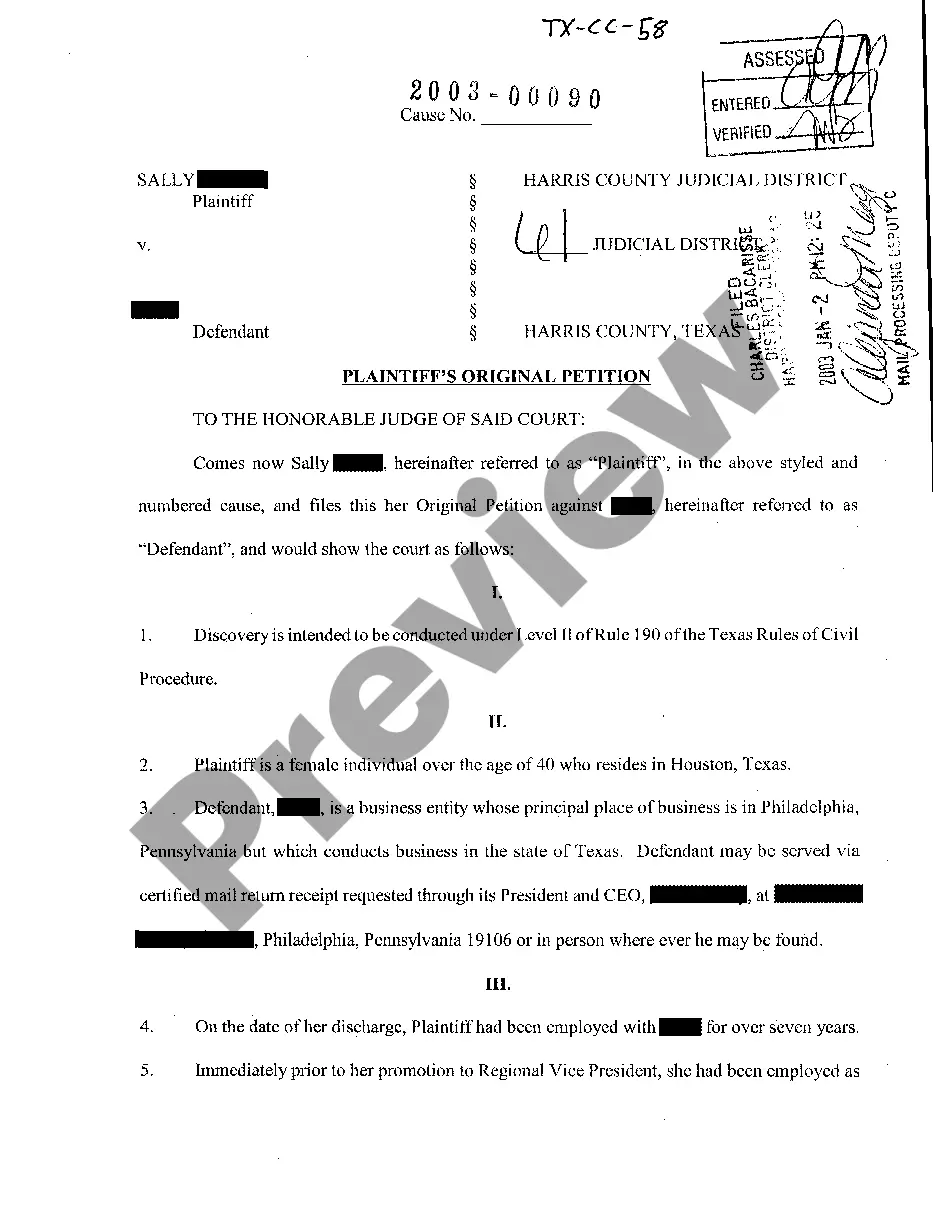

The Houston Texas Domestic Subsidiary Security Agreement, relating to the eatable benefit of Lenders and Agent, is a legal document that outlines the terms and conditions surrounding the collateral provided by a domestic subsidiary to secure loans or other forms of credit extended by lenders. This agreement serves as a mechanism to protect the interests of the lenders and the agent, ensuring that in the event of default or insolvency of the borrowing entity, they have a claim to the subsidiary's assets pledged as collateral. The purpose of this agreement is to provide security and enforceability for the lenders and agent in the event of non-payment or breach of the loan agreement. The Houston Texas Domestic Subsidiary Security Agreement includes several key provisions that govern the rights and benefits of the lenders and agent: 1. Collateral Identification: The agreement specifies the assets offered as collateral by the domestic subsidiary, which may include real estate, equipment, inventory, intellectual property, or other valuable assets. 2. Security Interest Creation: The agreement outlines the process by which the security interest in the collateral is created, ensuring that it is perfected and enforceable in accordance with applicable laws. 3. Priority of Interests: It stipulates the priority of the lenders' and agent's interests in the collateral, ensuring that they are entitled to an eatable share of the proceeds upon liquidation or sale. 4. Maintenance of Collateral: The agreement may include provisions requiring the domestic subsidiary to maintain and protect the collateral, including insurance coverage, maintenance obligations, and restrictions on disposal or encumbrance. 