Maricopa, Arizona, is a vibrant city located in the southern part of the state. It is home to various commercial establishments and industries, making it an attractive location for businesses to thrive. One such business is ADAC Laboratories, a renowned company that specializes in cutting-edge technology solutions. As ADAC Laboratories seeks to expand its operations and ensure financial stability, it entered into a borrower security agreement with ABN AFRO Bank. This legally binding agreement serves as a means to provide assurance and protection to the bank, ensuring the repayment of loans and the security of its investments. The Maricopa Arizona Borrower Security Agreement between ADAC Laboratories and ABN AFRO Bank outlines the terms and conditions under which ADAC Laboratories can obtain borrowed funds from the bank. It acts as a protective measure for ABN AFRO Bank by securing the assets and collateral of ADAC Laboratories in case of default or non-payment. This agreement includes crucial elements such as the identification of the borrower (ADAC Laboratories), the lender (ABN AFRO Bank), and their respective rights and obligations. It also includes provisions related to the repayment schedule, interest rates, and any penalties or fees for late payments. Additionally, the Maricopa Arizona Borrower Security Agreement specifies the collateral pledged by ADAC Laboratories to secure the loan. This collateral can be in the form of assets such as real estate, machinery, vehicles, or any other valuable property owned by the company. By providing collateral, ADAC Laboratories offers assurance to ABN AFRO Bank that, in the event of default, the bank can legally claim and sell the pledged assets to recover its outstanding dues. It is worth noting that multiple variations of the Maricopa Arizona Borrower Security Agreement between ADAC Laboratories and ABN AFRO Bank could exist, each tailored to specific loan requirements or situations. These variations may include agreements for different loan amounts, diverse collateral types, or specific repayment terms. Such customized agreements ensure that the unique needs of both the borrower and the lender are adequately addressed. In conclusion, the Maricopa Arizona Borrower Security Agreement between ADAC Laboratories and ABN AFRO Bank plays a pivotal role in securing financing and mitigating financial risks for ADAC Laboratories while safeguarding the interests of ABN AFRO Bank. By entering into this agreement, both parties establish a mutually beneficial relationship built on trust and transparency.

Maricopa Arizona Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank

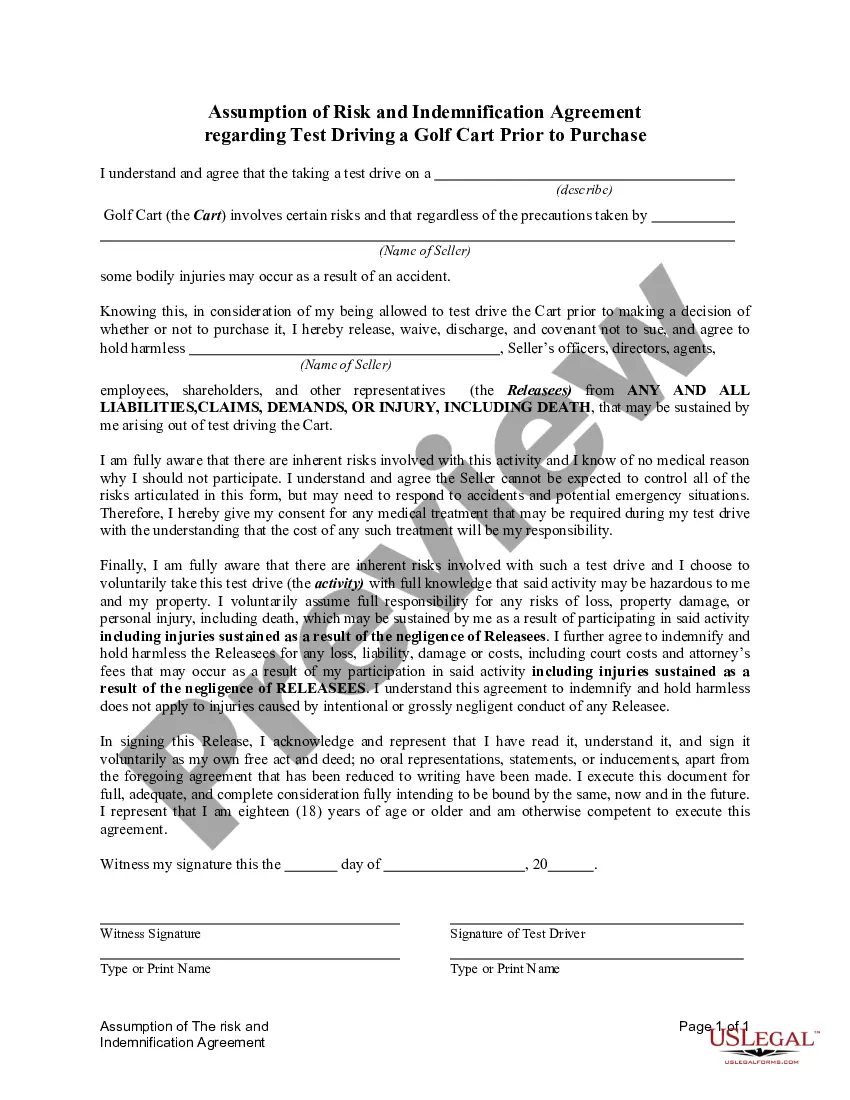

Description

How to fill out Maricopa Arizona Borrower Security Agreement Between ADAC Laboratories And ABN AMRO Bank?

Drafting papers for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to generate Maricopa Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank without expert assistance.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Maricopa Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Maricopa Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank:

- Examine the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a couple of clicks!