San Diego, California is a vibrant coastal city located in Southern California. Known for its near-perfect weather, picturesque beaches, thriving cultural scene, and diverse community, San Diego attracts millions of visitors each year. The Borrower Security Agreement between ADAC Laboratories and ABN AFRO Bank is a legal contract that outlines the terms and conditions of a loan agreement between the two entities. This agreement acts as a safeguard for the lender, ABN AFRO Bank, by securing the borrower's assets, and ensures that ADAC Laboratories will repay the loan in a timely manner. Under this agreement, ADAC Laboratories pledges various types of collateral to secure the loan, providing assurance to ABN AFRO Bank that they will have recourse in the event of default. These collateral assets may include real estate properties, equipment, accounts receivable, intellectual property rights, or any other valuable assets owned by ADAC Laboratories. The San Diego California Borrower Security Agreement between ADAC Laboratories and ABN AFRO Bank may have different variations depending on the specific loan purposes or circumstances. Some common variations of this agreement may include: 1. Real Estate Security Agreement: This type of agreement focuses primarily on using real estate properties owned by ADAC Laboratories as collateral. It outlines the rights and responsibilities of both parties regarding the use and maintenance of the properties during the loan tenure. 2. Equipment Security Agreement: In cases where ADAC Laboratories wants to secure a loan using specific equipment or machinery, an Equipment Security Agreement may be drafted. This agreement details the equipment being pledged, its condition, and any ongoing maintenance requirements. 3. Intellectual Property Security Agreement: If ADAC Laboratories possesses valuable intellectual property rights, such as patents, trademarks, or copyrights, this agreement allows ABN AFRO Bank to use them as collateral. It specifies the extent of rights granted and potential licensing arrangements if necessary. 4. Accounts Receivable Security Agreement: This type of agreement may be applicable when ADAC Laboratories wishes to use their outstanding accounts receivable, or money owed by customers, as collateral for the loan. The agreement outlines how ABN AFRO Bank can collect on those accounts in case of default. It is essential for both ADAC Laboratories and ABN AFRO Bank to carefully review and negotiate the terms of the Borrower Security Agreement to ensure that all assets are properly defined, and rights and obligations are clearly stated. Seeking legal advice and conducting due diligence is highly recommended before entering into such agreements to protect the interests of both parties involved.

San Diego California Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank

Description

How to fill out San Diego California Borrower Security Agreement Between ADAC Laboratories And ABN AMRO Bank?

Preparing documents for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate San Diego Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank without professional assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid San Diego Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the San Diego Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank:

