Oakland Michigan Borrower Security Agreement is a legal document that outlines the terms and conditions for extending credit facilities to borrowers in Oakland, Michigan. This agreement serves as a protective measure for lenders and ensures that they have a right to certain assets or collateral held by the borrower in case of default. The Borrower Security Agreement is a crucial component of the lending process as it helps mitigate the lender's risk. It provides a clear understanding of the rights and obligations of both parties, outlining the collateral that will secure the credit facility. In case of default, the lender can take legal action to recover the amount owed by liquidating or selling the collateral. Keywords related to the Oakland Michigan Borrower Security Agreement and its extension of credit facilities may include: 1. Collateral: The assets or property used as security to secure the credit facility. 2. Default: The failure of the borrower to fulfill their obligations under the agreement, resulting in the lender's right to take action. 3. Lender: The financial institution or individual providing the credit facilities. 4. Borrower: The individual or entity receiving the credit facilities. 5. Extension: The lengthening of the credit facility's repayment period. 6. Terms and Conditions: The specific provisions and requirements that both parties must adhere to. 7. Rights and Obligations: The agreed-upon responsibilities of the lender and borrower. 8. Legal Action: The actions taken by the lender to recover the owed amount in case of default. 9. Liquidation: The process of converting the collateral into cash to repay the outstanding debt. Different types of Oakland Michigan Borrower Security Agreements may exist, depending on the nature of the credit facilities and specific requirements. These may include: 1. Real Estate Mortgage: A security agreement involving the borrower's real estate property as collateral. 2. Chattel Mortgage: An agreement where movable property, such as vehicles or equipment, is used as collateral. 3. Accounts Receivable Financing Agreement: This type of security agreement involves using accounts receivable as collateral. 4. Personal Guarantee: When an individual provides a security agreement using personal assets as collateral to secure the credit facilities. It's important for borrowers and lenders in Oakland, Michigan, to carefully review and understand the specific terms and provisions outlined in the Borrower Security Agreement before entering into any credit facility agreements. Seeking legal advice is highly recommended ensuring compliance with relevant laws and regulations.

Oakland Michigan Borrower Security Agreement regarding the extension of credit facilities

