A San Jose California Borrower Security Agreement is a legally binding contract between ADAC Laboratories and ABN AFRO Bank. This agreement outlines the terms and conditions under which ADAC Laboratories can secure loans or credit facilities from ABN AFRO Bank. This type of agreement can vary based on the specific terms and conditions agreed upon by both parties. However, some key components commonly found in a San Jose California Borrower Security Agreement between ADAC Laboratories and ABN AFRO Bank may include: 1. Parties involved: The agreement will clearly state the names and contact information of the borrower (ADAC Laboratories) and the lender (ABN AFRO Bank). 2. Loan details: The agreement will specify the terms of the loan, such as the loan amount, interest rate, repayment period, and any applicable fees or penalties. 3. Collateral: ADAC Laboratories may be required to provide collateral, which can be in the form of assets, properties, or securities, to secure the loan. The agreement will describe the collateral provided and how it will be valued and managed. 4. Security Interest: The agreement will define the security interest that ABN AFRO Bank holds over ADAC Laboratories' assets. This ensures that in case of default or non-payment, the lender has the right to seize and liquidate the collateral to recover the outstanding debt. 5. Covenants and representations: The agreement may include specific promises made by ADAC Laboratories, such as maintaining insurance coverage on the collateral, providing financial statements, and complying with certain financial ratios. 6. Events of default: The agreement will outline the circumstances under which ABN AFRO Bank can declare ADAC Laboratories in default, such as non-payment, breach of covenants, or bankruptcy. It will also specify the remedies available to the lender if default occurs. It's important to note that the exact terms and conditions of a San Jose California Borrower Security Agreement can vary depending on the needs and negotiation between the parties involved. Different types or versions of a San Jose California Borrower Security Agreement between ADAC Laboratories and ABN AFRO Bank may include variations based on the loan amount, collateral type, or specific provisions tailored to meet the borrowing requirements of ADAC Laboratories. These variations can be outlined as separate agreements or amendments to the original agreement.

San Jose California Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank

Description

How to fill out San Jose California Borrower Security Agreement Between ADAC Laboratories And ABN AMRO Bank?

If you need to find a trustworthy legal paperwork provider to get the San Jose Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can select from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of supporting resources, and dedicated support team make it simple to find and complete various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply select to search or browse San Jose Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank, either by a keyword or by the state/county the document is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the San Jose Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download once the payment is processed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes these tasks less costly and more reasonably priced. Create your first business, organize your advance care planning, draft a real estate contract, or execute the San Jose Borrower Security Agreement between ADAC Laboratories and ABN AMRO Bank - all from the comfort of your home.

Join US Legal Forms now!

Form popularity

FAQ

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many ?loan documents? executed in conjunction with a loan.

A security agreement, in the law of the United States, is a contract that governs the relationship between the parties to a kind of financial transaction known as a secured transaction.

It is typically much faster under a security deed than a mortgage. Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.

An agreement or letter in which a lender (usually a bank or other financial institution) sets out the terms and conditions (including the conditions precedent) on which it is prepared to make a loan facility available to a borrower. The loan facility is typically a term loan, revolving facility or overdraft.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

