A Contra Costa California Borrower Security Agreement is a legal contract that outlines the terms and conditions of lending between ADAC Laboratories and ABN AFRO Bank in Contra Costa County, California. This agreement serves to provide ABN AFRO Bank with security for the repayment of a loan by ADAC Laboratories. The agreement includes various clauses and provisions that intend to protect the lender and ensure the borrower's commitment to repay the loan. Keywords: Contra Costa California, Borrower Security Agreement, ADAC Laboratories, ABN AFRO Bank, legal contract, terms and conditions, lending, loan repayment, security, clauses, provisions, lender, borrower commitment. Different types of Contra Costa California Borrower Security Agreements between ADAC Laboratories and ABN AFRO Bank may include variations in terms, collaterals, or loan purposes. Some possible types of agreements could be: 1. Real Estate Mortgage Agreement: This type of Borrower Security Agreement involves using a property owned by ADAC Laboratories as collateral for the loan provided by ABN AFRO Bank. The agreement specifies the terms related to the property, such as its valuation, insurance requirements, and conditions under which the lender can exercise its rights in case of default. 2. Equipment Financing Security Agreement: In this case, ADAC Laboratories pledges specific equipment or machinery as security for the loan. The agreement outlines the details of the equipment, its value, maintenance obligations, and the lender's rights in case of default or non-payment. 3. Accounts Receivable (AR) Financing Agreement: This agreement involves using ADAC Laboratories' accounts receivable as collateral. It outlines the terms and conditions related to the handling of ADAC Laboratories' invoices, how the proceeds will be applied towards the loan, and the lender's rights in collecting outstanding amounts directly from the customers in case of default. 4. Inventory Financing Agreement: If ADAC Laboratories maintains significant inventory, this agreement can be utilized, where the inventory serves as collateral. This agreement specifies the valuation, tracking, and monitoring requirements of the inventory, and how it will be utilized to repay the loan in the event of default. It is important to note that the actual types of Contra Costa California Borrower Security Agreements between ADAC Laboratories and ABN AFRO Bank will depend on the specific needs and circumstances of the borrowing entity and the nature of the loan.

Contra Costa California Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank

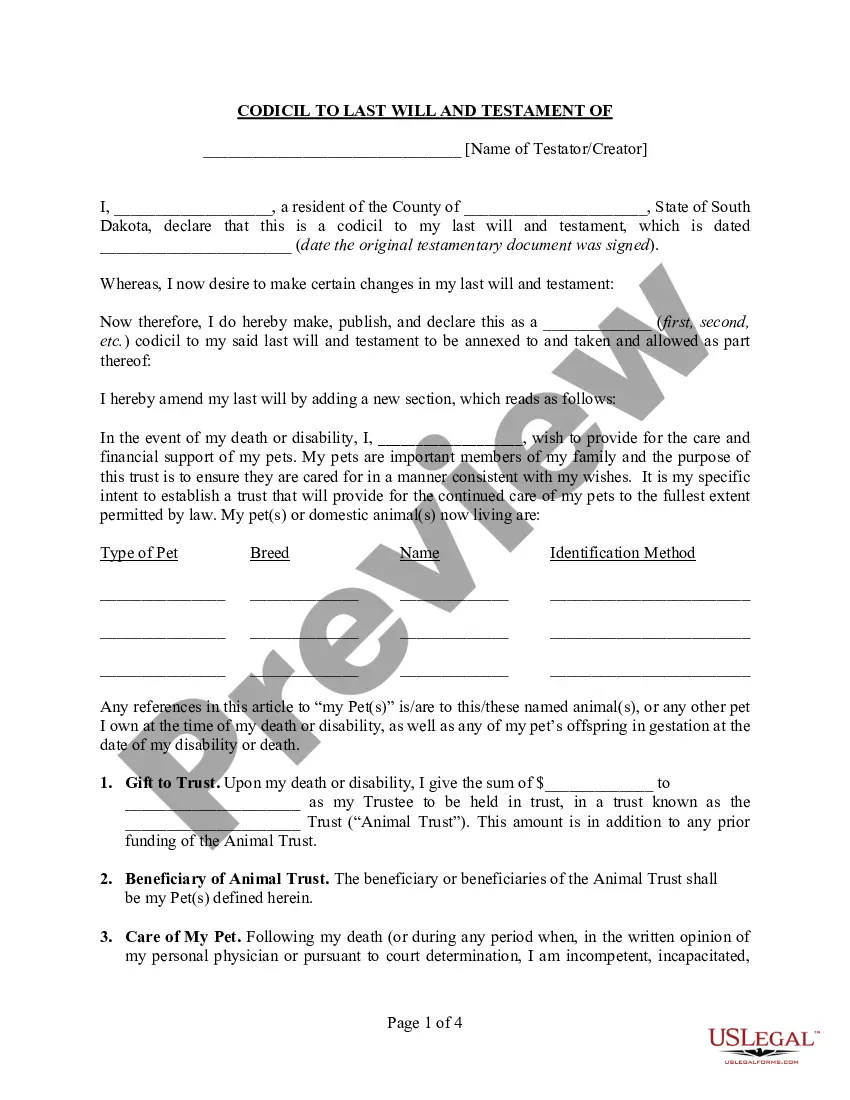

Description

How to fill out Contra Costa California Borrower Security Agreement Between ADAC Laboratories And ABN AMRO Bank?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life situation, locating a Contra Costa Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. In addition to the Contra Costa Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Contra Costa Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Contra Costa Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!