Dallas Texas Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations is a contractual agreement between a company and an investor relations advisor based in Dallas, Texas. This agreement outlines the terms, responsibilities, and expectations of both parties involved in managing and enhancing the company's financial communications and investor relations activities. Keywords: Dallas Texas, investor relations agreement, advisor, program, financial communications, investor relations. The Dallas Texas Investor Relations Agreement may have different types based on specific requirements or variations in the scope of services. Some of these variations include: 1. Comprehensive Investor Relations Agreement: This type of agreement encompasses a wide range of services related to financial communications and investor relations. It covers areas such as drafting and distributing press releases, preparing financial reports and presentations, organizing investor conferences or roadshows, maintaining relationships with investors and analysts, and managing regulatory compliance related to investor communications. 2. Strategic Investor Relations Agreement: A strategic agreement focuses on the development and execution of a tailored investor relations strategy. This includes identifying target investors, determining key messages, creating a roadmap for engagement with different stakeholders, and providing guidance on shareholder engagement and corporate governance matters. 3. Crisis Management Investor Relations Agreement: This type of agreement specifically addresses crisis situations that may impact a company's reputation, stock value, or financial stability. The advisor works closely with the company's management team to develop crisis communication plans, handle media inquiries, resolve investor concerns, and minimize the impact on the company's image and financial standing. 4. International Investor Relations Agreement: In the globalized business environment, companies with international activities require specialized investor relations services. This type of agreement involves managing communication efforts across multiple jurisdictions, dealing with international regulatory frameworks, addressing cultural differences, and adapting strategies to diverse investor communities. These different types of Dallas Texas Investor Relations Agreement reflect the varying needs and circumstances of companies aiming to strengthen their financial communications and investor relations. Companies should carefully consider their specific requirements and choose an agreement that best aligns with their objectives and target audience.

Dallas Texas Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations

Description

How to fill out Dallas Texas Investor Relations Agreement Regarding Advisor For A Program Of Financial Communications And Investor Relations?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Dallas Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to get the Dallas Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

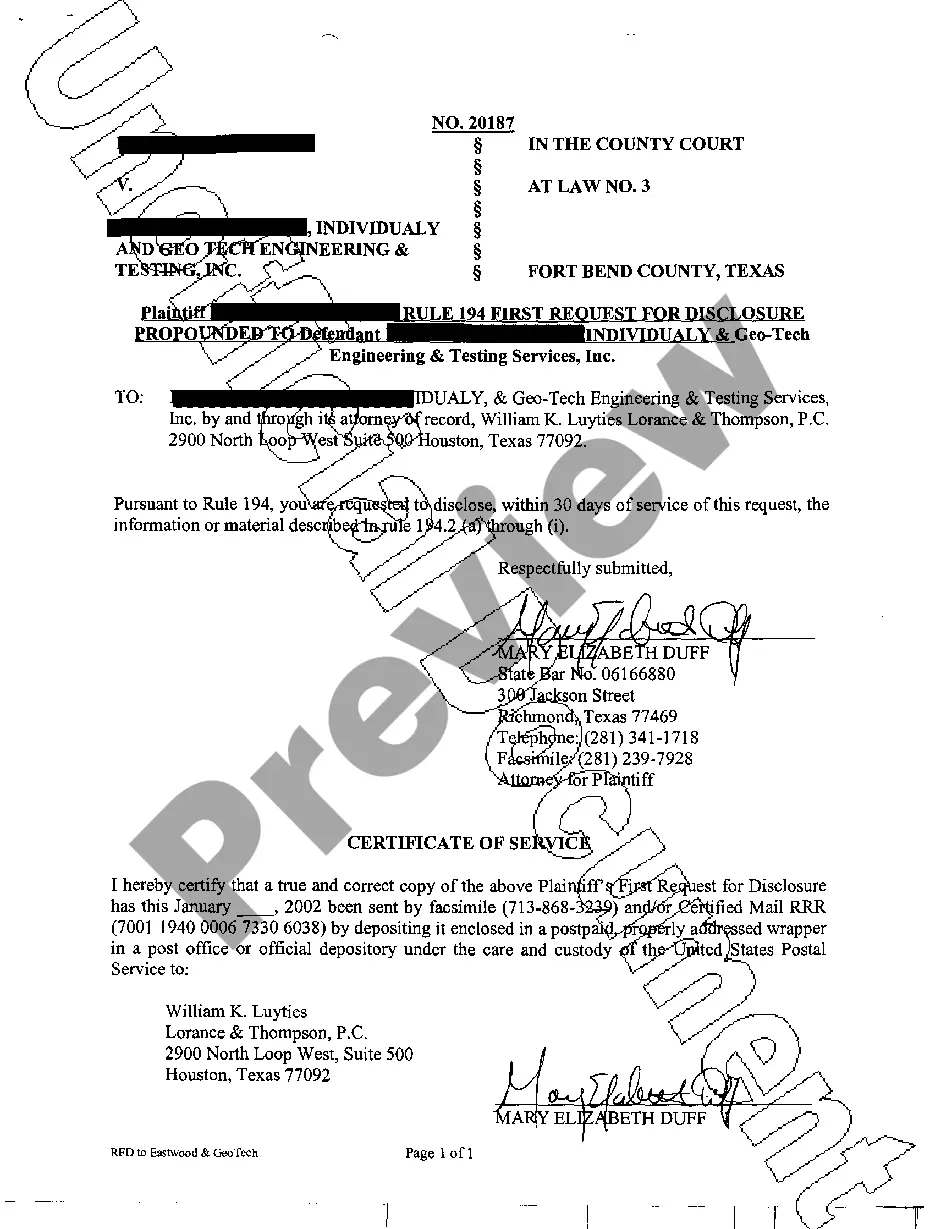

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!