The Nassau New York Plan of Merger refers to the legal agreement between two prominent grocery retail companies, Food Lion, Inc. and Hanna ford Brothers Company, along with FL Acquisition Sub, Inc., outlining their intention to merge their operations. This strategic move aims to combine their resources, expertise, and market presence to create a more powerful and competitive entity, ultimately benefiting both the companies and their customers. In this Plan of Merger, the stakeholders involved will be presented with a comprehensive outline of the merger process, clearly defining the terms and conditions under which the consolidation will take place. It will include various elements such as financial aspects, corporate governance, organizational structure, and post-merger integration strategies. The Nassau New York Plan of Merger is likely to encompass different types or aspects, categorized as follows: 1. Financial Terms: This section will detail the financial arrangements involved in the merger, which may include the exchange ratio of shares, valuation methods, debt assumptions, and any cash considerations to be paid to the shareholders of the merging entities. 2. Corporate Governance: Here, the new organizational structure and governance framework will be outlined. This will include the composition of the board of directors, management roles, decision-making processes, and any special provisions regarding voting rights and board representation for the merging companies. 3. Regulatory and Legal Compliance: Given that mergers require regulatory approvals, this section will highlight the steps to be taken to comply with relevant governmental and regulatory bodies. This may include antitrust reviews, obtaining necessary permits or licenses, and adhering to any specific legal requirements related to the merger. 4. Integration Strategies: Post-merger integration is crucial for the success of any consolidation. This portion will outline the detailed plans to combine operations, align corporate cultures, integrate IT systems, consolidate supply chains, rationalize real estate assets, and achieve synergies to enhance efficiency and profitability. 5. Employee Matters: This aspect will address the treatment of employees affected by the merger, including any anticipated workforce reductions, severance packages, employee benefits, and integration of human resources policies. By carefully drafting and adhering to the Nassau New York Plan of Merger, Food Lion, Hanna ford Brothers, and FL Acquisition Sub seek to ensure a smooth and successful integration, maximizing the potential benefits of their collaboration.

Nassau New York Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

How to fill out Nassau New York Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

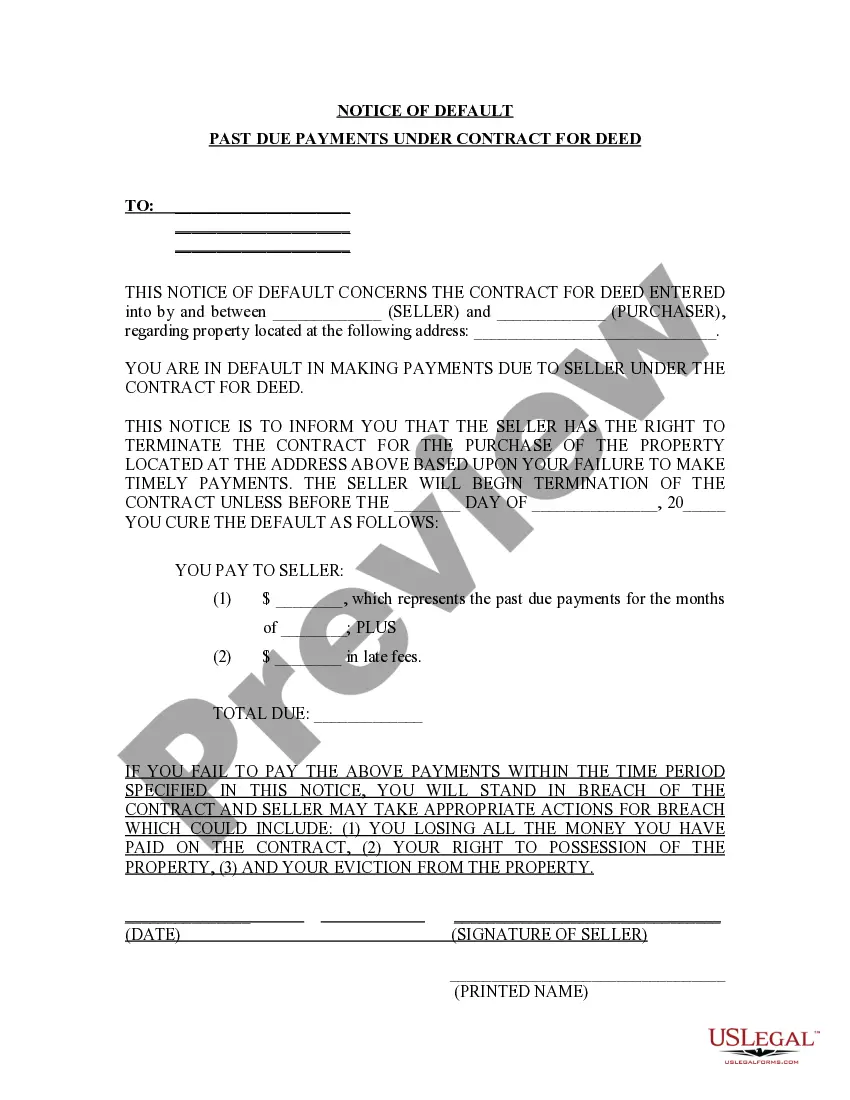

Preparing legal documentation can be difficult. Besides, if you decide to ask a lawyer to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Nassau Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc., it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the latest version of the Nassau Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc., you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Nassau Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Nassau Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!