The Orange California Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. is an agreement that outlines the process and terms of merger between these three entities. It involves the integration of their operations, assets, and resources to create a stronger and more efficient organization. Keywords: Orange California, plan of merger, Food Lion Inc., Hanna ford Brothers Company, FL Acquisition Sub Inc., agreement, integration, operations, assets, resources, organization. The Orange California Plan of Merger aims to streamline the business operations of Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. to achieve greater synergy, financial stability, and market share. By combining their expertise, resources, and customer base, the merged entity aims to expand its presence in the competitive retail industry. This plan involves the consolidation and alignment of processes, systems, and teams across these three companies, ensuring a smooth transition and minimal disruption to business operations. It outlines the steps and timelines for integrating various departments, such as finance, marketing, procurement, and human resources, to optimize efficiency and achieve cost savings. The Orange California Plan of Merger establishes the governance structure of the merged entity, including the composition of the board of directors and executive management. It also defines the roles and responsibilities of key personnel, ensuring effective leadership and decision-making throughout the integration process. While the specific types of Orange California Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. are not mentioned in the provided information, it's important to note that there could be different variations of the plan depending on the nature and scope of the merger. These variations might include specific provisions for asset acquisition, stock swaps, or other financial arrangements. Overall, the Orange California Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. is designed to create a stronger and more competitive retail organization in the region. Through strategic integration, the merged entity aims to leverage its combined resources and expertise to better serve customers, enhance shareholder value, and capitalize on growth opportunities in the market.

Orange California Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

How to fill out Orange California Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

Drafting documents for the business or personal demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Orange Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Orange Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Orange Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.:

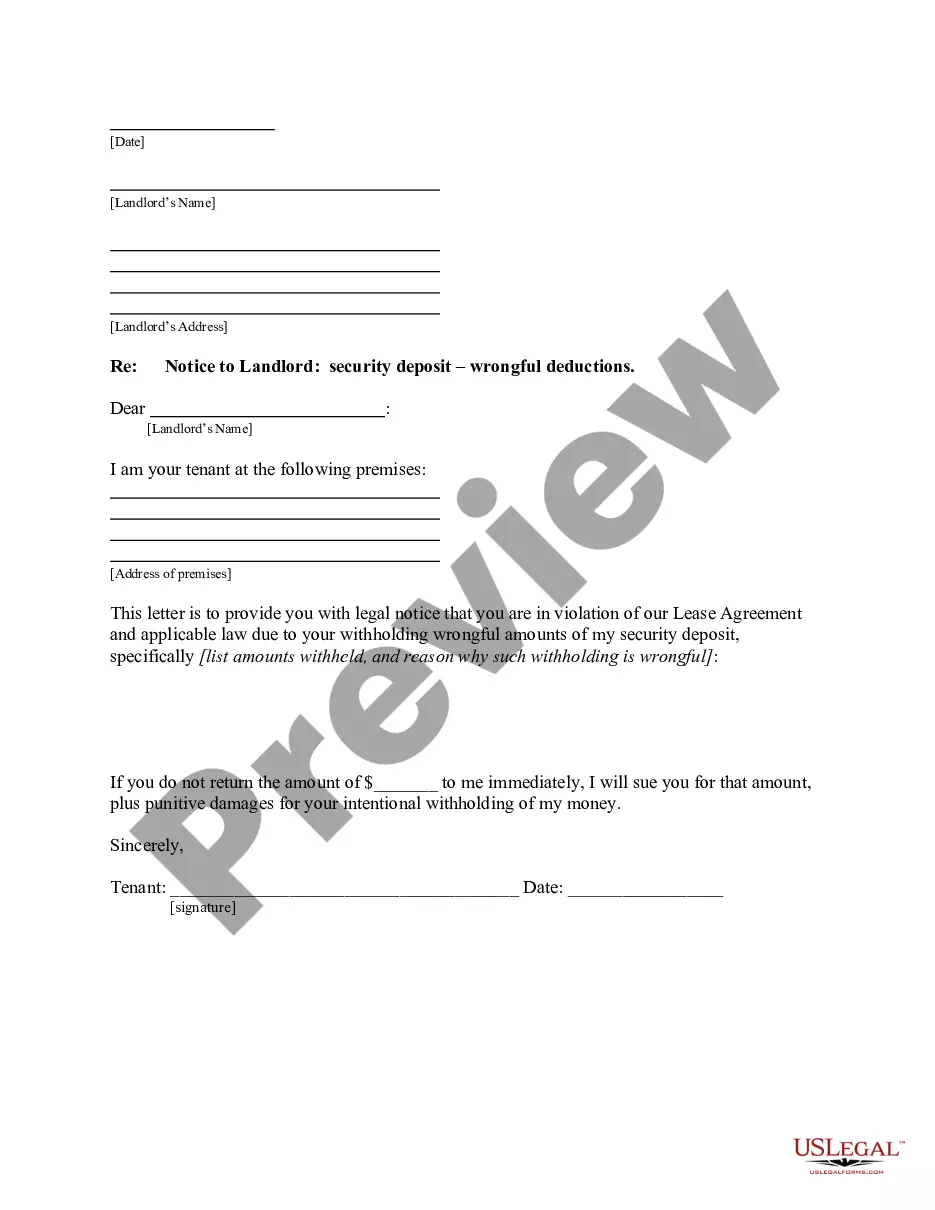

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a couple of clicks!

Form popularity

FAQ

Between the United States and Europe, the two have 6,500 stores with 375,000 employees and 50 million customers per week. In the United States, Ahold owns Giant, Stop & Shop and the online grocery service Peapod. Delhaize owns Hannaford and Food Lion.

Founded and based in Salisbury, N.C., since 1957, Food Lion is a company of Ahold Delhaize USA, the U.S. division of Zaandam-based Ahold Delhaize. For more information, visit foodlion.com.

Between the United States and Europe, the two have 6,500 stores with 375,000 employees and 50 million customers per week. In the United States, Ahold owns Giant, Stop & Shop and the online grocery service Peapod. Delhaize owns Hannaford and Food Lion.

2002. The company changes the name of its supermarkets from Shop 'n Save to Hannaford throughout Maine, Massachusetts, New Hampshire and Vermont.

The global parent company of Stop & Shop has agreed to buy the owner of Hannaford for $10.4 billion, a move that will cut costs for two supermarket giants that have experience slow growth in recent years....Related. Delhaize GroupRoyal Ahold NVEmployees150,000227,00013 more rows ?

Food Lion buying Hannaford - Aug. 18, 1999. NEW YORK (CNNfn) - Food Lion Inc. agreed Wednesday to buy supermarket rival Hannaford Brothers for about $3.6 billion in cash, stock and debt, creating a grocery powerhouse with operations from Maine to Florida.

Between the United States and Europe, the two have 6,500 stores with 375,000 employees and 50 million customers per week. In the United States, Ahold owns Giant, Stop & Shop and the online grocery service Peapod. Delhaize owns Hannaford and Food Lion. Those stores are expected to keep their names.

The global parent company of Stop & Shop has agreed to buy the owner of Hannaford for $10.4 billion, a move that will cut costs for two supermarket giants that have experience slow growth in recent years....Related. Delhaize GroupRoyal Ahold NVEmployees150,000227,00013 more rows ?

In 2000, Delhaize America bought Hannaford; the purchase both eliminated an emerging competitor to its Food Lion chain in the Southeast and expanded Delhaize operations into the Northeast. Some Hannaford locations in North Carolina were sold to Lowes Foods upon the buyout by Delhaize while others were closed.