The San Diego, California Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. is a strategic agreement outlining the consolidation of these three companies into one entity. This merger aims to combine the resources, expertise, and market presence of the involved parties to create a stronger and more competitive organization in the grocery industry. By merging Food Lion, Inc., a well-established grocery chain, with Hanna ford Brothers Company, a regional supermarket chain, the companies seek to leverage their complementary strengths and expand their market reach. The inclusion of FL Acquisition Sub, Inc. reaffirms the commitment to a seamless integration process, enabling a smooth transition of operations. This Plan of Merger entails a comprehensive framework that covers various aspects of the consolidation. It involves the legal and financial details of the merger, such as the transfer of shares, capital structure, and the allocation of assets and liabilities. Furthermore, it outlines the governance and leadership structure for the new organization, including the appointment of key executives and board members. The merger plan also considers the employees of both Food Lion, Inc. and Hanna ford Brothers Company, outlining any necessary workforce adjustments and retention strategies to ensure a harmonious integration of human resources. Additionally, it emphasizes the commitment to maintaining high ethical standards, customer satisfaction, and the company's mission and values throughout the merger process. This particular Plan of Merger may have different types or variations, depending on the specific objectives, terms, and conditions agreed upon by the parties involved. These types could include reverse mergers, forward triangular mergers, or mergers with cash or stock transactions. Each type may involve distinctive legal, financial, and operational considerations, which would be detailed in the specific plan. In summary, the San Diego, California Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. represents an ambitious undertaking aimed at strengthening the companies' positions in the grocery industry. Through strategic alignment, synergies, and efficient resource allocation, this merger aims to enhance the quality and convenience of retail options for consumers while creating new growth opportunities for the newly formed entity.

San Diego California Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

How to fill out San Diego California Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

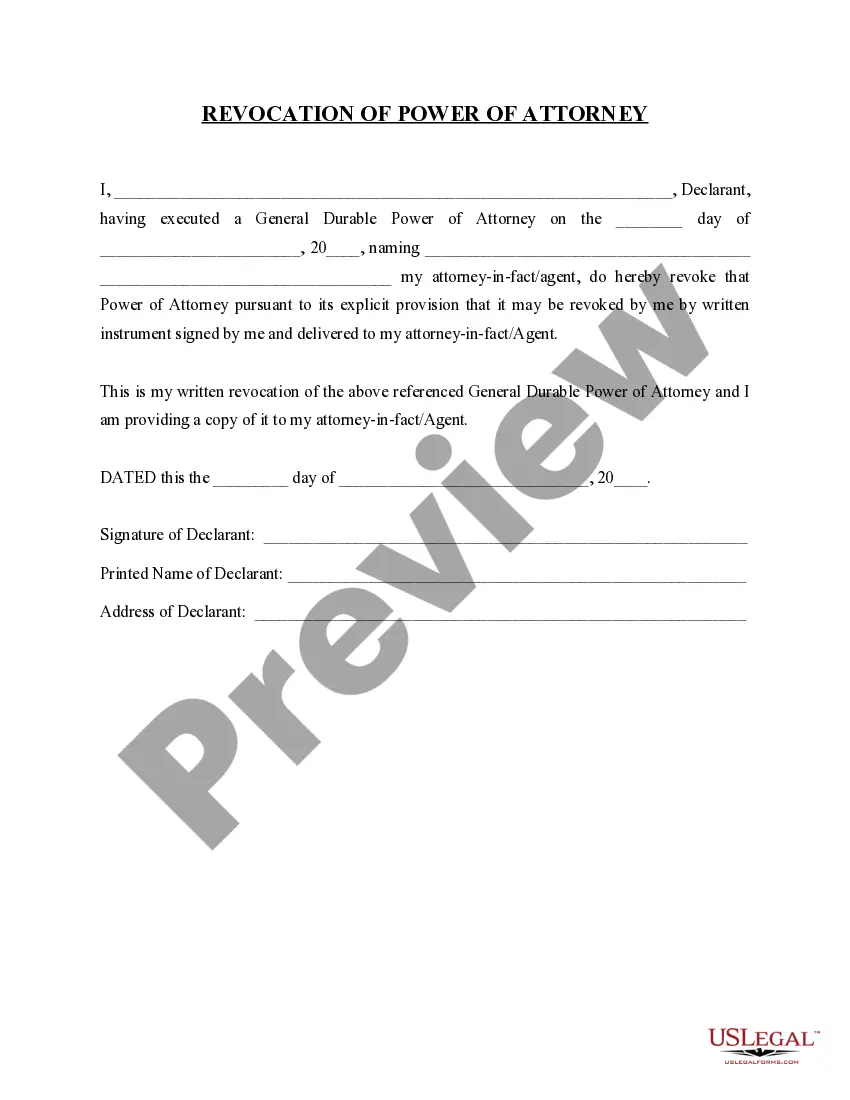

Drafting documents for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create San Diego Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. without expert assistance.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid San Diego Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the San Diego Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a few clicks!