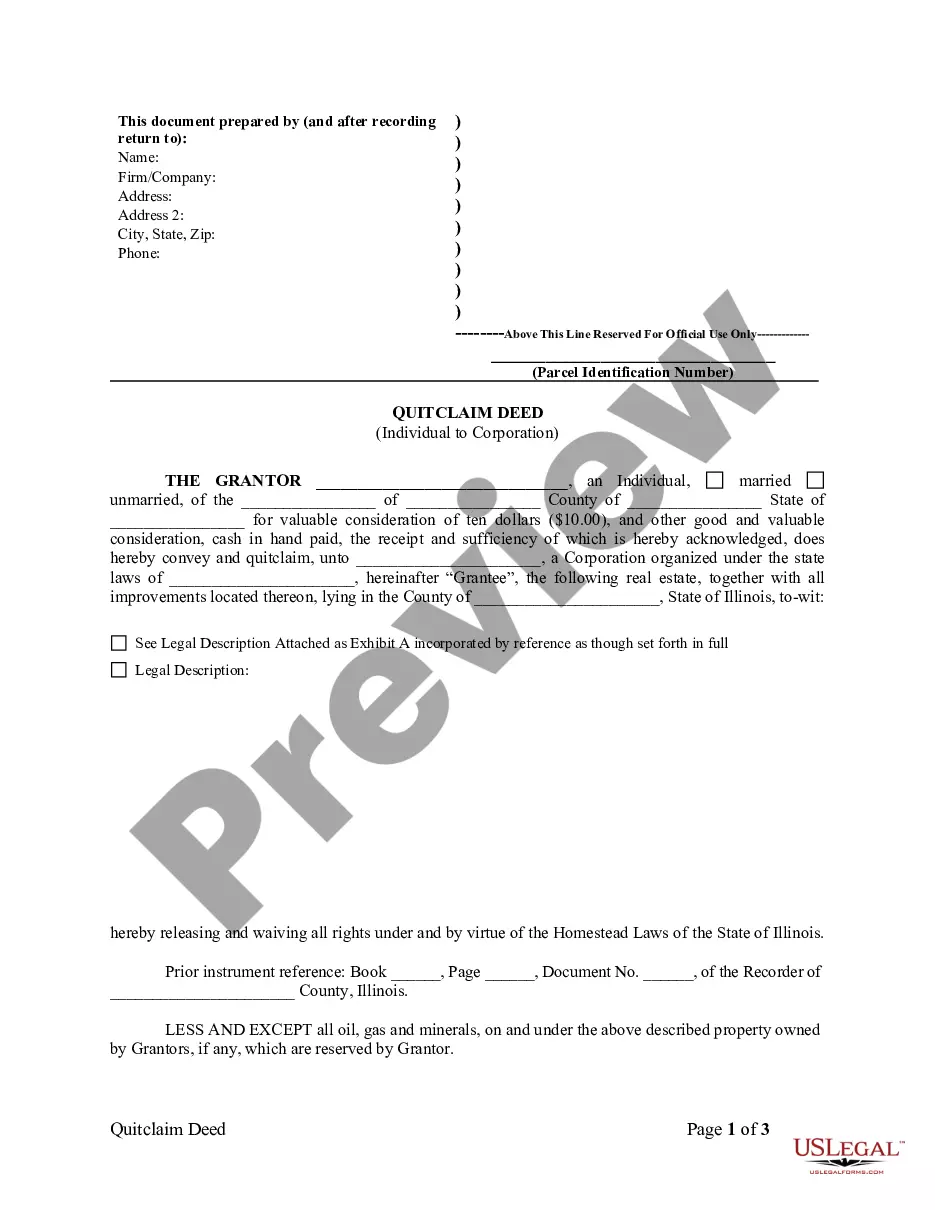

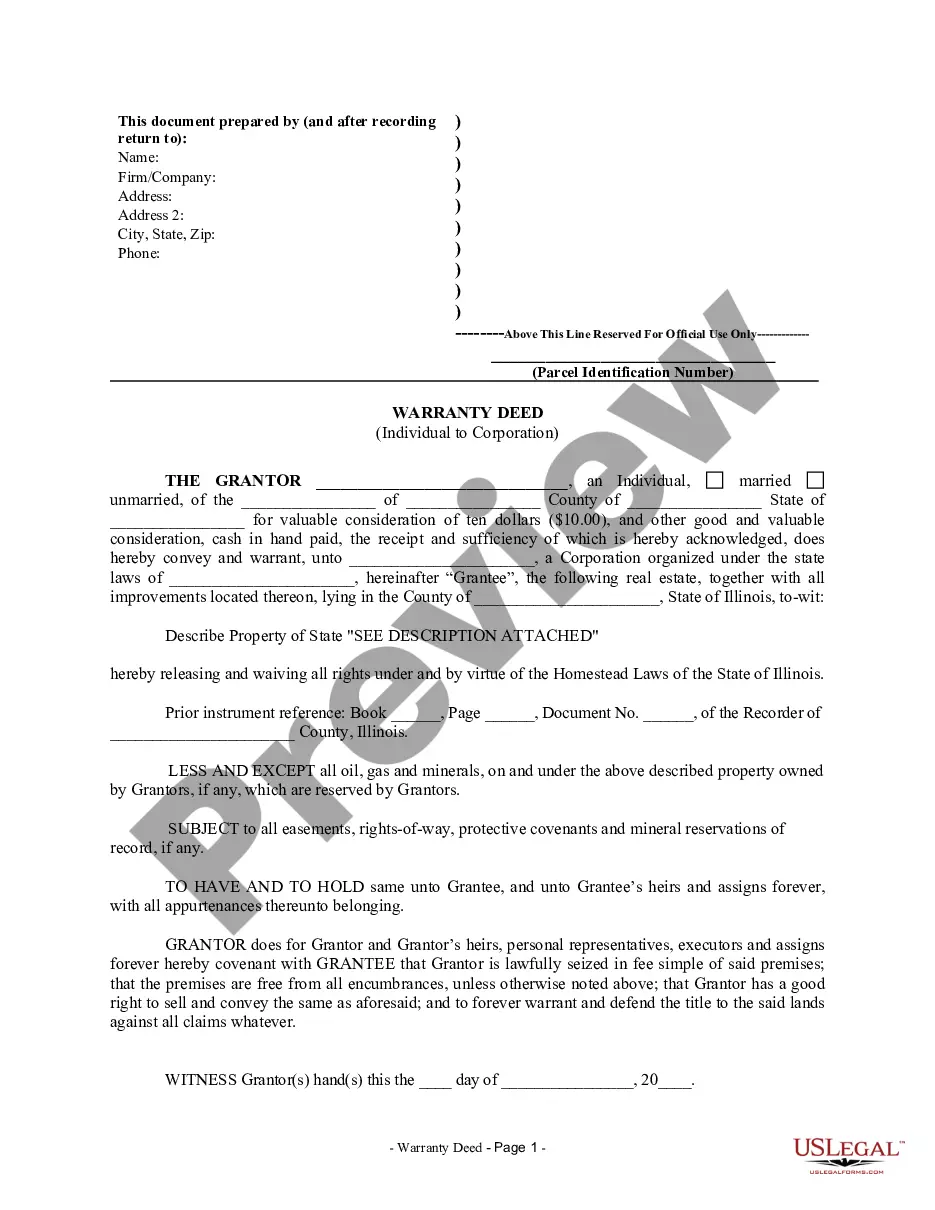

The Orange California Subscription Agreement — 6% Series G Convertible Preferred Stock is a legal document that outlines the terms and conditions between Object Soft Corp. and Investors for the issuance and sale of preferred stock. This agreement serves as a crucial framework for the financial relationship between both parties, ensuring a clear understanding of the rights and responsibilities associated with the preferred stock. The Subscription Agreement establishes the terms of the investment and outlines the number of shares being issued, the purchase price, as well as any conversion provisions. By utilizing the keyword "Orange California," it suggests that this specific agreement is applicable within the jurisdiction of Orange County, California. The 6% Series G Convertible Preferred Stock refers to a specific class of preferred stock offered by Object Soft Corp. to potential Investors. This preferred stock carries a fixed annual dividend rate of 6%, ensuring investors receive a steady income stream from their investment. The "Series G" designation signifies that this particular class falls within the larger framework of previously issued preferred stocks. The Convertible nature of the preferred stock allows Investors the option to convert their shares into common stock at a predetermined conversion price. This provision grants flexibility to investors, enabling them to potentially benefit from future company growth and appreciate the value of their investment. It is worth noting that there may be variations or subsequent series of preferred stock within the Orange California Subscription Agreement. These different series could be denoted by letters of the alphabet (such as Series A, Series B, etc.) and offer distinct terms, such as differing dividend rates, conversion prices, or other special provisions. However, in the context of this content, the focus remains on the 6% Series G Convertible Preferred Stock. In summary, the Orange California Subscription Agreement — 6% Series G Convertible Preferred Stock is a legally binding contract that governs the issuance and sale of preferred stock between Object Soft Corp. and Investors in Orange County, California. It outlines specific terms, such as the number of shares, purchase price, annual dividend rate, and convertible options. This comprehensive agreement aims to ensure transparency, clarity, and mutual understanding between the parties involved.