5. Events of Default: It specifies the events that constitute default, such as non-payment, breach of covenants, or insolvency, triggering the lenders' and agent's rights to enforce their security interests. 6. Enforcement Remedies: The agreement defines the rights and remedies available to the lenders and agent in the event of default, including the right to take possession or control of the collateral, sell it in a commercially reasonable manner, and apply the proceeds to satisfy their claims. Different variations of the Houston Texas Domestic Subsidiary Security Agreement may exist, depending on the specific circumstances and requirements of the parties involved. For example, one type may focus on real estate collateral, while another may pertain to intellectual property assets. However, the overall objective remains consistent — to provide a legal framework that ensures the eatable benefit of lenders and the agent from the collateral provided by a domestic subsidiary.

Houston Texas Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

Description

How to fill out Houston Texas Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

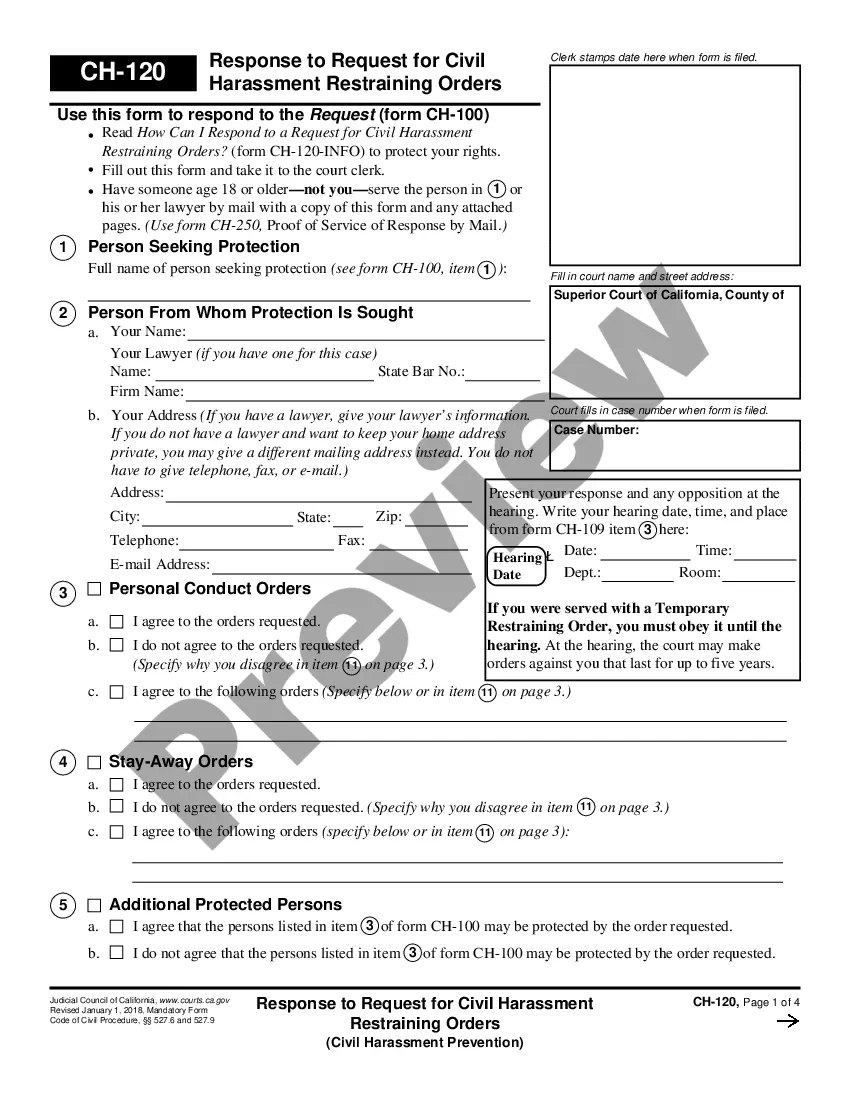

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Houston Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Therefore, if you need the current version of the Houston Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Houston Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Houston Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!