Description

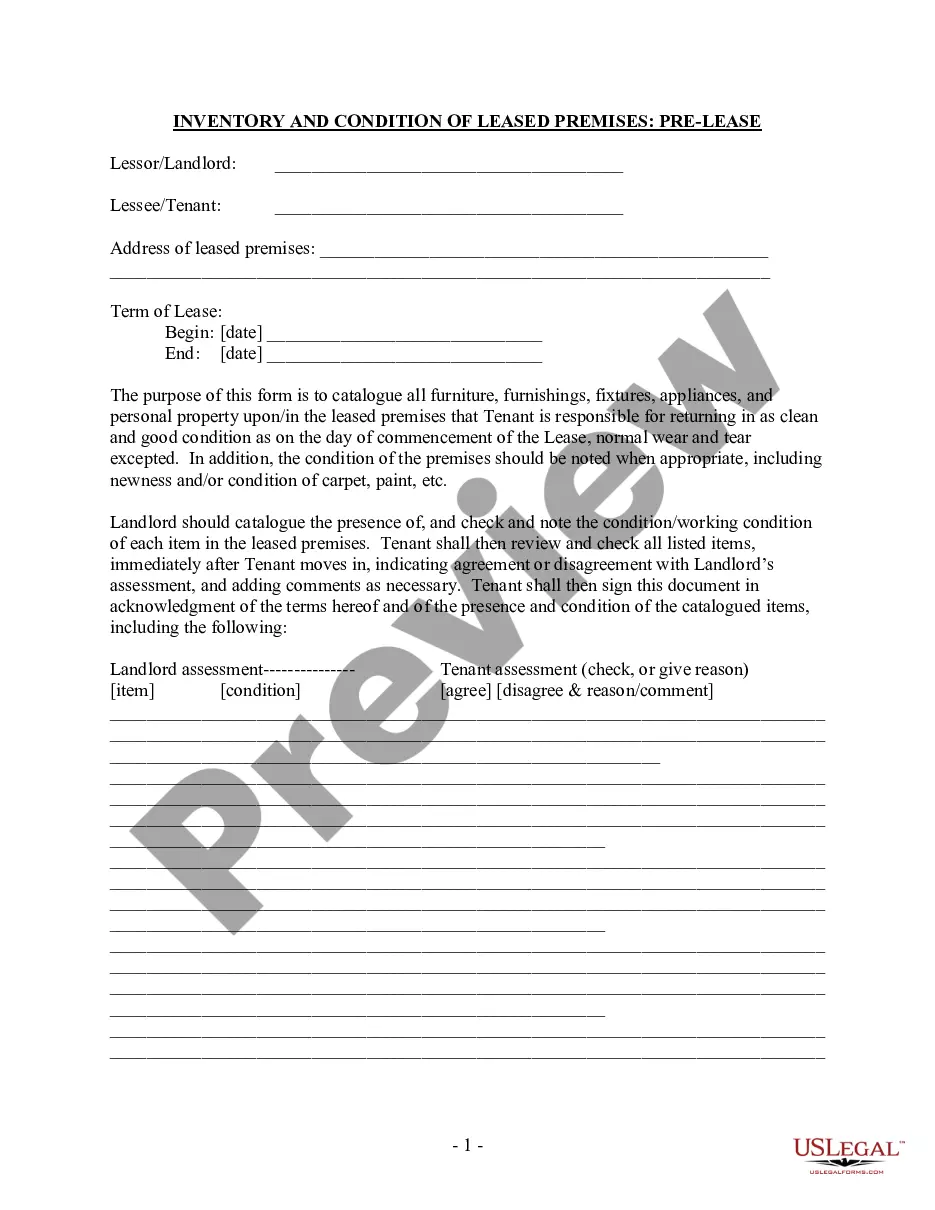

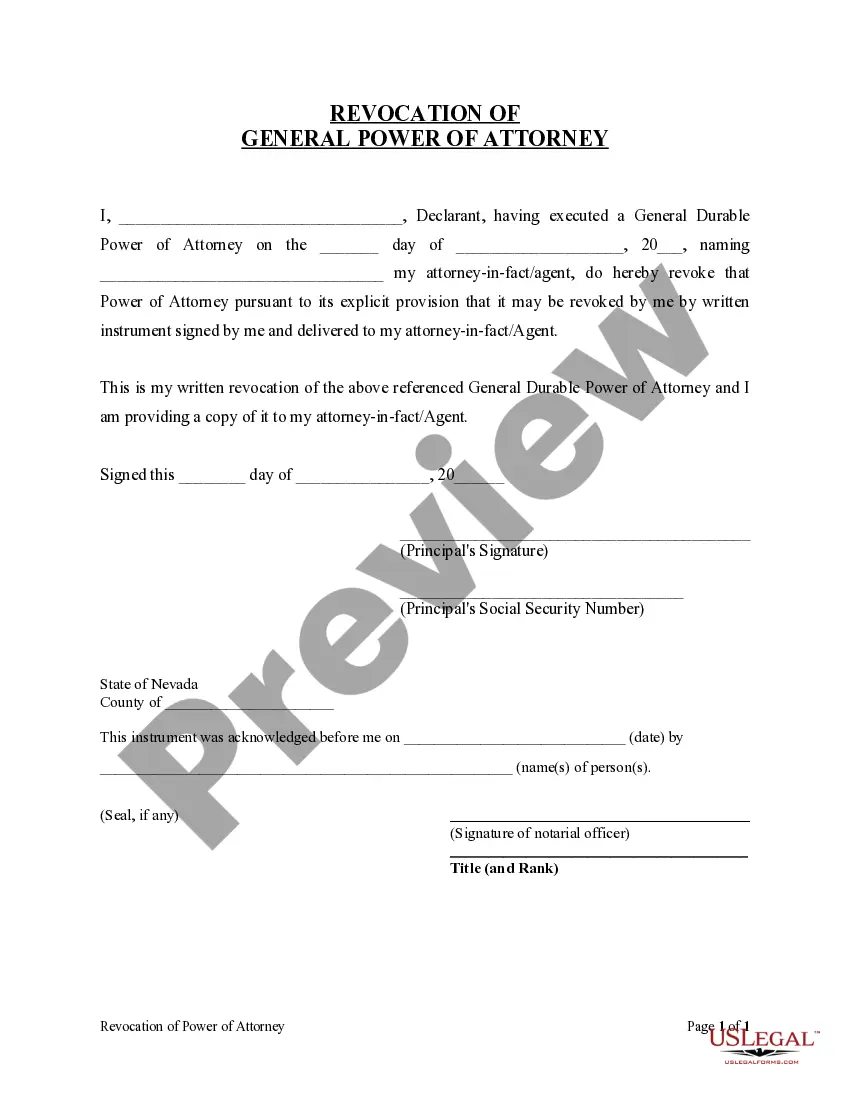

How to fill out Oakland Michigan Borrower Security Agreement Regarding The Extension Of Credit Facilities?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business objective utilized in your region, including the Oakland Borrower Security Agreement regarding the extension of credit facilities.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Oakland Borrower Security Agreement regarding the extension of credit facilities will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Oakland Borrower Security Agreement regarding the extension of credit facilities:

- Ensure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Oakland Borrower Security Agreement regarding the extension of credit facilities on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!