Fairfax, Virginia, Plan of Merger: Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. The Fairfax, Virginia Plan of Merger serves as the legal foundation for the consolidation of grocery retail giants Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. This strategic merger aims to enhance operational efficiency, brand competitiveness, and market share within the grocery industry. Key Merger Objectives: This comprehensive plan outlines the following significant objectives: 1. Synergies and Cost Efficiencies: The merger aims to leverage the combined resources, distribution networks, and purchasing power of all entities involved. This synergy seeks to reduce supply chain costs, improve economies of scale, and streamline operations to optimize customer satisfaction and corporate profitability. 2. Brand Positioning and Market Expansion: The merger plan focuses on strengthening the market presence of both Food Lion and Hanna ford Brothers. By pooling their market insights and customer demographics, the companies aim to expand their footprint, open new store locations, and penetrate previously untapped regions. 3. Supplier Network Optimization: Through this merger, Food Lion, Hanna ford Brothers, and FL Acquisition Sub, Inc., aim to enhance their supplier relationships. This collaboration will lead to a consolidated approach towards negotiations, creating stronger partnerships that benefit all parties involved. 4. Technological Integration: The Fairfax, Virginia Plan of Merger recognizes the importance of technological advancements in the highly competitive retail sector. The companies plan to invest in cutting-edge systems and technology upgrades to improve inventory management, customer experience, and data analytics capabilities. Types of Fairfax, Virginia Plan of Mergers: 1. Horizontal Merger: This type of merger occurs between companies operating in the same industry. In the case of Food Lion and Hanna ford Brothers, both are well-established grocery retailers, making this a horizontal merger. 2. Triangular Merger: FL Acquisition Sub, Inc., serves as the intermediary in this merger. This type of transaction allows for a structured transfer of assets and shares between the acquiring and acquired companies while maintaining each entity's legal existence. 3. Statutory Merger: Under the Fairfax, Virginia Plan of Merger, the companies will execute a statutory merger. This legal process results in the consolidation of Food Lion and Hanna ford Brothers into a single entity, resulting in FL Acquisition Sub, Inc. being dissolved. Overall, the Fairfax, Virginia Plan of Merger represents a strategic step towards optimizing operations, improving market presence, and leveraging collective strengths to benefit customers, stakeholders, and the grocery industry as a whole.

Fairfax Virginia Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

How to fill out Fairfax Virginia Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business objective utilized in your county, including the Fairfax Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc..

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Fairfax Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Fairfax Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.:

- Ensure you have opened the right page with your regional form.

