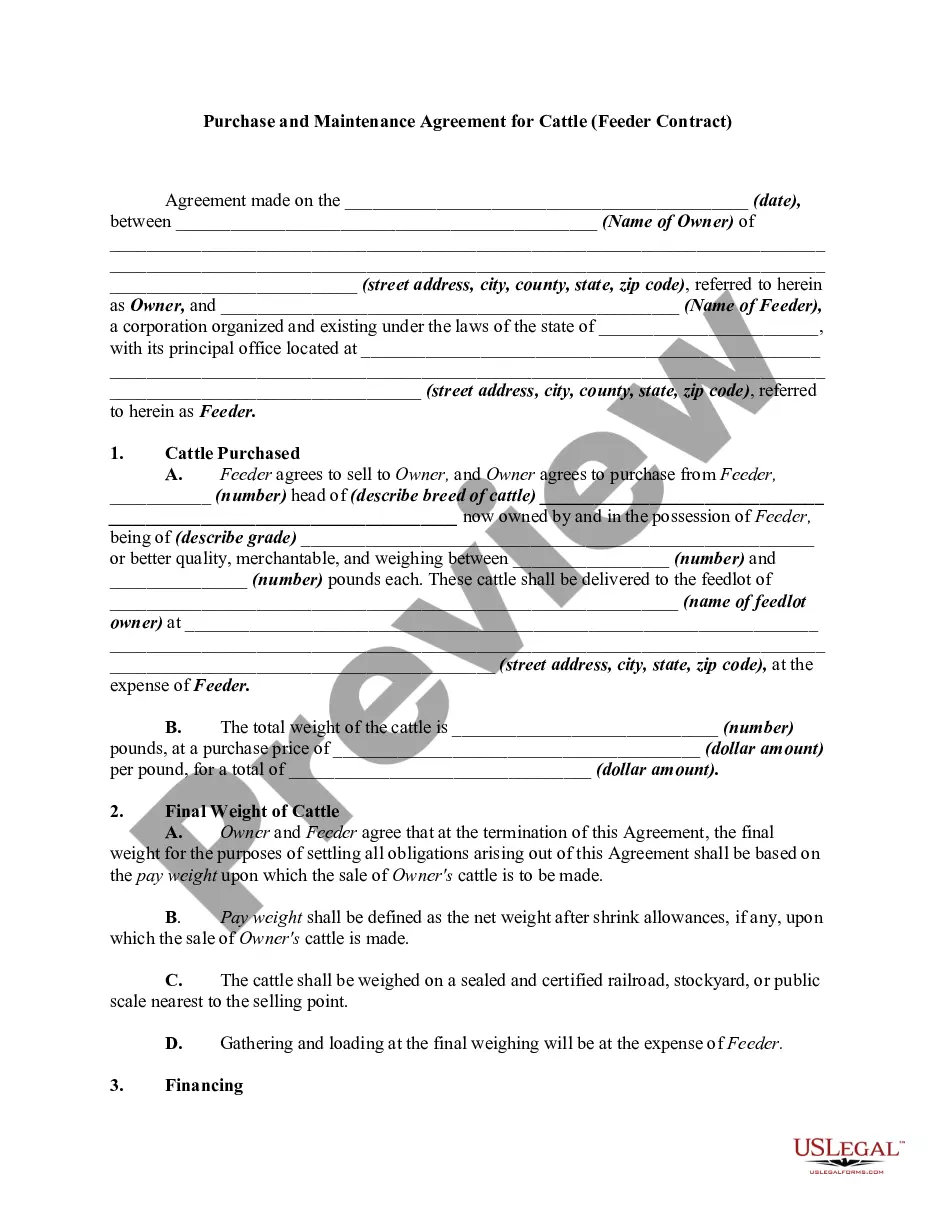

Travis Texas Borrower Security Agreement is a legal document outlining the terms and conditions that borrowers in Texas need to abide by when extending credit facilities. This agreement is crucial for protecting the lenders' interests and ensuring the repayment of loans or credit borrowed by individuals or businesses. The Travis Texas Borrower Security Agreement covers various aspects related to the extension of credit facilities. It includes detailed information about the borrower, lender, and the specific terms and conditions agreed upon for the credit extension. This agreement serves as a legally binding contract, offering security to lenders and establishing the borrower's obligations and responsibilities. Key components commonly found in Travis Texas Borrower Security Agreements to concerning credit facilities may include: 1. Pledge of assets: The agreement may require the borrower to pledge specific assets as collateral, which can be seized by the lender in the case of default or non-payment. 2. Guarantees: In certain cases, a third party or co-borrower may provide personal guarantees to secure the loan, ensuring the repayment if the borrower cannot fulfill their obligations. 3. Repayment terms: The agreement outlines the specific repayment schedule, including interest rates, payment due dates, and any penalties for late or missed payments. 4. Default provisions: This section defines the events that would constitute a default, such as non-payment, breach of terms, or bankruptcy, and elaborates on the actions the lender can take in such situations. 5. Cross-default provisions: If the borrower has multiple credit facilities, this provision explains how the default on one facility can trigger default on others, potentially accelerating the repayment obligations. 6. Financial covenants: The agreement may include specific financial metrics or ratios that the borrower must maintain during the loan term, ensuring their financial stability and ability to meet repayment obligations. 7. Collateral valuations: Some agreements may require periodic valuations of the pledged collateral to ensure its continued value and adequacy for loan purposes. 8. Amendments and waivers: This section outlines the process for any amendments or waivers to the agreed terms, specifying the conditions under which changes can be made. Travis Texas Borrower Security Agreements regarding the extension of credit facilities may have different variations or subtypes based on various factors, such as the nature of credit (personal, business, mortgage, etc.), the amount of credit being extended, and the specific requirements of the lender. However, the fundamental purpose of these agreements remains the same — to establish a legal framework for lenders and borrowers to facilitate credit transactions while safeguarding their respective interests.

Travis Texas Borrower Security Agreement regarding the extension of credit facilities

Description

How to fill out Travis Texas Borrower Security Agreement Regarding The Extension Of Credit Facilities?

Do you need to quickly create a legally-binding Travis Borrower Security Agreement regarding the extension of credit facilities or maybe any other form to manage your own or corporate affairs? You can go with two options: hire a legal advisor to write a valid paper for you or draft it entirely on your own. The good news is, there's another option - US Legal Forms. It will help you get neatly written legal paperwork without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific form templates, including Travis Borrower Security Agreement regarding the extension of credit facilities and form packages. We offer documents for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, double-check if the Travis Borrower Security Agreement regarding the extension of credit facilities is tailored to your state's or county's regulations.

- In case the form includes a desciption, make sure to verify what it's suitable for.

- Start the search over if the form isn’t what you were looking for by using the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Travis Borrower Security Agreement regarding the extension of credit facilities template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the templates we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

These include credit sale agreements, hire purchase agreements and conditional sale agreements.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

How do I find my Credit Agreements? Your reported Credit Agreements will appear on your Credit Report, giving you a detailed list of your current and past lenders, amounts owed, the status of the accounts, and more.

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

In accordance with article 60L of the Regulated Activities Order, (a) a credit agreement: (i) to finance a transaction between the borrower and a person ("the supplier") other than the lender; and.

Important lending terms included in the credit agreement include the annual interest rate, how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

A credit agreement is a legally binding contract between a borrower and a lender that must be agreed by both parties. It holds the terms of any type of credit, such as overdrafts, credit cards or personal loans. That's why a credit agreement for a personal loan is normally referred to as a loan agreement.