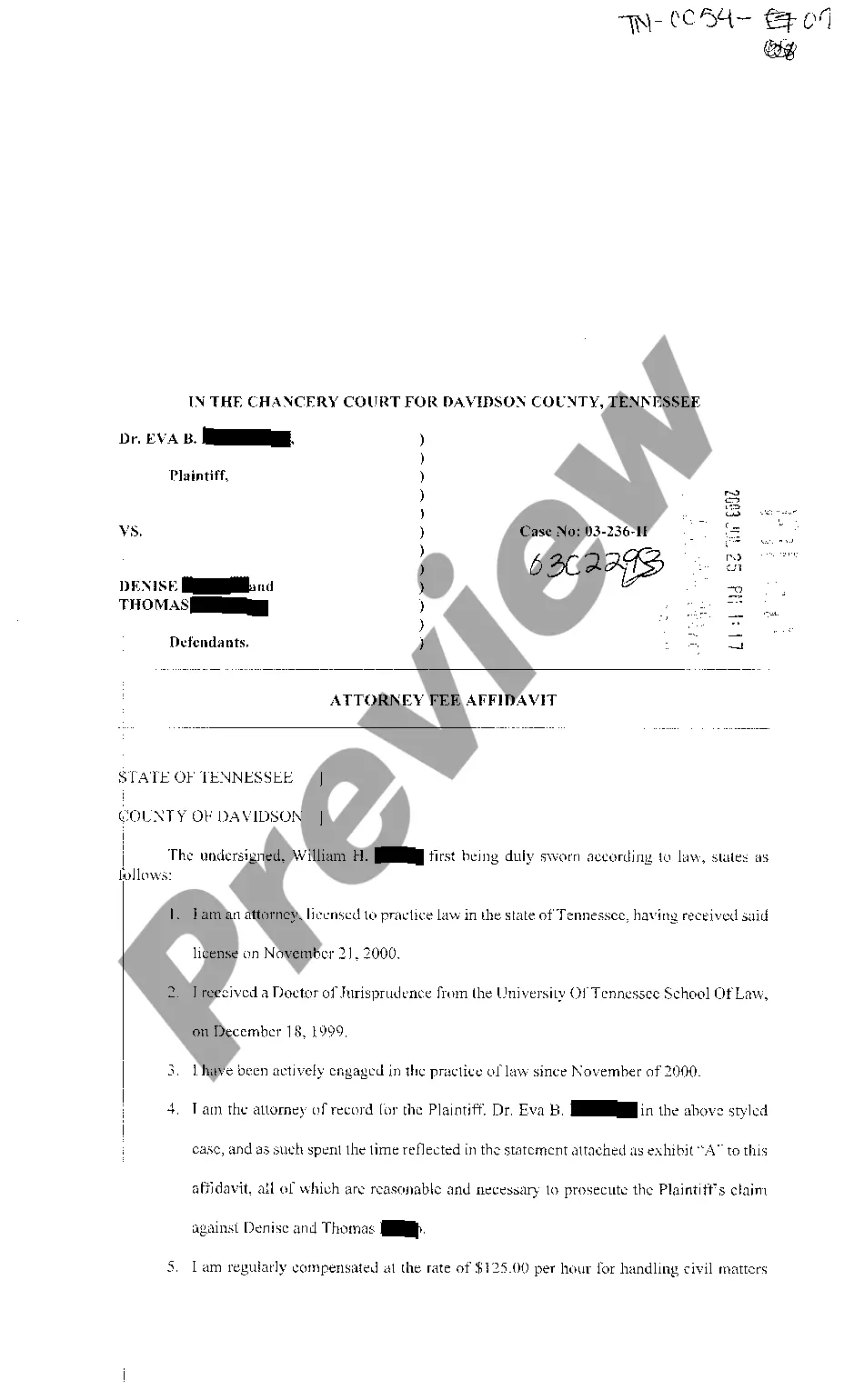

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.

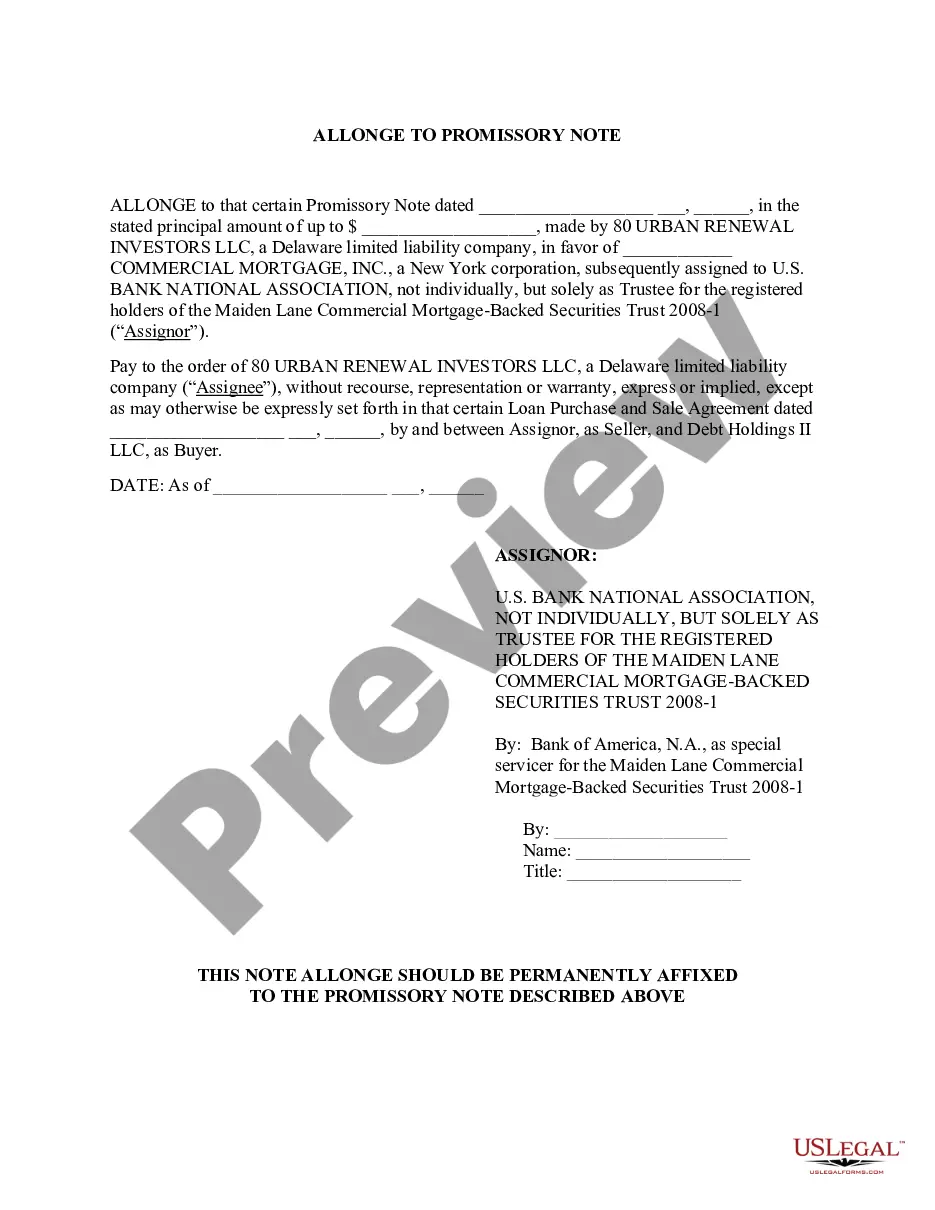

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.