The Oakland Michigan Amended and Restated Credit Agreement between ADAC Laboratories, various financial institutions, and ABN AFRO Bank is a legally binding contract that outlines the terms and conditions for a credit facility provided to ADAC Laboratories by the participating financial institutions, with ABN AFRO Bank as the administrative agent. This agreement aims to regulate the borrowing, repayment, and overall management of credit between the parties involved. Keywords: Oakland Michigan, Amended and Restated Credit Agreement, ADAC Laboratories, financial institutions, ABN AFRO Bank, credit facility, administrative agent, borrowing, repayment, management. Types of Oakland Michigan Amended and Restated Credit Agreement may include: 1. Revolving Credit Facility Agreement: This type of agreement allows ADAC Laboratories to have access to a pre-approved credit limit, from which they can borrow and repay multiple times within a specified period. The agreement will outline the terms, interest rate, repayment schedule, and any associated fees. 2. Term Loan Agreement: Under this agreement, ADAC Laboratories will receive a specific amount of credit from the financial institutions that they will repay over a designated period with interest. The agreement will establish the repayment structure, interest rate, and any other terms related to this specific loan. 3. Syndicated Credit Agreement: In a syndicated credit agreement, multiple financial institutions collaborate to provide a larger credit facility to ADAC Laboratories. Each institution shares the risk and terms of the loan. ABN AFRO Bank may act as the administrative agent, overseeing the disbursement, repayments, and overall management of the syndicated credit facility. 4. Secured Credit Agreement: This type of agreement involves ADAC Laboratories providing collateral, such as assets or property, to secure the credit facility. In the event of default, the financial institutions may have the right to claim and liquidate the collateral to recover the outstanding balance. 5. Subordinated Credit Agreement: In a subordinated credit agreement, the financial institutions agree to be subordinate to another creditor, typically ABN AFRO Bank. This means that if ADAC Laboratories faces financial distress or bankruptcy, the subordinated creditors have lower priority in claiming the assets and are typically repaid after the senior creditors, such as ABN AFRO Bank. 6. Swing line Credit Agreement: A swing line credit agreement provides ADAC Laboratories with a short-term, unsecured line of credit for immediate financing needs. ABN AFRO Bank may act as the lender for this type of credit agreement. It is essential to note that the specific types of agreements may vary based on the terms negotiated between ADAC Laboratories, the financial institutions, and ABN AFRO Bank in the context of the Oakland Michigan Amended and Restated Credit Agreement.

Oakland Michigan Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank

Description

How to fill out Oakland Michigan Amended And Restated Credit Agreement Between ADAC Laboratories, Various Financial Institution And ABN AMRO Bank?

Preparing papers for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to generate Oakland Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank without expert assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Oakland Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Oakland Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank:

