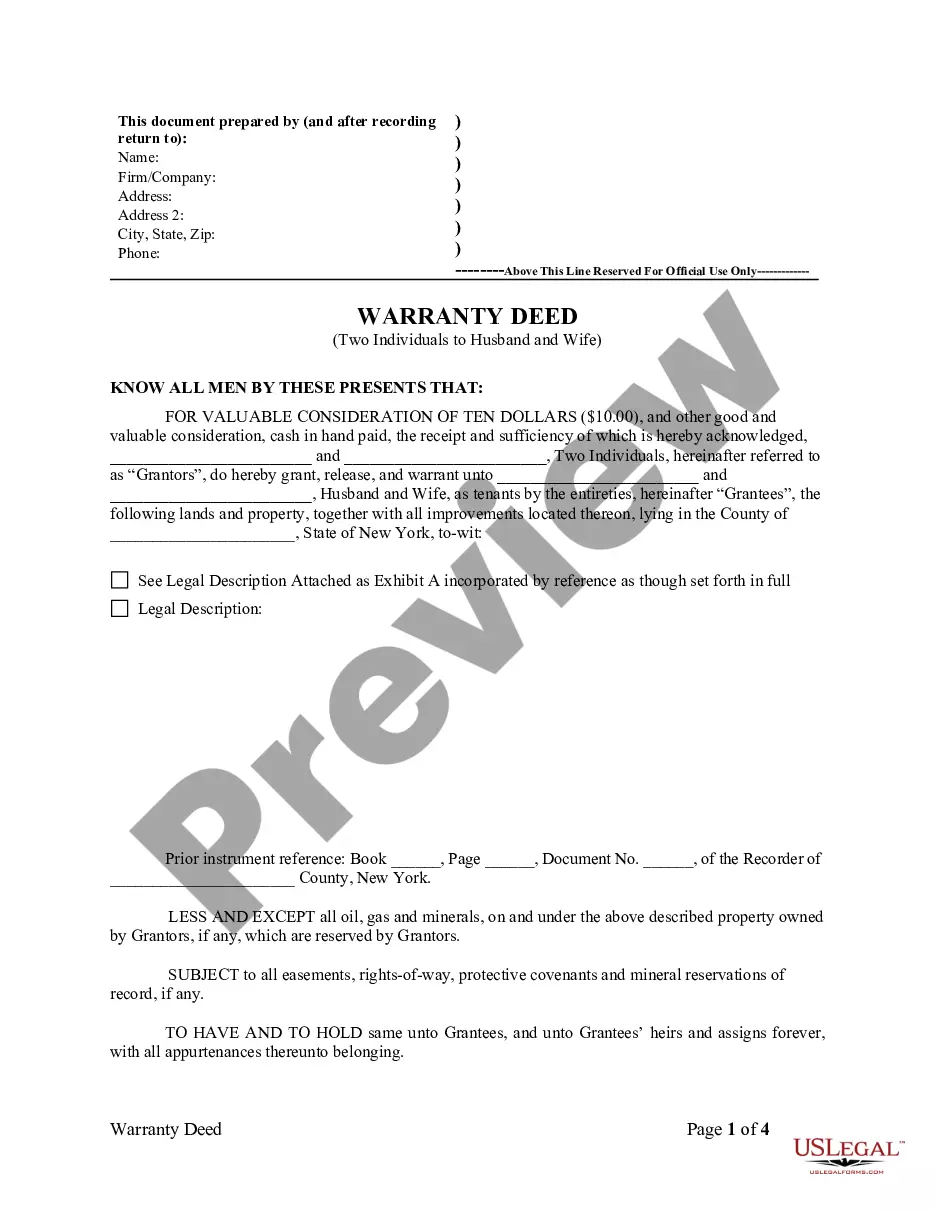

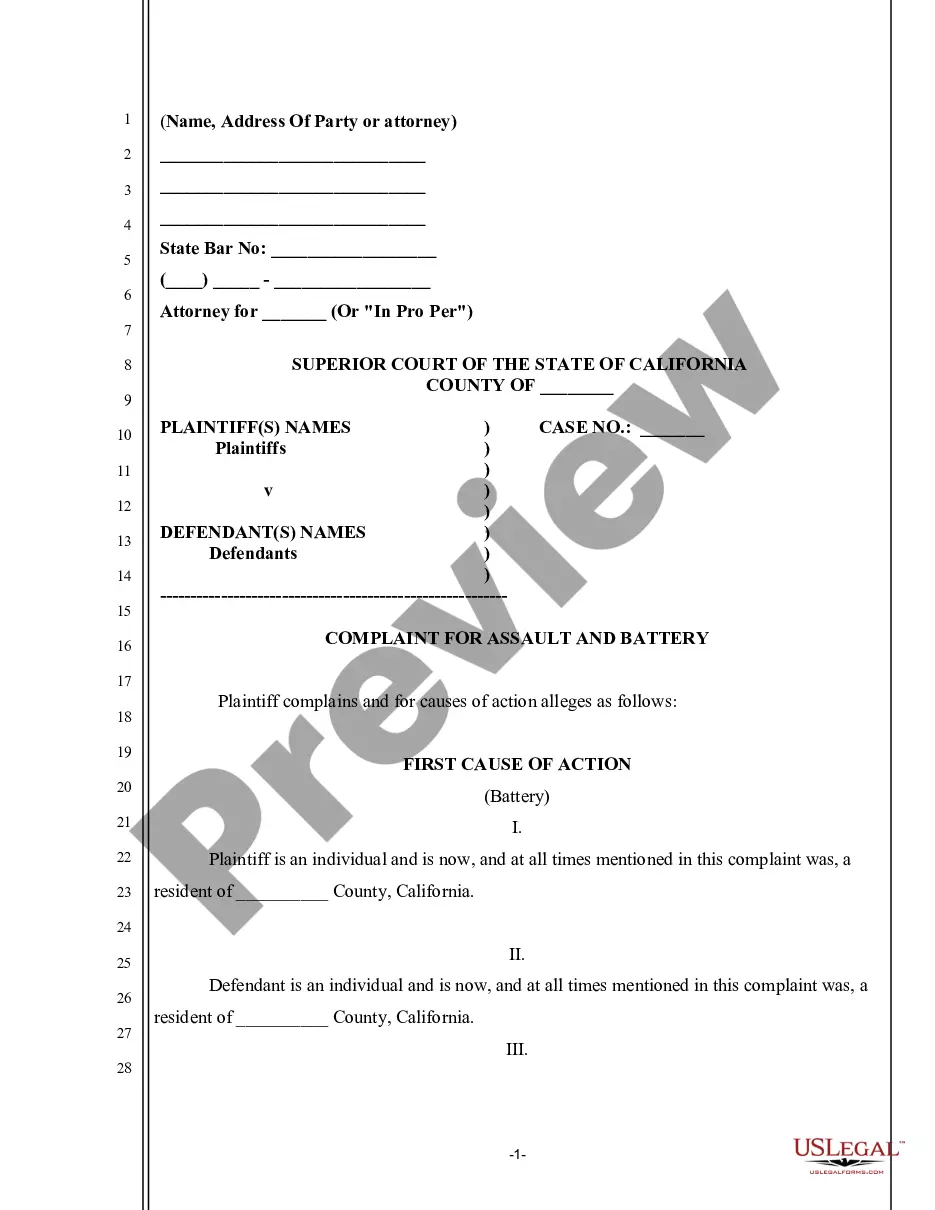

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!