Orange California Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock

Description

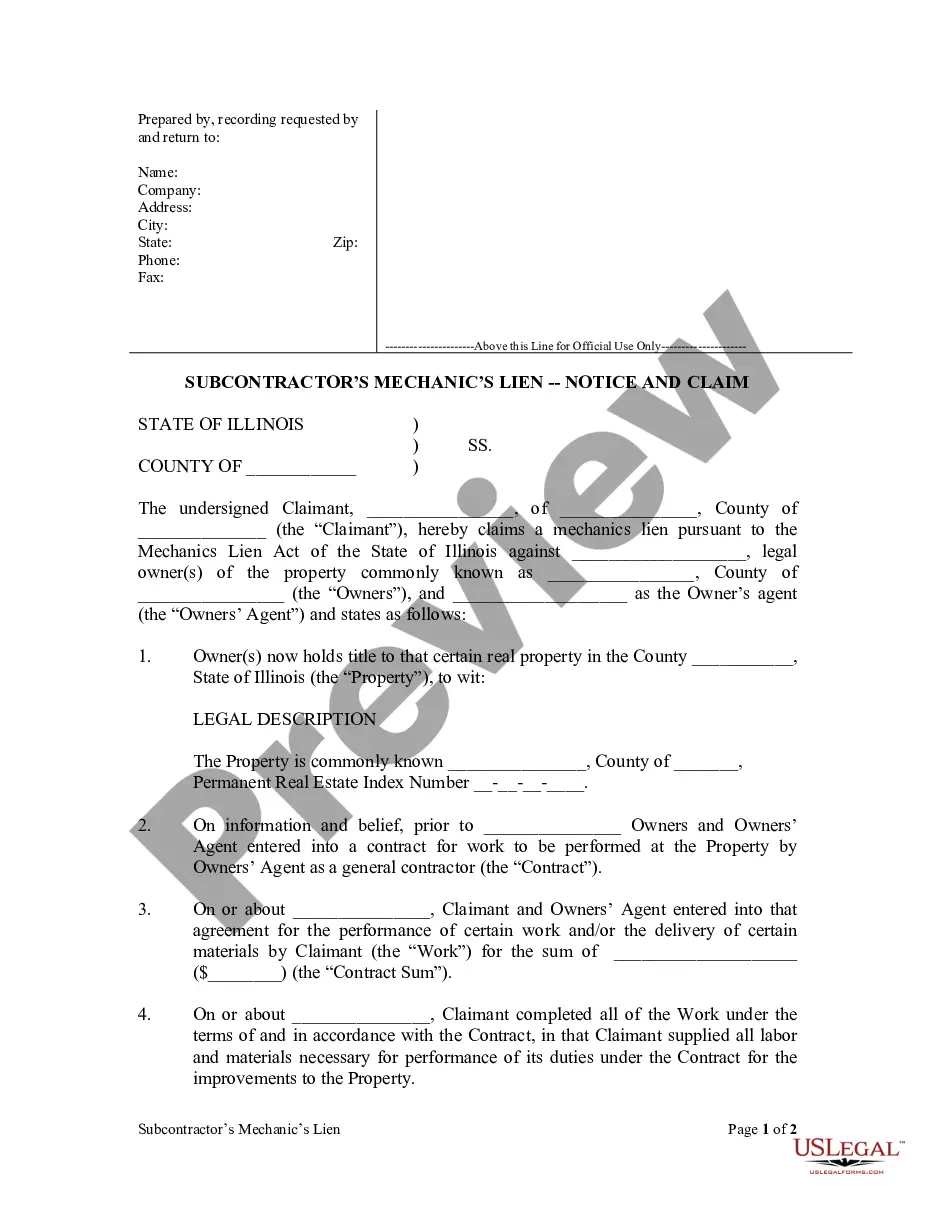

How to fill out Orange California Subscription Agreement - 6% Series G Convertible Preferred Stock - Between ObjectSoft Corp. And Investors Regarding Issuance And Sale Of Preferred Stock?

Creating documents, like Orange Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock, to manage your legal affairs is a challenging and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can take your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for a variety of cases and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Orange Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before getting Orange Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock:

- Ensure that your document is specific to your state/county since the regulations for writing legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Orange Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start using our website and download the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!