The Wayne Michigan Investor Relations Agreement is a legally binding document that outlines the terms and conditions between a company and an advisor for the implementation of a program focused on financial communications and investor relations. This agreement aims to establish a mutually beneficial relationship to effectively manage and communicate the company's financial information to various stakeholders and investors. The primary objective of a Wayne Michigan Investor Relations Agreement is to enhance the company's reputation, increase investor confidence, and ultimately support the company's growth in the marketplace. It is designed to ensure accurate, transparent, and timely communication with shareholders, potential investors, financial analysts, and regulatory bodies. The agreement typically covers various aspects, such as the scope of services to be provided by the advisor, including financial analysis, strategic planning, messaging development, communication strategy, and media relations. The agreement may also address specific responsibilities related to investor presentations, earnings releases, annual reports, and other corporate communications. Additionally, the Wayne Michigan Investor Relations Agreement may outline the frequency and format of financial reporting, detailing the deliverables and deadlines for various communication materials. It may also specify the advisor's access to financial data, confidential information, and key company personnel. Different types of Wayne Michigan Investor Relations Agreements regarding Advisors for a Program of Financial Communications and Investor Relations may include: 1. Exclusive Advisor Agreement: This type of agreement ensures that the advisor has the sole responsibility for all financial communications and investor relations activities of the company. The advisor is given exclusive rights to handle all aspects of investor relations, limiting the involvement of other parties. 2. Non-Exclusive Advisor Agreement: This type of agreement allows the company to engage multiple advisors or consultancies concurrently for financial communications and investor relations activities. It provides flexibility in choosing among various advisors, depending on specific areas of expertise or targeted markets. 3. Project-based Advisor Agreement: In cases where the company requires specialized assistance for a specific project, such as an initial public offering (IPO), a merger or acquisition, or a major financial restructuring, a project-based advisor agreement can be established. This agreement is limited in duration and scope, specifically catering to the needs of the project at hand. In conclusion, the Wayne Michigan Investor Relations Agreement is a critical document that establishes the framework for a company's financial communications and investor relations program with the guidance of an advisor. It ensures effective and transparent communication, aiming to build trust, enhance reputation, and support the company's growth in the market.

Wayne Michigan Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations

Description

How to fill out Wayne Michigan Investor Relations Agreement Regarding Advisor For A Program Of Financial Communications And Investor Relations?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Wayne Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Wayne Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Wayne Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations:

