Nassau New York Domestic Subsidiary Security Agreement is a legally binding contract that outlines the terms and conditions for securing the assets of a domestic subsidiary in Nassau, New York. In this agreement, certain provisions are in place to ensure the eatable benefit of lenders and the agent involved. The primary purpose of this agreement is to establish a framework for the lateralization of the domestic subsidiary's assets to protect the interests of lenders and the agent. By pledging certain assets as collateral, the lenders gain a higher level of security and reassurance in the event of default or insolvency. Keywords: Nassau New York, Domestic Subsidiary, Security Agreement, Eatable Benefit, Lenders, Agent, Lateralization, Assets, Default, Insolvency. Types of Nassau New York Domestic Subsidiary Security Agreement regarding the eatable benefit of Lenders and Agent include: 1. Fixed Charge Security Agreement: This type of agreement grants lenders a fixed charge over specific assets of the domestic subsidiary, enabling them to prioritize repayment in case of default. The fixed charge provides lenders with a first-ranking claim on identified assets, thus ensuring an eatable benefit. 2. Floating Charge Security Agreement: Unlike a fixed charge, a floating charge grants lenders a claim over a class of assets rather than specific ones. This type of agreement enables the domestic subsidiary to continue conducting business and utilizing assets until default occurs. Once triggered, the floating charge converts into a fixed charge, ensuring an eatable benefit for lenders. 3. All Assets Debenture: This agreement is a comprehensive security arrangement where the domestic subsidiary pledges all of its assets as collateral for the benefit of lenders and the agent. It provides lenders with an additional layer of security, encompassing all present and future assets, ensuring an eatable benefit. 4. General Security Agreement (GSA): The GSA covers a wide range of assets within the domestic subsidiary, granting lenders a security interest in various types of collateral — such as inventory, accounts receivable, equipment, and intellectual property. It ensures an eatable benefit by providing a comprehensive security arrangement. In conclusion, Nassau New York Domestic Subsidiary Security Agreement is a crucial document that establishes the terms and conditions for protecting the interests of lenders and the agent. The agreement may take various forms, including fixed charge, floating charge, all assets' debenture, or general security agreement, each designed to ensure an eatable benefit for the parties involved.

Nassau New York Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

Description

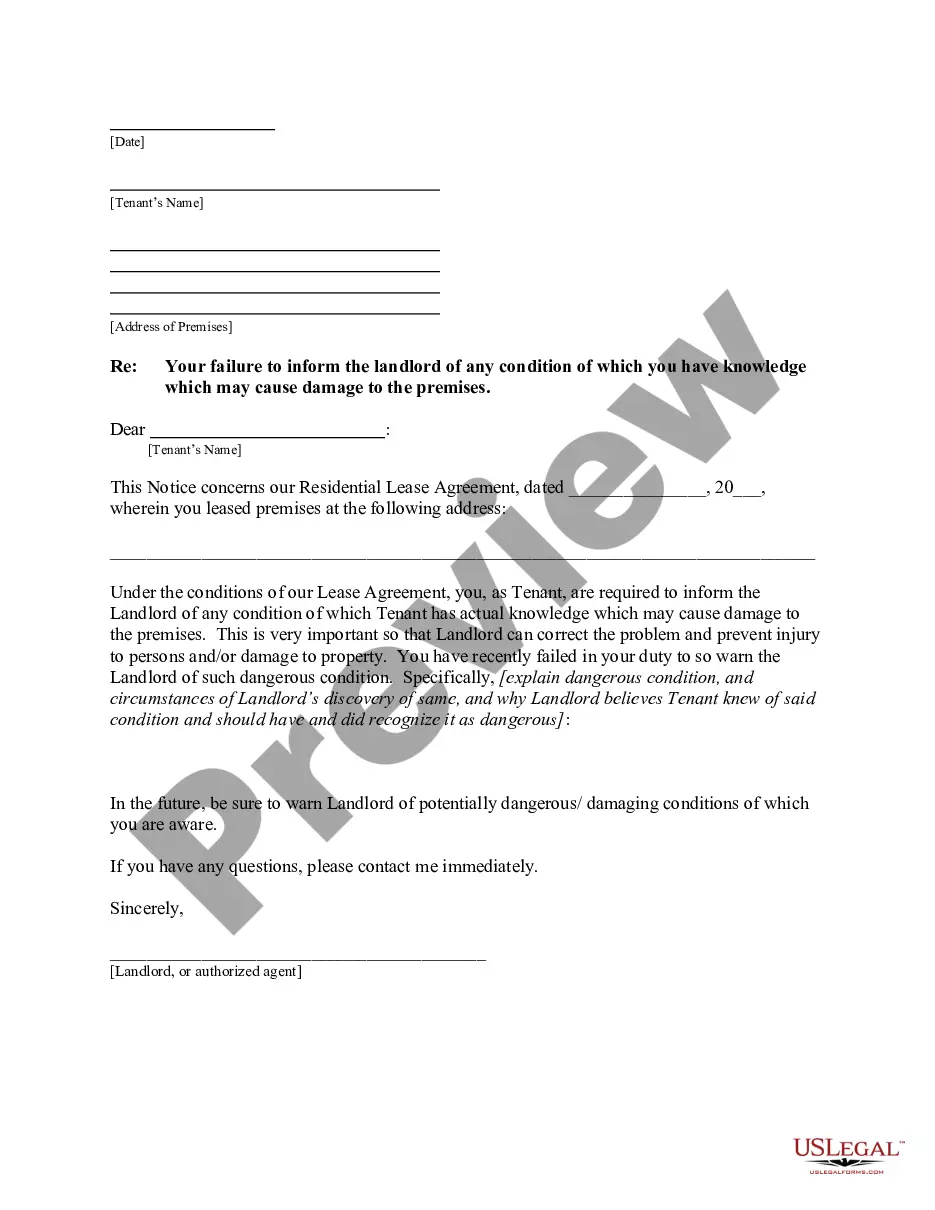

How to fill out Nassau New York Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

Whether you plan to open your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Nassau Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Nassau Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent. Adhere to the instructions below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!