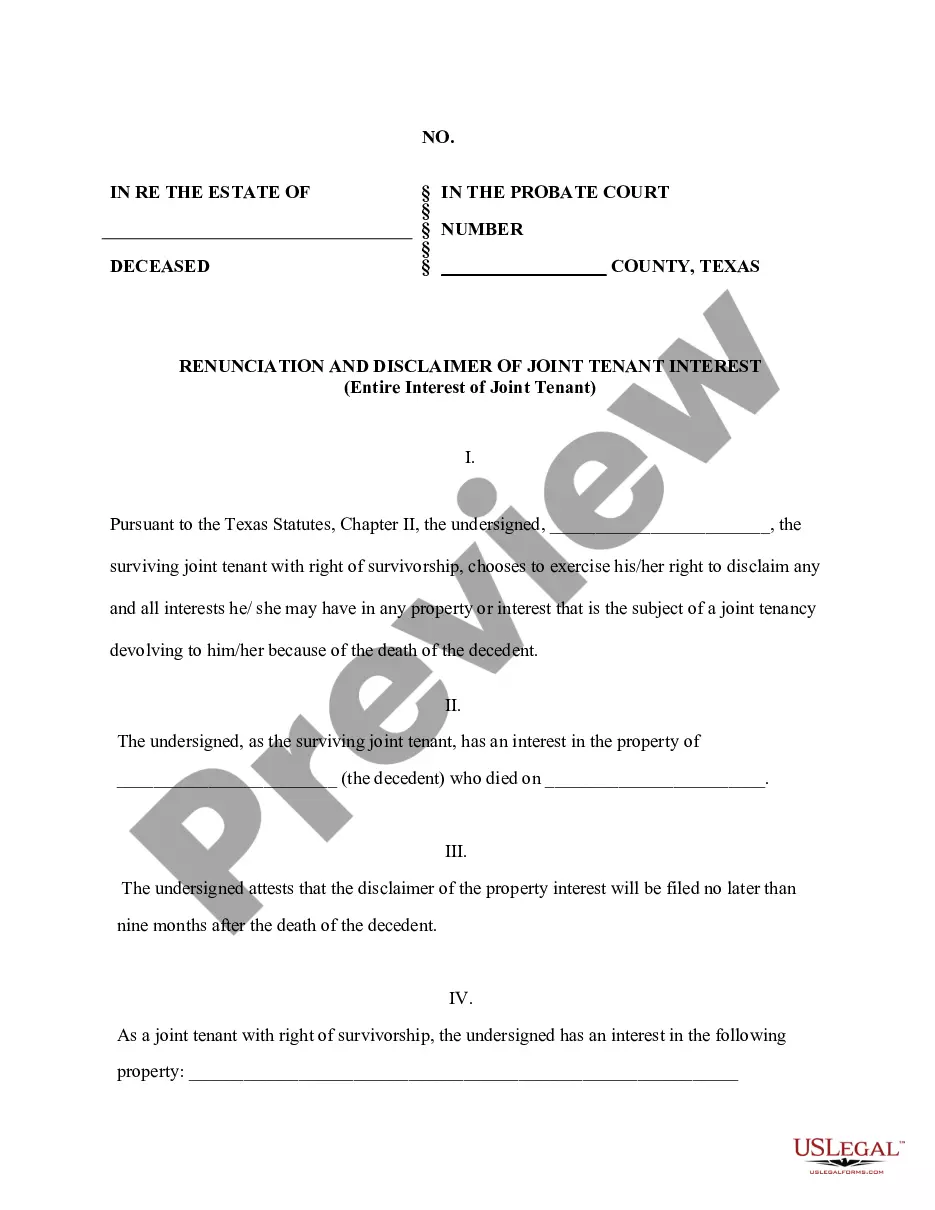

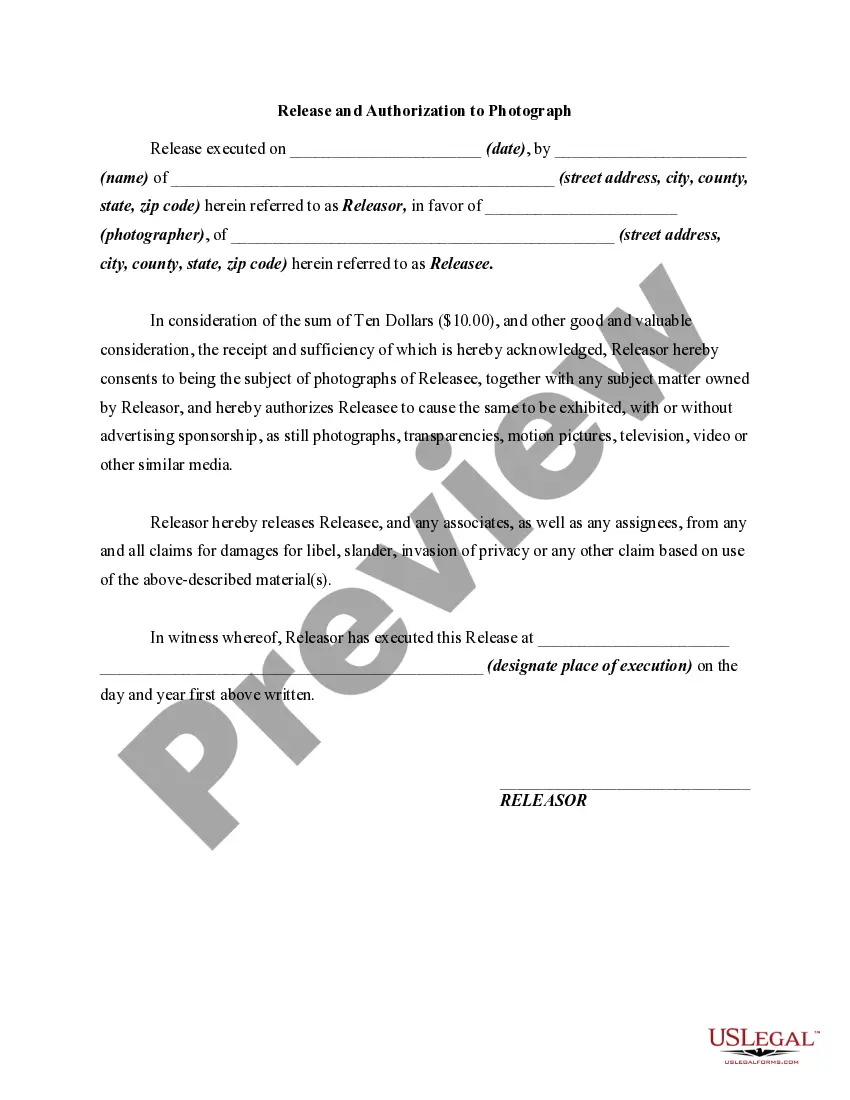

