The Maricopa Arizona Agreement between E.C. Net Manufacturing, LLC and Charge. Com, Inc. is a comprehensive document that outlines the terms and conditions of their joint venture in establishing a fulfillment and distribution center. This agreement focuses on pricing and revenue pertaining to the shipment of goods. The fulfillment and distribution center joint venture aims to optimize the efficiency of order fulfillment and ensure timely delivery of products. By combining their resources, E.C. Net Manufacturing, LLC and Charge. Com, Inc. strive to enhance customer satisfaction and expand their market reach. Key provisions within this agreement include: 1. Purpose and Scope: This section outlines the primary objective of the joint venture, which is to establish a fulfillment and distribution center in Maricopa, Arizona. It clarifies the specific goods and services that will be handled and distributed through this center. 2. Duration: The agreement sets forth the duration of the joint venture, specifying the commencement date and any potential extensions or early termination provisions. 3. Governing Law and Jurisdiction: This section identifies the governing law and jurisdiction that will govern any disputes arising from this agreement. It ensures that both parties adhere to the legal requirements and regulations of Maricopa, Arizona. 4. Investment and Contributions: The agreement details the financial contributions of each party towards the establishment, maintenance, and operational costs of the fulfillment and distribution center. It clarifies the allocation of resources and responsibilities between the parties. 5. Pricing and Revenue: The agreement outlines the pricing structure for shipments and the distribution of revenue. It establishes a transparent method of calculating prices, considering factors such as shipping distance, weight, and specific customer requirements. It also outlines the distribution of revenue between the parties based on their respective contributions to the joint venture. Potential types of Maricopa Arizona Agreements between E.C. Net Manufacturing, LLC and Charge. Com, Inc. regarding a joint venture of fulfillment and distribution center and pricing and revenue of shipments may include variations specific to: 1. Exclusive/Non-Exclusive Agreement: This type of agreement can determine whether the joint venture is exclusive to the involved parties, restricting them from collaborating with other entities in the same industry or geographic region. Alternatively, it can also allow non-exclusivity, enabling the parties to engage in similar ventures with other entities. 2. Revenue Sharing Agreement: In this variation, the agreement may include specific clauses on how the revenue generated from the joint venture will be shared between the parties. This could be a fixed percentage allocation based on their initial investment or contribution, or it may establish different profit-sharing ratios based on the performance of individual product lines or territories. 3. Termination Agreement: This type of agreement would outline the conditions under which the joint venture can be terminated, either by mutual agreement or due to specific events such as breach of contract, bankruptcy, or a significant change in business circumstances. It would provide clear guidelines on the process and consequences of termination, including the distribution of assets and liabilities among the parties. In all of these variations, the primary focus remains on establishing a successful joint venture, enhancing fulfillment and distribution processes, and ensuring fair pricing and revenue distribution for shipments within the fulfillment and distribution center in Maricopa, Arizona.

Maricopa Arizona Agreement between E.C. Net Manufacturing, LLC and Ichargeit.Com, Inc. regarding joint venture of fulfillment and distribution center and pricing and revenue of shipments