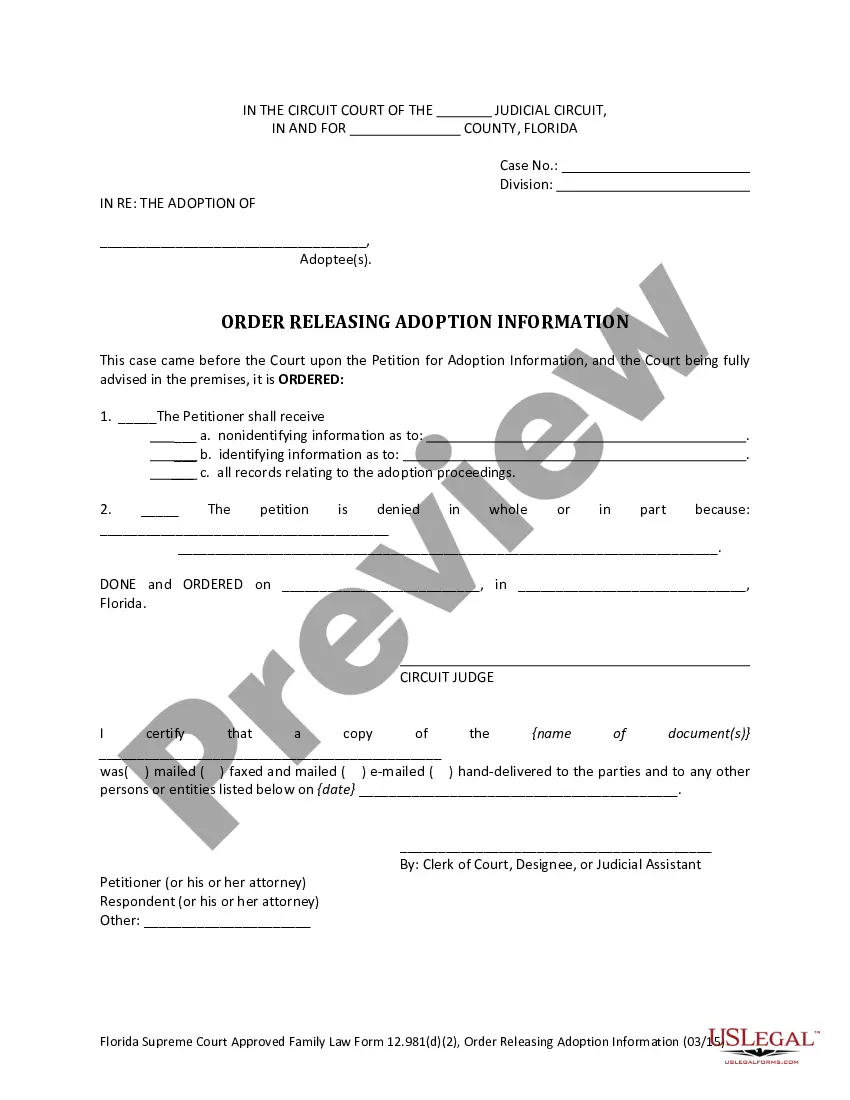

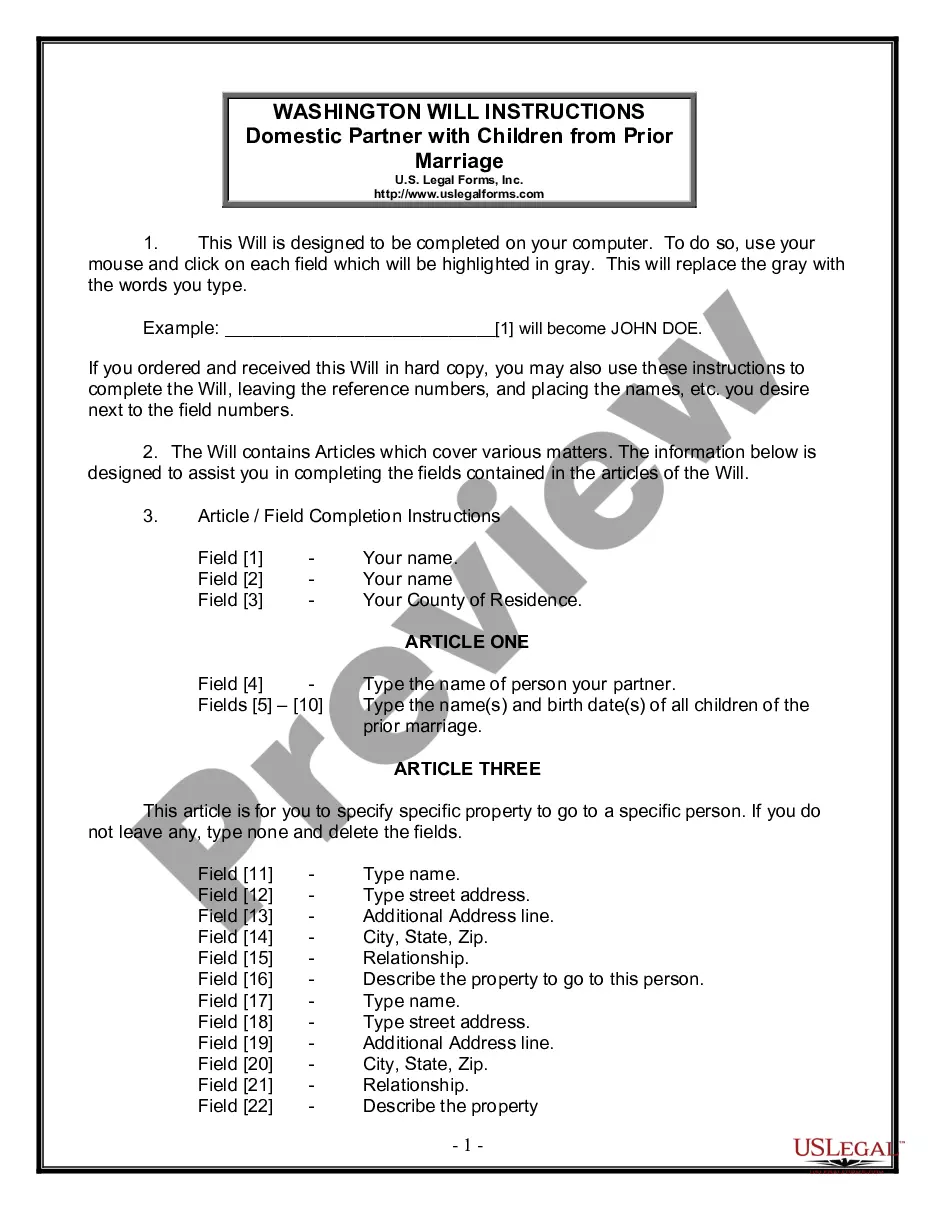

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Fairfax Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!