Phoenix Arizona Investor Relations Agreement is a legally binding contract entered into by a company or organization in Phoenix, Arizona and an advisor or consulting firm who specializes in providing financial communications and investor relations services. This agreement outlines the terms and conditions under which the advisor will assist the company in developing and implementing a comprehensive program to attract and engage investors and effectively communicate with the financial community. The purpose of this agreement is to establish a professional relationship between the company and the advisor, with the objective of enhancing the company's public image, increasing investor awareness, and ultimately driving shareholder value. The advisor will utilize their expertise and industry knowledge to provide strategic guidance and execute various initiatives designed to achieve these goals. Key provisions of the Phoenix Arizona Investor Relations Agreement include: 1. Scope of Services: This section defines the specific services and activities the advisor will perform for the company. This may include drafting press releases, developing investor presentations, organizing investor conferences, creating and maintaining a company website, and engaging with the financial media on behalf of the company. 2. Term of the Agreement: The agreement will specify the length of the engagement, typically ranging from six months to several years. It may also outline any conditions for renewal or termination of the agreement. 3. Compensation and Expenses: The agreement will outline the advisor's fees and payment terms for their services. This may include a retainer, monthly fee, or success-based compensation structure. Additionally, expenses incurred by the advisor during the execution of their duties, such as travel or marketing materials, may also be addressed. 4. Confidentiality and Non-Disclosure: To protect the company's proprietary and sensitive information, the agreement will include provisions requiring the advisor to maintain strict confidentiality and not disclose any privileged information to third parties. 5. Representations and Warranties: Both parties will make certain representations and warranties to each other regarding their authority, compliance with laws and regulations, and ownership of intellectual property rights. Different types of Phoenix Arizona Investor Relations Agreements regarding Advisor for a Program of Financial Communications and Investor Relations may include: 1. Strategic Advisory Agreement: This agreement focuses on providing high-level strategic guidance and advice to the company, helping them make informed decisions to attract investors and improve their financial communications. 2. Public Relations Agreement: This type of agreement primarily focuses on enhancing the company's public image and reputation through various means, including media relations, crisis management, and community engagement. 3. Investor Communications Agreement: This agreement specifically emphasizes developing and executing an ongoing investor communications plan, which may involve regular updates, educational materials, and shareholder meetings. In conclusion, a Phoenix Arizona Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations is a crucial document that governs the relationship between a company and its advisor, outlining the services provided, compensation, confidentiality, and other important terms.

Phoenix Arizona Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations

Description

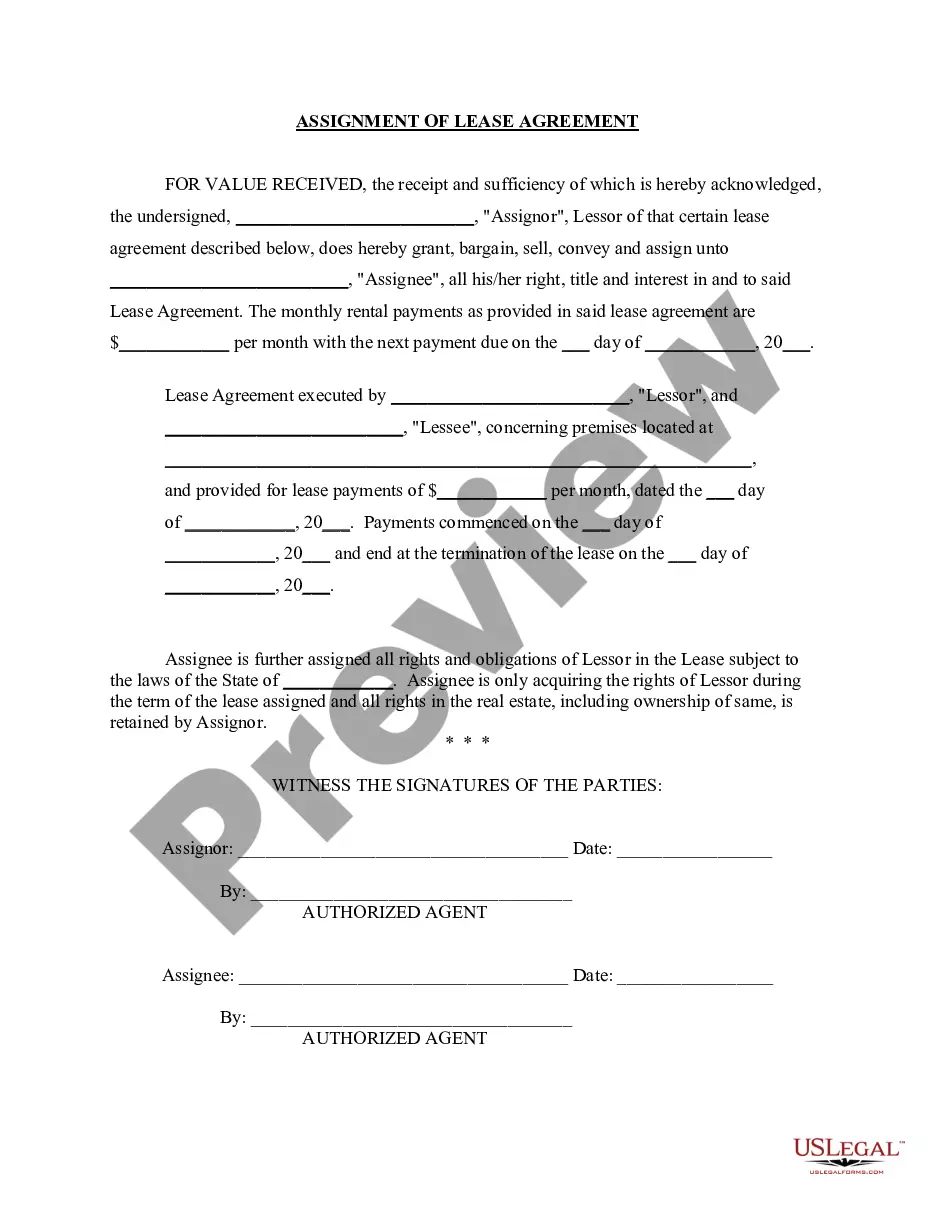

How to fill out Phoenix Arizona Investor Relations Agreement Regarding Advisor For A Program Of Financial Communications And Investor Relations?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Phoenix Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in different types ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find information materials and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how you can locate and download Phoenix Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some records.

- Check the related document templates or start the search over to locate the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and purchase Phoenix Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Phoenix Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you need to deal with an extremely difficult situation, we recommend getting an attorney to check your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-compliant documents with ease!