Chicago, Illinois Subscription Agreement is a legal document that outlines the terms and conditions between Charge. Com, Inc. (the Company) and a prospective investor (the Investor) for the purchase of units consisting of common stock and common stock warrant. This agreement is crucial for both parties, as it ensures a clear understanding of the investment terms and protects the rights of both the Company and the Investor. The Chicago, Illinois Subscription Agreement typically includes the following key components: 1. Parties: Clearly identifies the Company and the Investor, along with their respective addresses and contact information. 2. Subscription and Purchase: Specifies the number of units (shares) the Investor wishes to purchase and the total consideration offering for these units. 3. Representations and Warranties: Describes the representations and warranties made by both the Company and the Investor. This section may cover areas such as authority, approval, compliance with laws, disclosure of information, and financial statements. 4. Risk Factors: Presents a list of risk factors associated with the investment, such as market risks, general economic conditions, regulatory changes, and potential conflicts of interest. 5. Subscription Process: Outlines the process the Investor must follow to subscribe and purchase the units. This includes submitting a subscription agreement, providing necessary supporting documents, and making the required payment. 6. Capitalization: Provides an overview of the Company's authorized and outstanding shares, including any additional capitalization details relevant to the investment. 7. Transfer Restrictions: Limits the Investor's ability to transfer or assign the units without prior written consent from the Company. 8. Terms of Units: Specifies the terms and conditions associated with the units, including their conversion rights, voting rights, dividend rights, and liquidation preferences. 9. Representations of the Investor: Requires the Investor to confirm that they have reviewed all available information and have conducted due diligence before making the investment. 10. Governing Law and Jurisdiction: Determines the applicable laws and location for resolving any disputes arising from the agreement. Additional types of Chicago, Illinois Subscription Agreements: 1. Series A Subscription Agreement: Specifically for early-stage financing rounds or initial funding rounds. 2. Series B Subscription Agreement: Pertaining to subsequent funding rounds after the Series A round. 3. Convertible Note Subscription Agreement: If the investment is in the form of convertible debt, where the Investor loans money to the Company, which can be converted into equity at a later date. 4. Preferred Stock Subscription Agreement: For investors who prefer preferred shares to common shares, offering additional privileges and preferences. 5. Employee Stock Option Subscription Agreement: In cases where the investment involves issuing stock options to employees as part of their compensation package. These variations may have specific clauses and terms tailored to their unique circumstances. It is important for both the Company and the Investor to carefully review and understand the terms of the agreement before signing. Consulting legal professionals is always recommended ensuring compliance with relevant laws and regulations.

Chicago Illinois Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant

Description

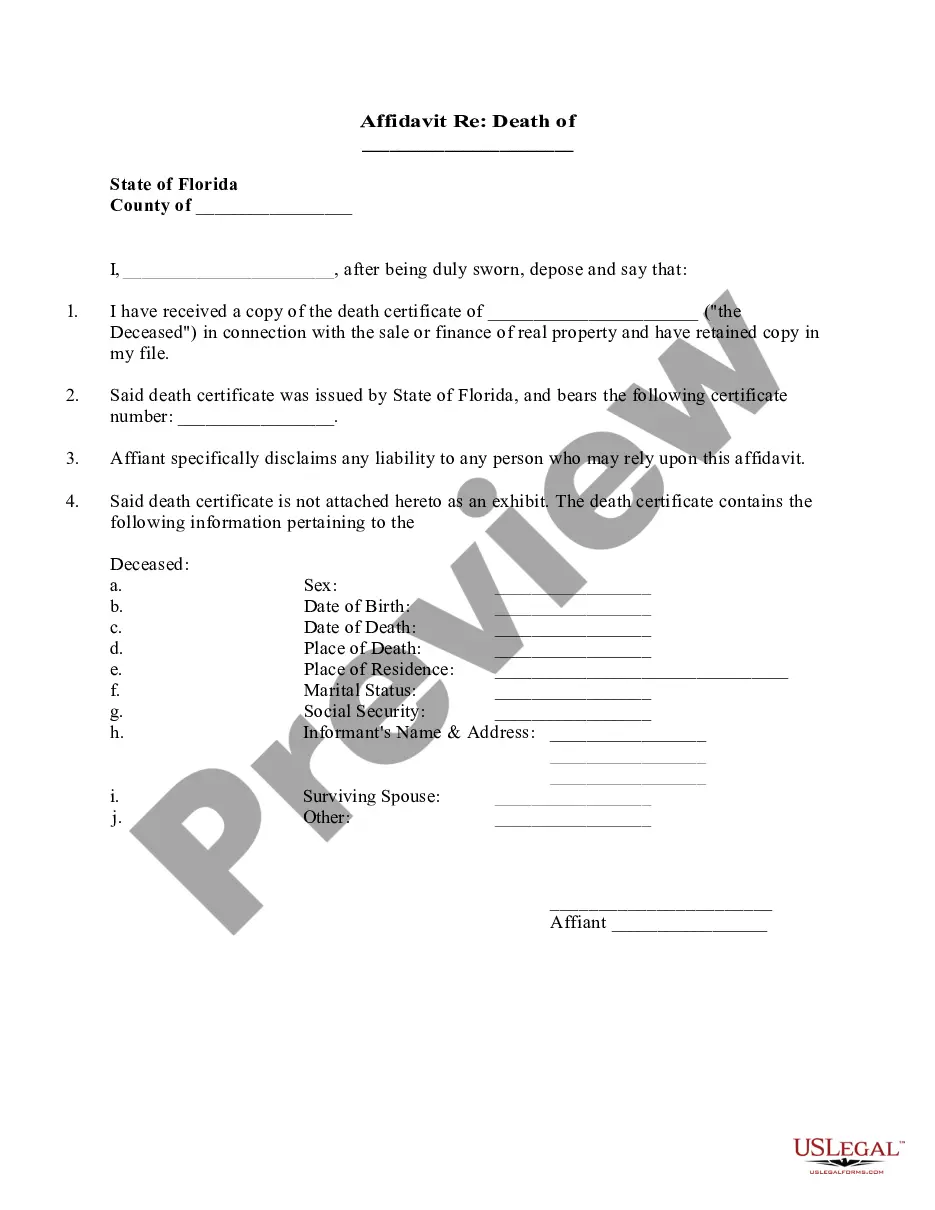

How to fill out Chicago Illinois Subscription Agreement Between Ichargeit.Com, Inc. And Prospective Investor For The Purchase Of Units Consisting Of Common Stock And Common Stock Warrant?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Chicago Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the latest version of the Chicago Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Chicago Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Chicago Subscription Agreement between Ichargeit.Com, Inc. and prospective investor for the purchase of units consisting of common stock and common stock warrant and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!