The Chicago Illinois Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. is a crucial business move that aims to consolidate the strengths and resources of these companies in order to drive growth and enhance their position in the highly competitive market. This strategic plan of merger involves the joining of forces between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. to create a stronger, more diversified and innovative entity. By combining their expertise, market presence, and resources, this merger is poised to generate immense value for these organizations and their stakeholders. The Chicago Illinois Plan of Merger refers to the specific legal framework and formal agreement under which these companies plan to merge. It outlines the terms and conditions, as well as the rights and responsibilities of each party involved. This plan encompasses various elements, including the consideration offered to the shareholders, the organizational structure of the merged entity, the governance and decision-making processes, and other crucial details necessary for a successful integration. This merger is expected to bring several benefits to the companies involved. Firstly, it will enable them to leverage their complementary strengths and market presence, leading to enhanced operational efficiencies and economies of scale. The combined entity will also have an increased market share, enabling it to negotiate better terms with suppliers and offer more competitive pricing to customers. Additionally, the Chicago Illinois Plan of Merger will foster synergies in research and development, marketing, and distribution channels. This will facilitate the introduction of innovative products, expansion into new markets, and accelerated growth. By pooling their resources and expertise, Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. aim to create a stronger and more resilient organization capable of withstanding market challenges and seizing new opportunities. It is important to note that while the specifics of the Chicago Illinois Plan of Merger have not been disclosed, there may be various types of mergers that these companies are considering. Some possible types of mergers include: 1. Horizontal Merger: This type of merger occurs when two companies operating in the same industry and offering similar products or services combine their operations. In this case, Food Lion, Inc. and Hanna ford Brothers Company could potentially explore a horizontal merger to consolidate their positions in the grocery retail industry. 2. Vertical Merger: This type of merger involves the integration of companies operating at different stages of the supply chain. For example, Food Lion, Inc. and FL Acquisition Sub, Inc. might consider a vertical merger if FL Acquisition Sub, Inc. is involved in food production or distribution. This would allow the merged entity to have better control over the supply chain and achieve cost savings. 3. Conglomerate Merger: A conglomerate merger takes place when companies operating in different industries or business sectors come together. Although less likely in the case of these companies, Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. may explore a conglomerate merger if there are strategic advantages or synergies to be gained from diversifying their operations. Overall, the Chicago Illinois Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. represents a significant step towards growth and consolidation in the grocery retail industry. By capitalizing on their collective strengths, these companies hope to create a more competitive and resilient organization that can navigate the evolving market dynamics and deliver value to their customers and shareholders.

Chicago Illinois Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

How to fill out Chicago Illinois Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

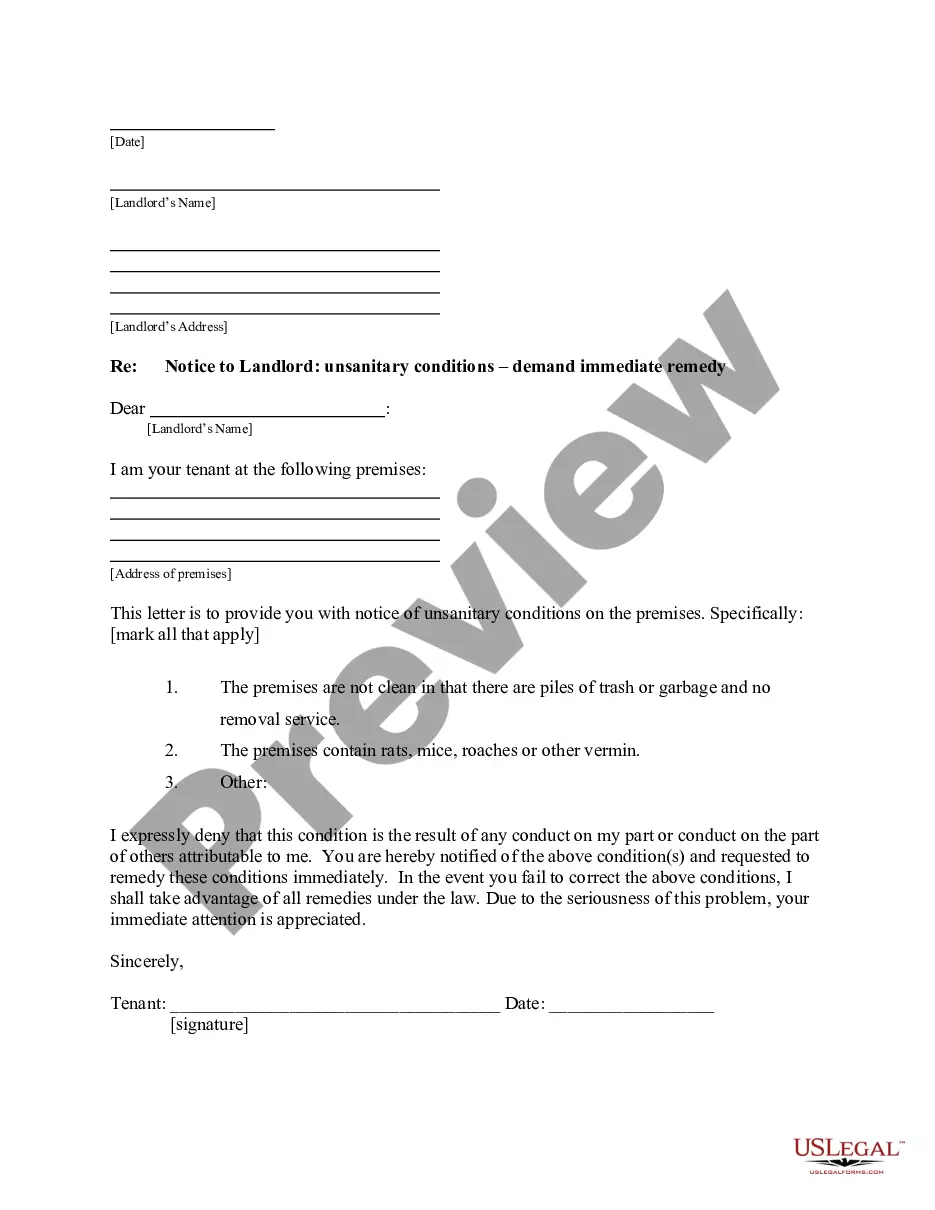

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for professional help to draft some of them from the ground up, including Chicago Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc., with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various types varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find detailed materials and guides on the website to make any tasks related to document execution simple.

Here's how you can locate and download Chicago Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc..

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the related document templates or start the search over to locate the right document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Chicago Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc..

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Chicago Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc., log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer completely. If you need to cope with an extremely difficult case, we advise getting an attorney to review your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and get your state-compliant paperwork effortlessly!