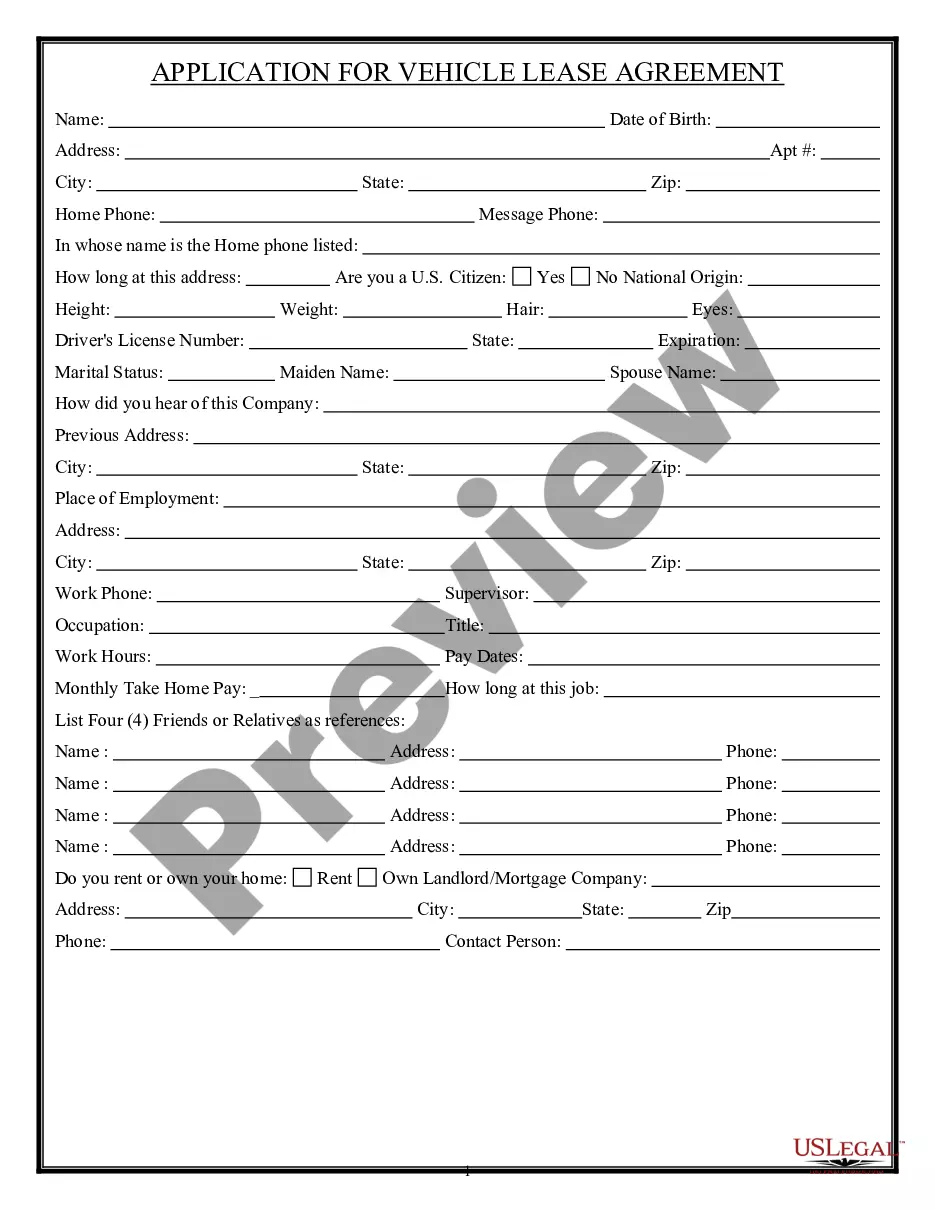

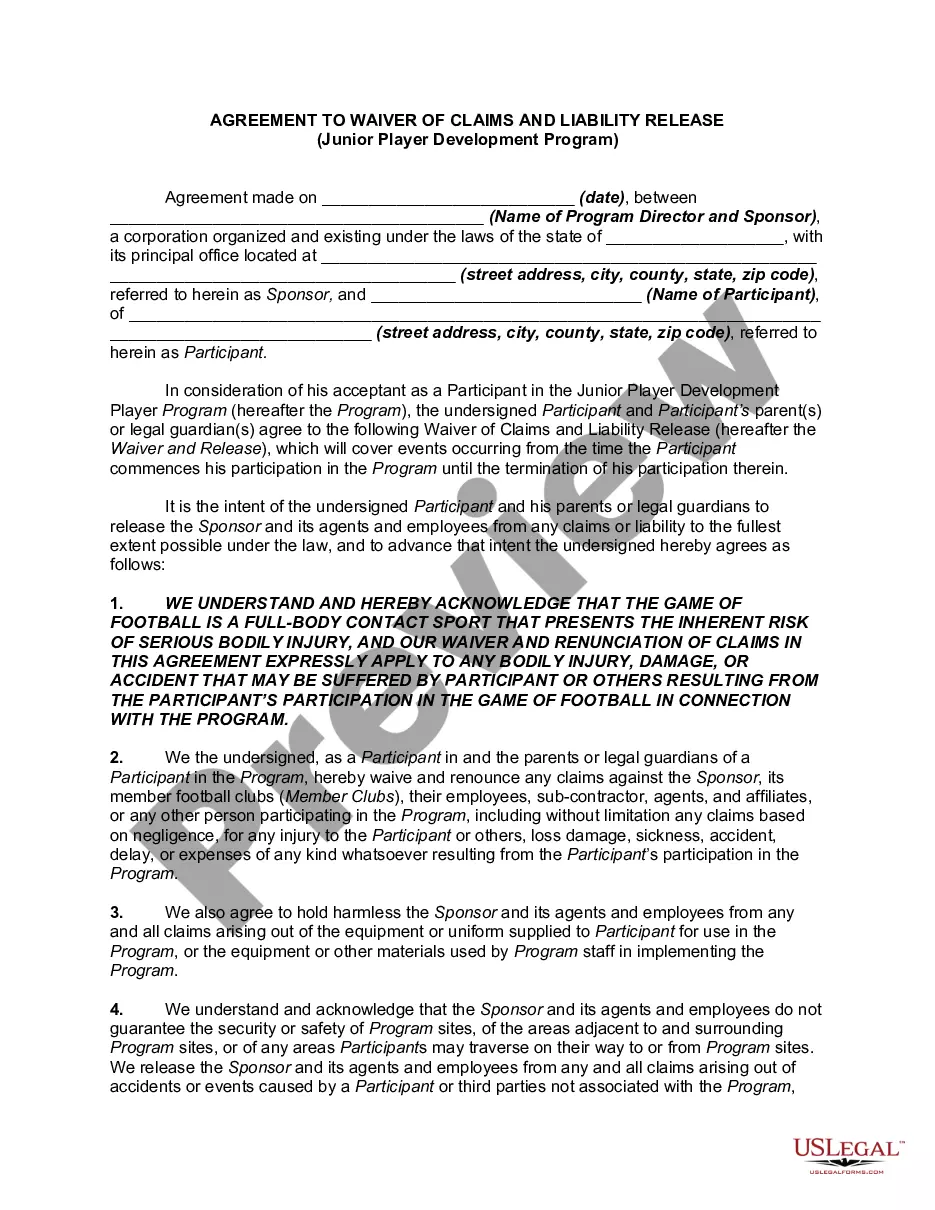

- Look through the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any use case with just a couple of clicks!