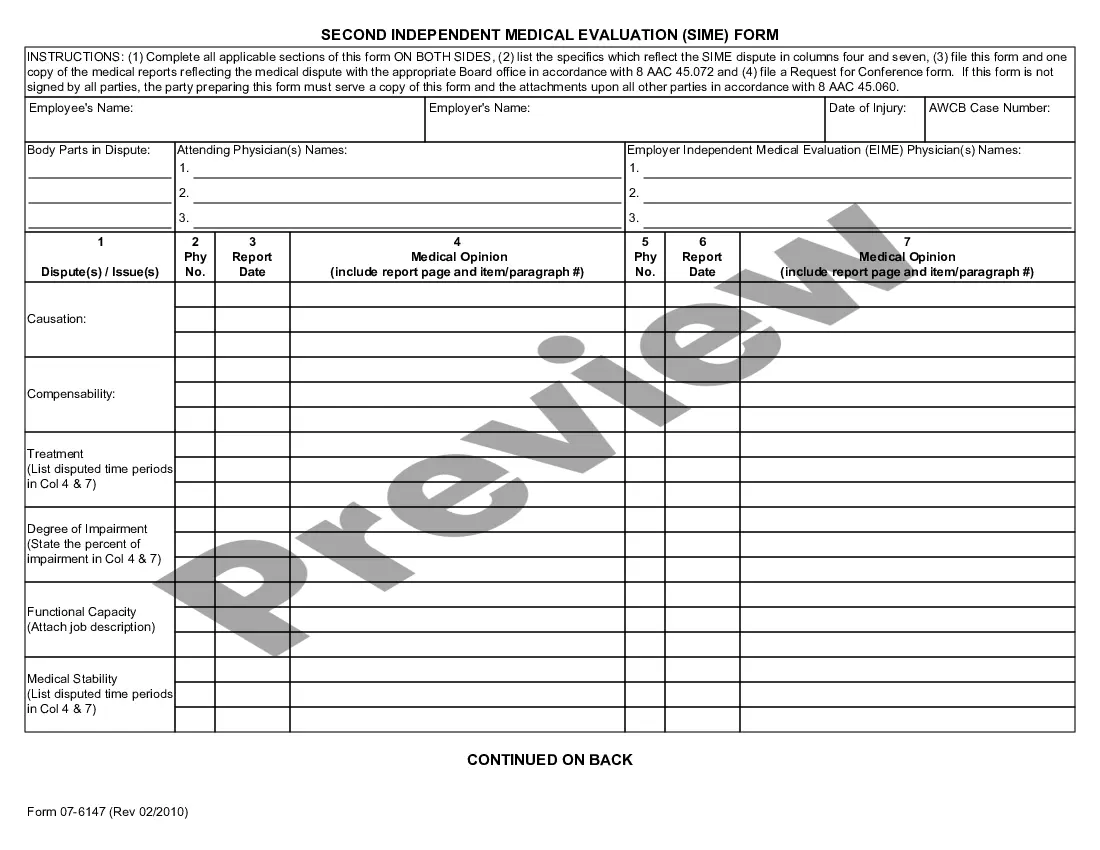

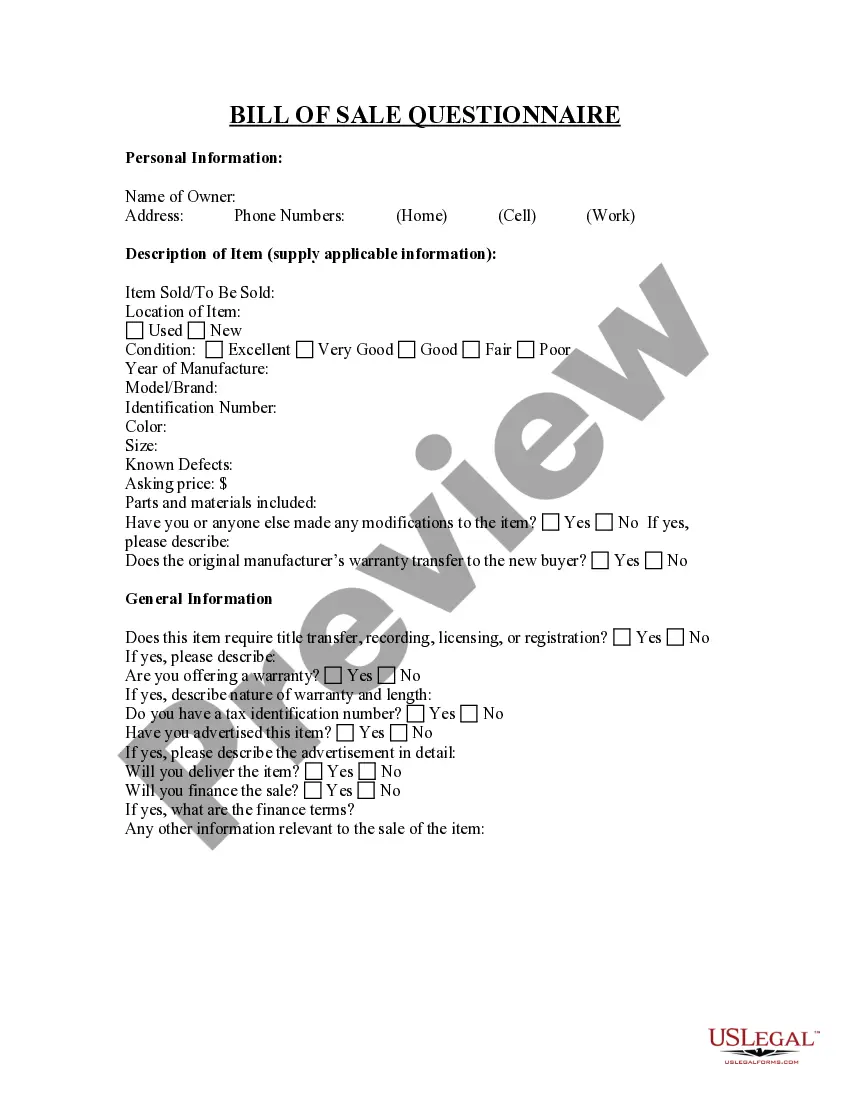

- Examine the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!