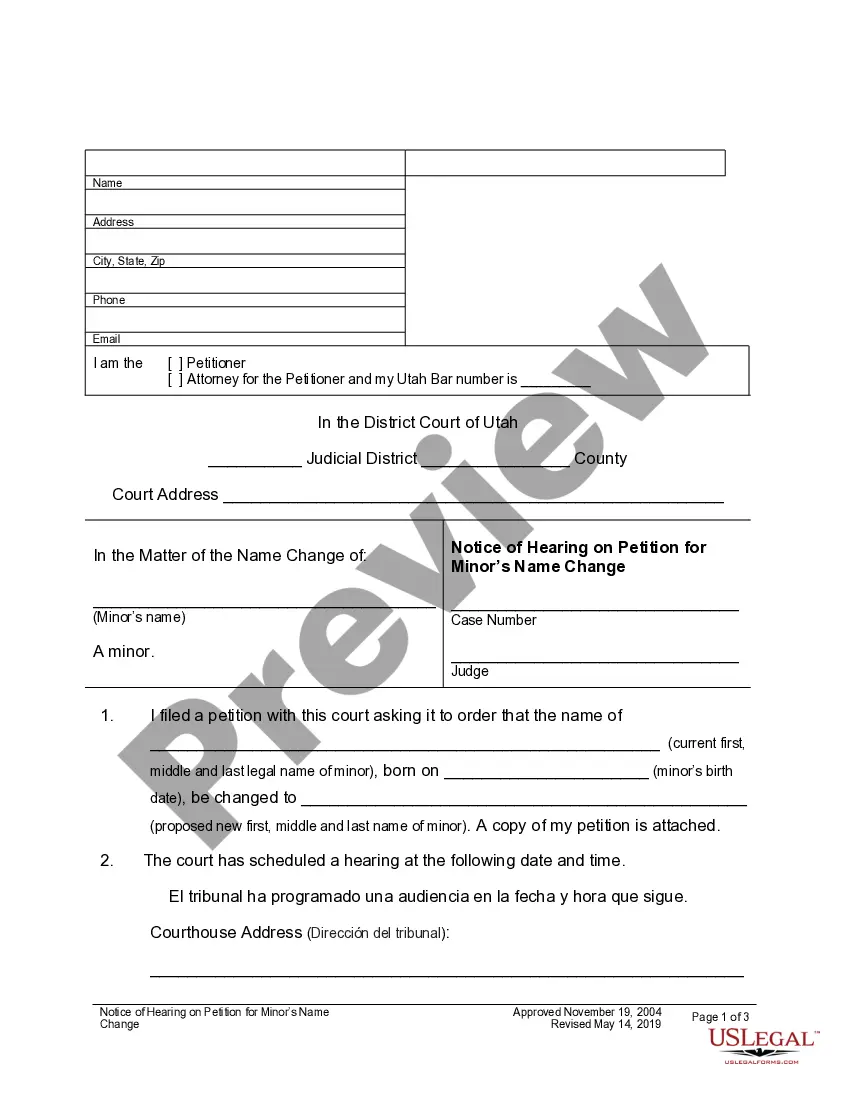

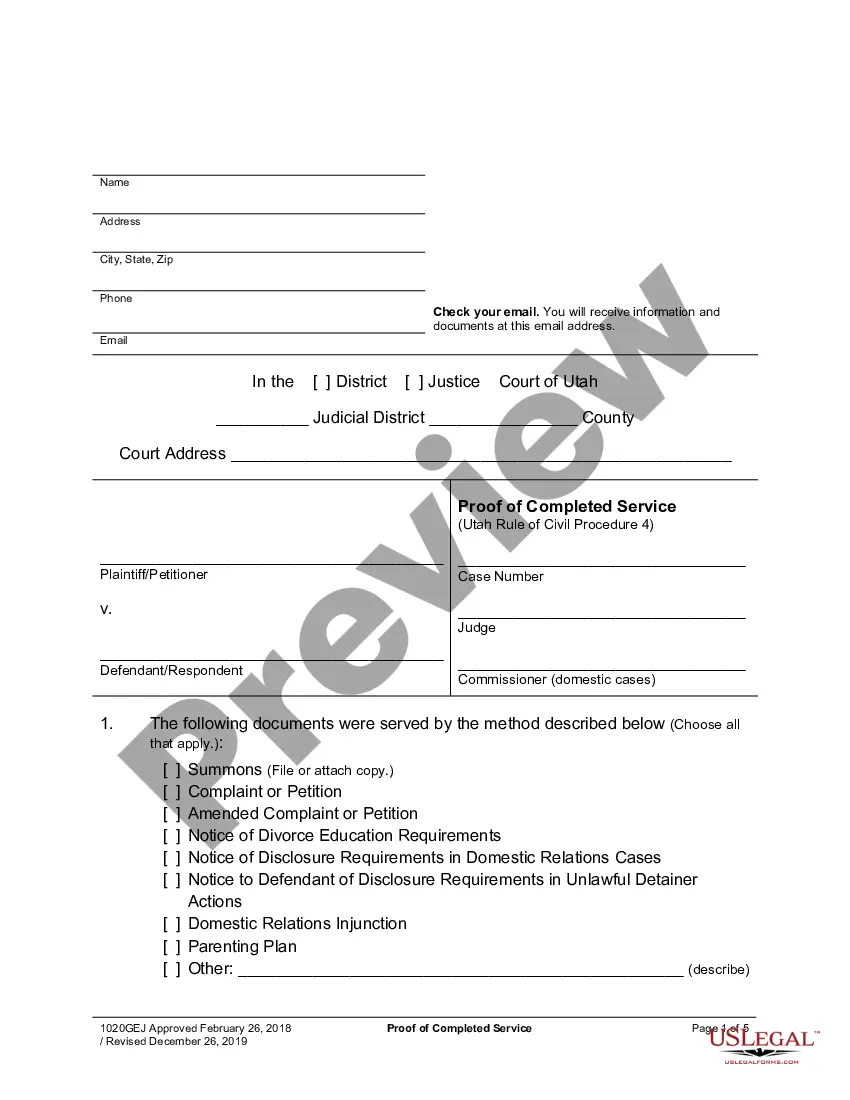

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!