Santa Clara California Amended and Restated Credit Agreement is a legal document that governs the terms and conditions of the credit facility provided by various financial institutions, including ABN AFRO Bank, to ADAC Laboratories, a company based in Santa Clara, California. This agreement outlines the borrower's obligations, lender's rights, and sets forth the terms of the loan. The Santa Clara California Amended and Restated Credit Agreement between ADAC Laboratories, various financial institutions, and ABN AFRO Bank may have different types, depending on the specific requirements and structure of the financing. These types can include: 1. Revolving Credit Facility: This type of credit agreement provides ADAC Laboratories with a predetermined credit limit, allowing them to borrow, repay, and re-borrow funds within the authorized limit as per their cash flow needs. Interest is charged on the outstanding balance, and there may be a commitment fee for the unused portion of the facility. 2. Term Loan Agreement: In this type of credit agreement, ADAC Laboratories receives a lump sum loan upfront, which is repaid over a fixed period of time with regular installments. Interest rates can be fixed or floating, based on market conditions and negotiations. 3. Bridge Loan Agreement: A short-term financing option, the bridge loan agreement is designed to provide ADAC Laboratories with immediate funding until a permanent financing solution, such as a bond issuance or long-term loan, can be secured. Bridge loans often come with higher interest rates and are usually paid back within a year. 4. Working Capital Line of Credit: This credit facility is specifically used to finance ADAC Laboratories' day-to-day operations, including inventory purchases, accounts receivable, and other short-term needs. The line of credit is often based on a percentage of the company's eligible accounts receivable and inventory valuations. The Santa Clara California Amended and Restated Credit Agreement between ADAC Laboratories, various financial institutions, and ABN AFRO Bank will define the specific terms, conditions, covenants, and collateral requirements that govern the respective credit facility. It will also outline any amendments or changes made to the initial credit agreement, ensuring transparency and legal protection for all parties involved.

Santa Clara California Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank

Description

How to fill out Santa Clara California Amended And Restated Credit Agreement Between ADAC Laboratories, Various Financial Institution And ABN AMRO Bank?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Santa Clara Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Santa Clara Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank from the My Forms tab.

For new users, it's necessary to make several more steps to get the Santa Clara Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank:

