The Contra Costa California Borrower Security Agreement is a legally binding contract that outlines the terms and conditions for extending credit facilities to borrowers in the Contra Costa County, California region. This agreement serves as a protective measure for lenders as it establishes the borrower's commitment to repaying the debt and provides a mechanism for addressing any default or non-compliance issues. Keywords: Contra Costa California, Borrower Security Agreement, extension of credit facilities, legal contract, terms and conditions, lenders, borrowers, repayment, debt, default, non-compliance. There may be different types of Contra Costa California Borrower Security Agreements depending on the specific requirements and circumstances of the credit facilities being extended. Some variations of the agreement may include: 1. Secured Credit Facility Agreement: This type of agreement involves the borrower providing collateral, such as real estate, equipment, or other valuable assets, as security against the credit being extended. If the borrower defaults on their obligations, the lender has the right to seize and sell the collateral to recover their debt. 2. Unsecured Credit Facility Agreement: In contrast to a secured agreement, an unsecured agreement does not require the borrower to provide collateral. Instead, the borrower's creditworthiness and financial standing alone serve as the basis for granting credit facilities. However, the agreement may include provisions for the lender to take legal action or pursue other remedies in the event of default. 3. Revolving Credit Facility Agreement: This type of agreement establishes a line of credit that the borrower can access repeatedly, up to a pre-approved limit. The borrower can borrow, repay, and re-borrow funds as needed without having to renegotiate the agreement each time. This can be advantageous for businesses with fluctuating cash flow needs. 4. Term Loan Facility Agreement: Unlike a revolving credit facility, a term loan facility provides a borrower with a specific amount of funds that must be repaid over a predetermined period, including interest. The repayment schedule and interest rate are typically fixed, facilitating easier financial planning for both the borrower and lender. 5. Construction Loan Facility Agreement: This agreement is specifically designed for borrowers involved in construction projects. The lender agrees to provide funds in stages as the construction progresses. The agreement may include provisions concerning the release of funds, inspections, and the borrower's obligations regarding construction progress, permits, and compliance with local regulations. These variations showcase the flexibility and customization possible in the Contra Costa California Borrower Security Agreement to cater to the unique financial needs and circumstances of borrowers seeking credit facilities.

Contra Costa California Borrower Security Agreement regarding the extension of credit facilities

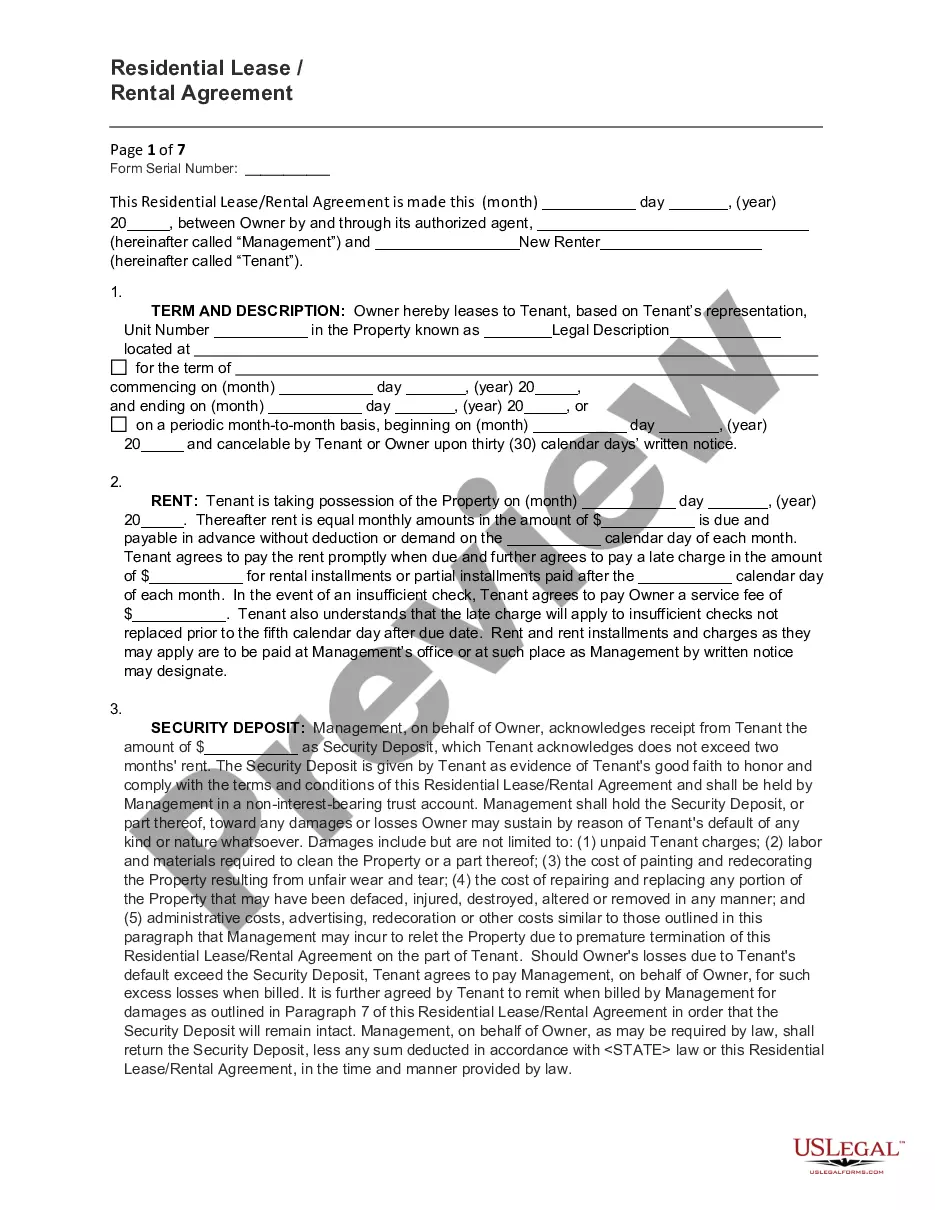

Description

How to fill out Contra Costa California Borrower Security Agreement Regarding The Extension Of Credit Facilities?

Preparing documents for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Contra Costa Borrower Security Agreement regarding the extension of credit facilities without professional assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Contra Costa Borrower Security Agreement regarding the extension of credit facilities on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Contra Costa Borrower Security Agreement regarding the extension of credit facilities:

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a few clicks!