Tarrant Texas Borrower Security Agreement is a legally binding document that outlines the terms and conditions between a borrower and a lender when extending credit facilities. This agreement serves as a protective measure for the lender to secure their financial interest in case the borrower defaults on the loan. It establishes a framework in which collateral assets are pledged as security, providing the lender with a means of recourse. The Tarrant Texas Borrower Security Agreement specifies various aspects of the credit extension, including the loan amount, interest rates, repayment terms, and conditions for default. It typically requires the borrower to provide collateral, such as property, equipment, or inventory, as security for the loan. The agreement outlines the specific assets that will serve as collateral, their estimated value, and the process of valuing the collateral if necessary. In some cases, a Tarrant Texas Borrower Security Agreement may include provisions regarding guarantees or co-signers. Guarantees can be additional individuals or entities that assume joint responsibility for the loan and offer additional security to the lender. Co-signers, on the other hand, act as backup borrowers who are equally liable for loan repayment should the primary borrower fail to meet their obligations. Furthermore, the Tarrant Texas Borrower Security Agreement may include covenants and restrictions that the borrower must adhere to throughout the duration of the loan. These covenants could involve maintaining a specific level of insurance coverage, providing regular financial statements, fulfilling certain reporting requirements, or obtaining the lender's permission before engaging in particular business activities. Overall, the Tarrant Texas Borrower Security Agreement is designed to protect both the lender and the borrower. It ensures that the lender has sufficient recourse in case of default and provides a framework for the borrower to access credit facilities while maintaining financial responsibility. The agreement sets clear expectations and obligations for each party, reducing the potential for disputes and facilitating a positive lending relationship. While there may not be different types of Tarrant Texas Borrower Security Agreements regarding the extension of credit facilities, variations can arise based on the specific terms negotiated between the lender and borrower. These agreements can be tailored to meet the unique needs and circumstances of individual borrowers, allowing for some flexibility within the framework of borrower security agreements.

Tarrant Texas Borrower Security Agreement regarding the extension of credit facilities

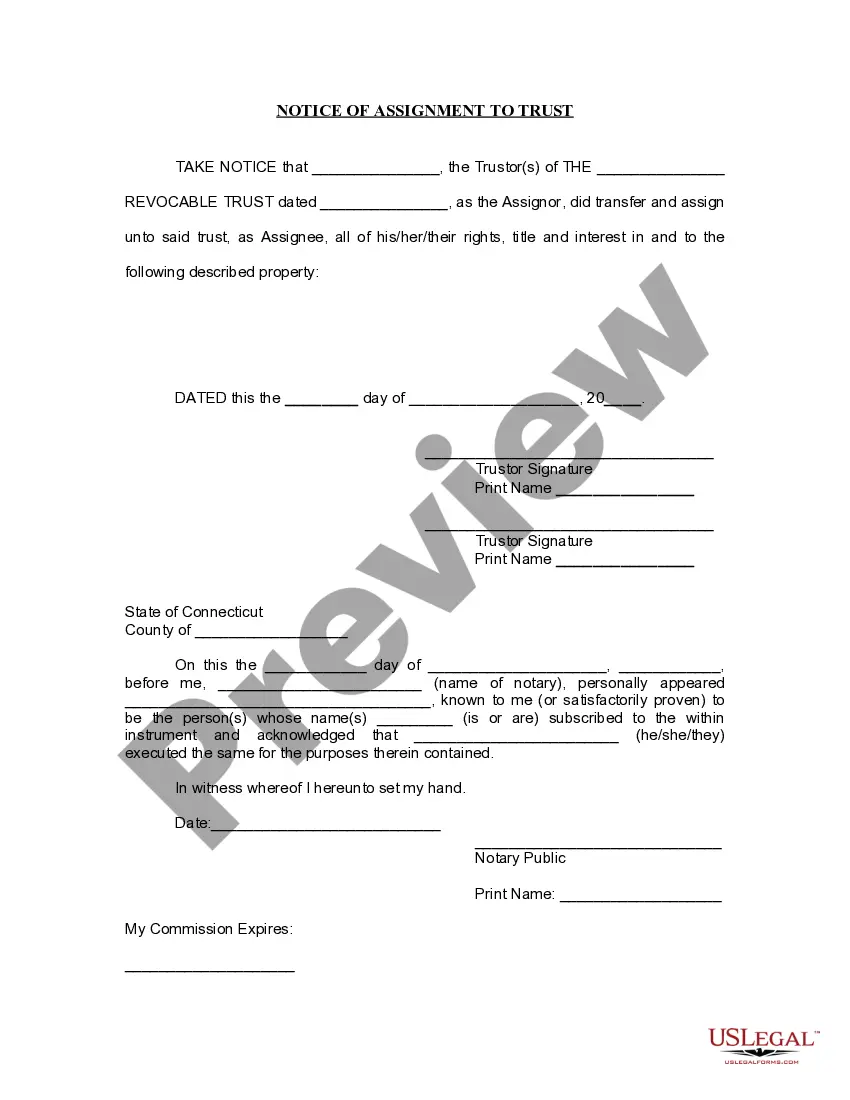

Description

How to fill out Tarrant Texas Borrower Security Agreement Regarding The Extension Of Credit Facilities?

How much time does it normally take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, finding a Tarrant Borrower Security Agreement regarding the extension of credit facilities meeting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. In addition to the Tarrant Borrower Security Agreement regarding the extension of credit facilities, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Tarrant Borrower Security Agreement regarding the extension of credit facilities:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Tarrant Borrower Security Agreement regarding the extension of credit facilities.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!