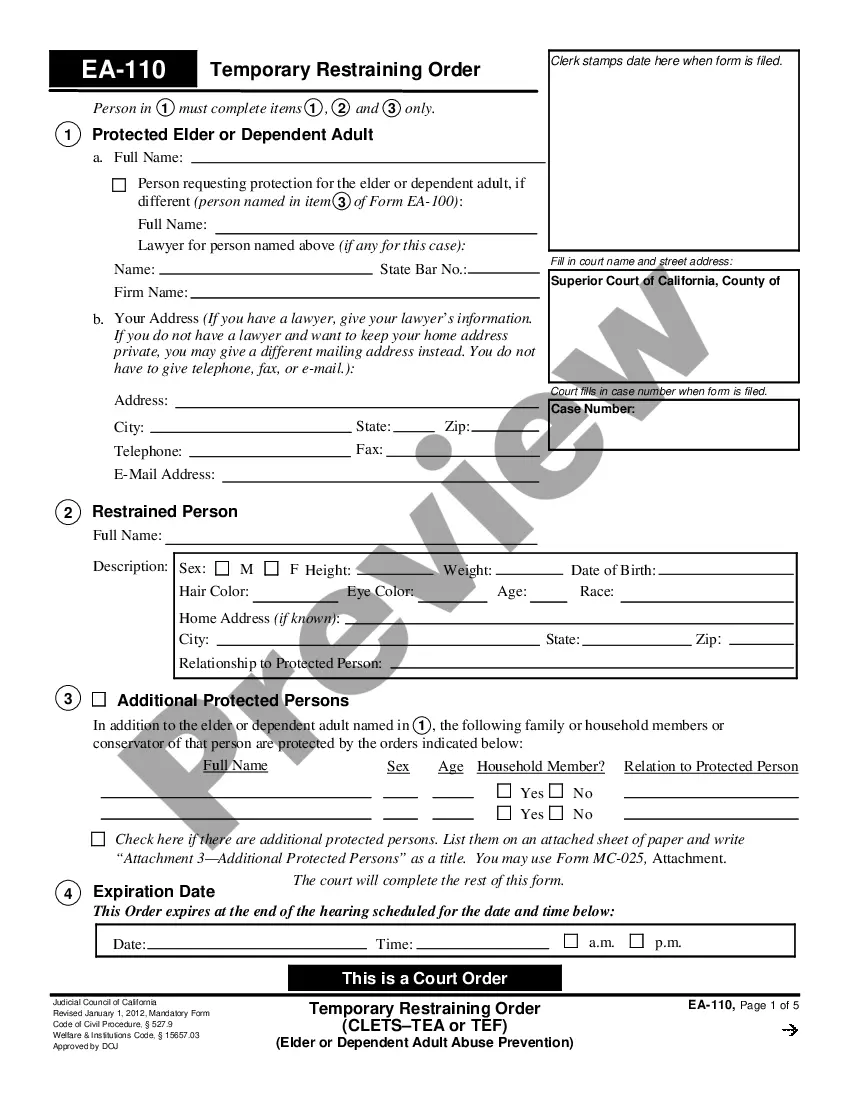

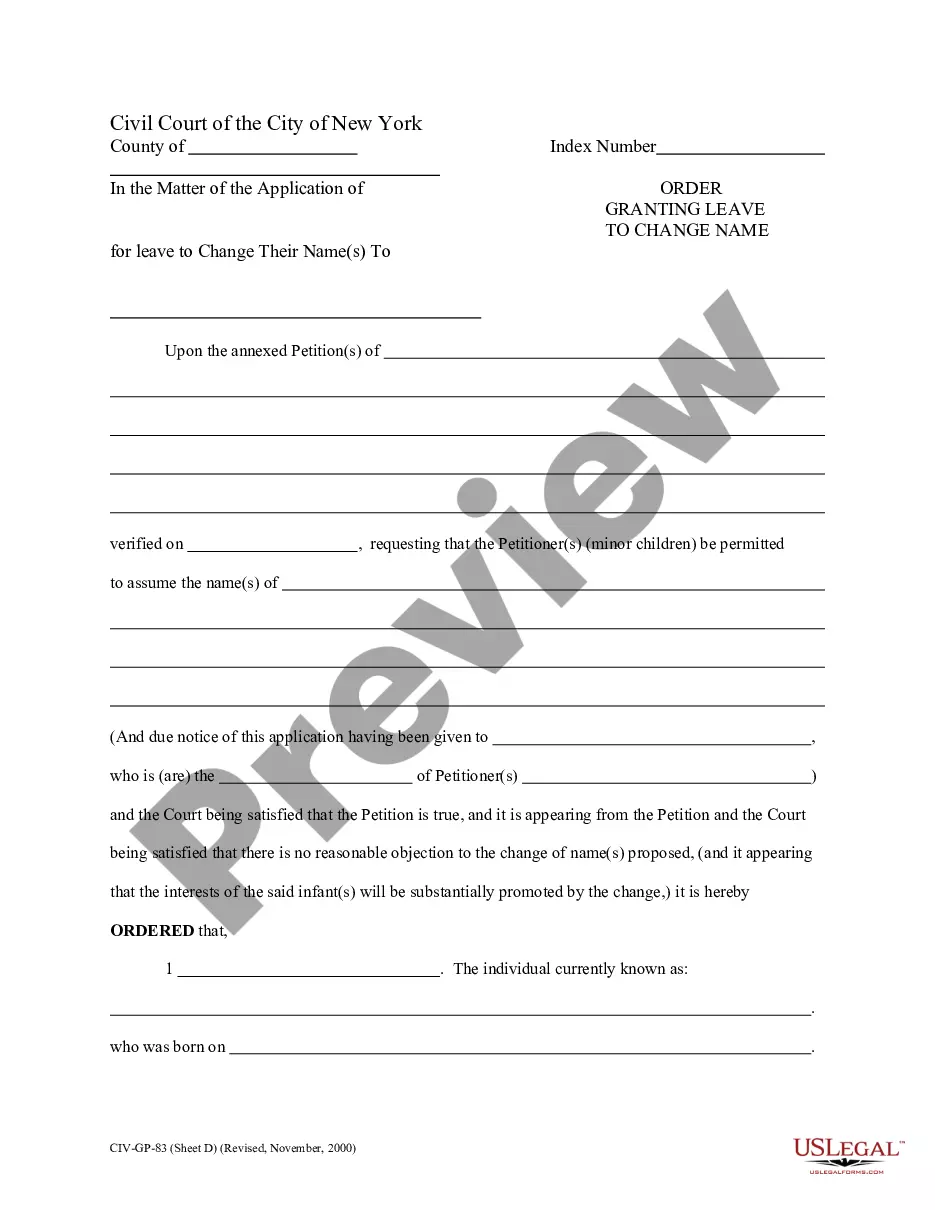

- Analyze the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!