The Maricopa Arizona Subscription Agreement — 6% Series G Convertible Preferred Stock is a legal document that outlines the terms and conditions for the issuance and sale of preferred stock between Object Soft Corp. and investors. This agreement is essential for both parties as it protects their rights and interests throughout the transaction. The agreement includes various clauses and provisions that are crucial for a successful stock issuance and sale process. It outlines the number of shares of preferred stock to be issued, the purchase price per share, and the payment terms. It also specifies the conversion ratio, which determines the number of shares of common stock an investor can convert their preferred shares into. Furthermore, the agreement encompasses the dividend rate, which in this case is set at 6%. This ensures that the investors will receive a fixed dividend payment on their preferred stock, providing them with a steady income stream. The Maricopa Arizona Subscription Agreement — 6% Series G Convertible Preferred Stock also addresses the conversion rights of the investors. It specifies the conversion price, which is the predetermined price at which the preferred shares can be converted into common shares. This conversion feature provides investors with the opportunity to partake in any potential appreciation of the common stock value. In addition to the standard terms mentioned above, there may be variations of the Maricopa Arizona Subscription Agreement — 6% Series G Convertible Preferred Stock. These variations could include different dividend rates, conversion ratios, or other specific provisions tailored to meet the needs of particular investors or circumstances. It is important for both Object Soft Corp. and the investors to review and understand the terms and conditions laid out in the subscription agreement. This ensures clarity and minimizes the potential for any confusion or disputes in the future. Overall, the Maricopa Arizona Subscription Agreement — 6% Series G Convertible Preferred Stock is a comprehensive document that sets the foundation for a smooth and transparent transaction between Object Soft Corp. and its investors. This agreement safeguards the rights and obligations of all parties involved and serves as a roadmap for successful preferred stock issuance and sale.

Maricopa Arizona Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock

Description

How to fill out Maricopa Arizona Subscription Agreement - 6% Series G Convertible Preferred Stock - Between ObjectSoft Corp. And Investors Regarding Issuance And Sale Of Preferred Stock?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official documentation that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your county, including the Maricopa Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Maricopa Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock will be available for further use in the My Forms tab of your profile.

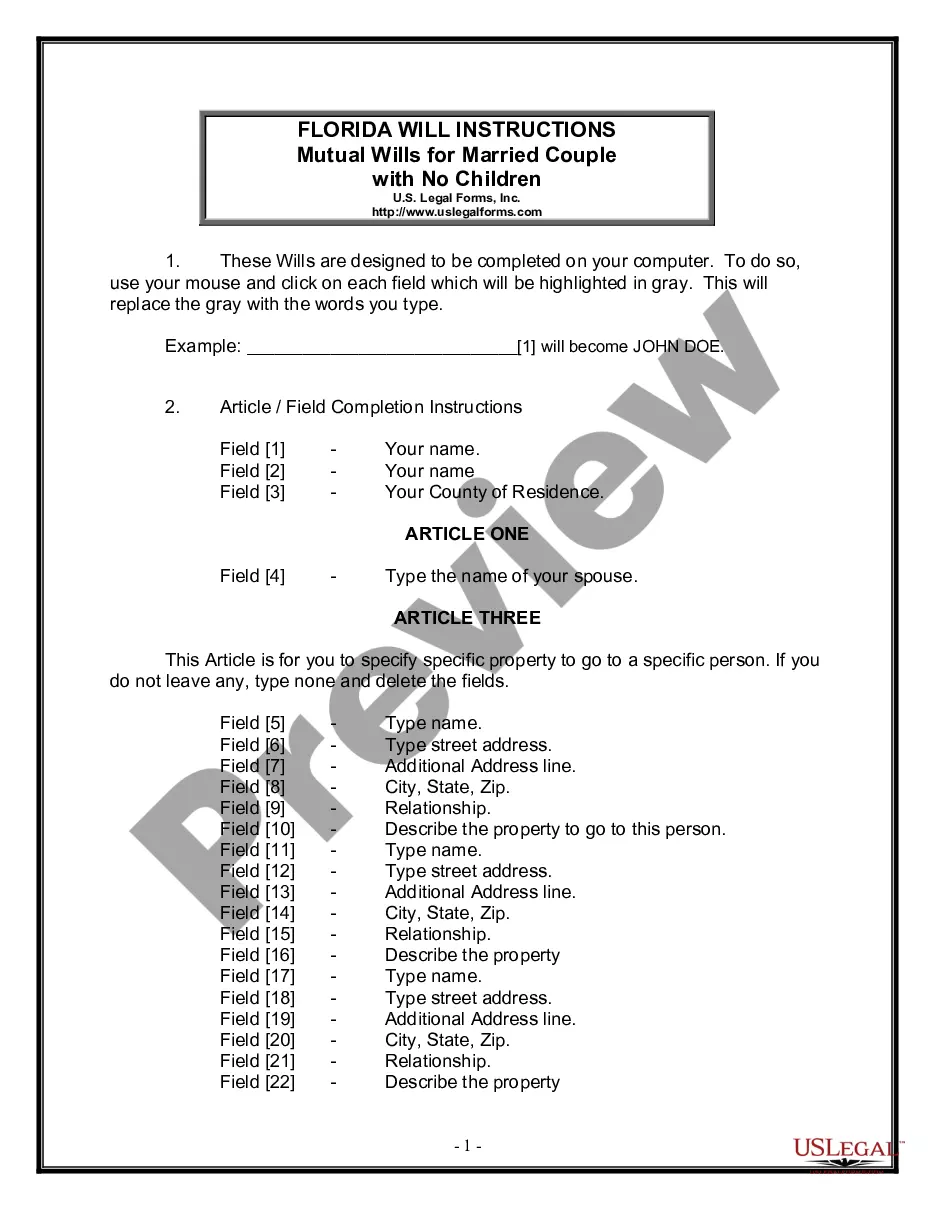

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the Maricopa Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock:

- Make sure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Maricopa Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!