Description

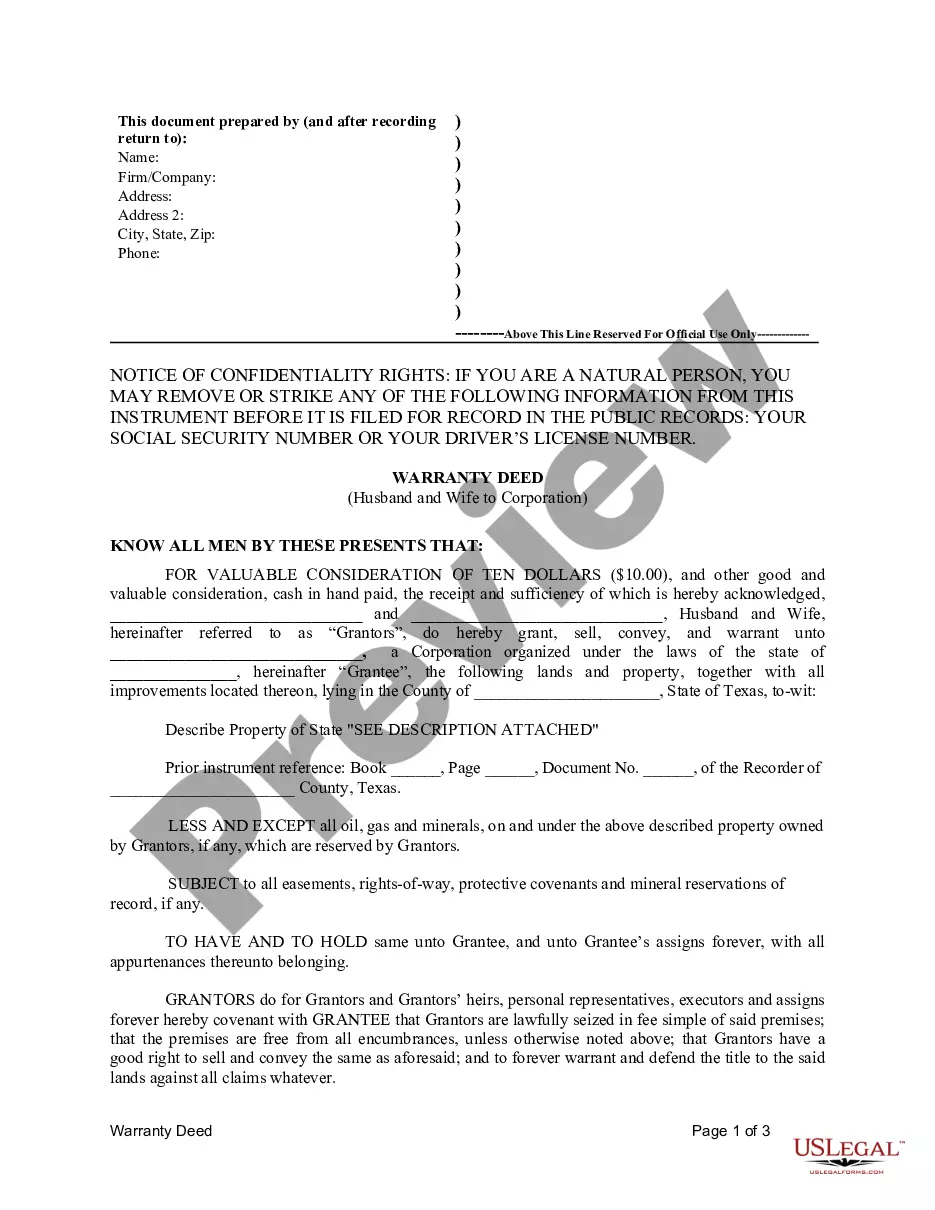

How to fill out Maricopa Arizona Agreement Between E.C. Net Manufacturing, LLC And Ichargeit.Com, Inc. Regarding Joint Venture Of Fulfillment And Distribution Center And Pricing And Revenue Of Shipments?

If you need to find a trustworthy legal form provider to get the Maricopa Agreement between E.C. Net Manufacturing, LLC and Ichargeit.Com, Inc. regarding joint venture of fulfillment and distribution center and pricing and revenue of shipments, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of learning materials, and dedicated support team make it easy to locate and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to search or browse Maricopa Agreement between E.C. Net Manufacturing, LLC and Ichargeit.Com, Inc. regarding joint venture of fulfillment and distribution center and pricing and revenue of shipments, either by a keyword or by the state/county the form is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Maricopa Agreement between E.C. Net Manufacturing, LLC and Ichargeit.Com, Inc. regarding joint venture of fulfillment and distribution center and pricing and revenue of shipments template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less costly and more affordable. Create your first company, arrange your advance care planning, draft a real estate contract, or execute the Maricopa Agreement between E.C. Net Manufacturing, LLC and Ichargeit.Com, Inc. regarding joint venture of fulfillment and distribution center and pricing and revenue of shipments - all from the comfort of your home.

Join US Legal Forms now!