Maricopa Arizona Stock Option Agreement — A Comprehensive Overview of iChargeit.com, Inc.'s Stock Option Agreements Introduction: The Maricopa Arizona Stock Option Agreement is a crucial legal document that governs the terms and conditions between iChargeit.com, Inc. (the "Company") and its employees or eligible stakeholders in Maricopa, Arizona. This agreement outlines various provisions regarding stock options, granting employees the opportunity to purchase company stock at a future date, often at a predetermined price known as the exercise price. Types of Maricopa Arizona Stock Option Agreements: 1. Standard Stock Option Agreement: This is the basic type of stock option agreement offered by iChargeit.com, Inc., providing employees the right to purchase a specified number of company stocks within a defined period. This agreement typically includes critical terms such as the vesting schedule, exercise price, and expiration date. 2. Incentive Stock Option Agreement (ISO): iChargeit.com, Inc. may offer SOS to its employees, which have unique tax advantages. Eligibility for SOS is typically restricted to employees only. SOS must adhere to specific requirements outlined by the Internal Revenue Service (IRS), like maintaining a ten-year exercise period and using a predetermined formula to determine the maximum allowed number of options. 3. Non-Qualified Stock Option Agreement (NO): Nests are another option iChargeit.com, Inc. might provide to its employees. These stock options do not qualify for special tax treatment under the IRS guidelines, unlike SOS. Nests offer greater flexibility in terms of the number of options granted, exercise price determination, and a wide range of potential recipients, including both employees and non-employee stakeholders. Key Features of the Maricopa Arizona Stock Option Agreement: 1. Vesting Schedule: The stock option agreement establishes a vesting schedule, which outlines the period over which employees acquire ownership rights to the granted stock options. This schedule incentivizes employees to remain with the company and contribute to its long-term success. 2. Exercise Price and Expiration Date: The agreement specifies the exercise price, i.e., the price at which an employee can purchase the company stocks. It also establishes an expiration date, after which the stock options become void if not exercised. 3. Stock Option Termination: In certain situations, the stock option agreement may be terminated or expire prematurely. These circumstances typically include an employee's voluntary termination, retirement, or termination with cause. The agreement usually outlines the procedures and consequences in case of early termination. 4. Change of Control: To address potential changes in the company's ownership or control, the agreement may include provisions related to stock options in the event of a merger, acquisition, or other significant corporate transactions. Conclusion: The Maricopa Arizona Stock Option Agreement offered by iChargeit.com, Inc., provides employees with an opportunity for future financial growth and alignment with the company's success. As an integral part of the employee compensation package, stock option agreements help attract, retain, and motivate talented individuals. By clearly defining the terms and conditions, these agreements contribute to a transparent and mutually beneficial relationship between the company and its employees.

Maricopa Arizona Stock Option Agreement of Ichargeit.Com, Inc.

Description

How to fill out Maricopa Arizona Stock Option Agreement Of Ichargeit.Com, Inc.?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Maricopa Stock Option Agreement of Ichargeit.Com, Inc., you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Maricopa Stock Option Agreement of Ichargeit.Com, Inc. from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Maricopa Stock Option Agreement of Ichargeit.Com, Inc.:

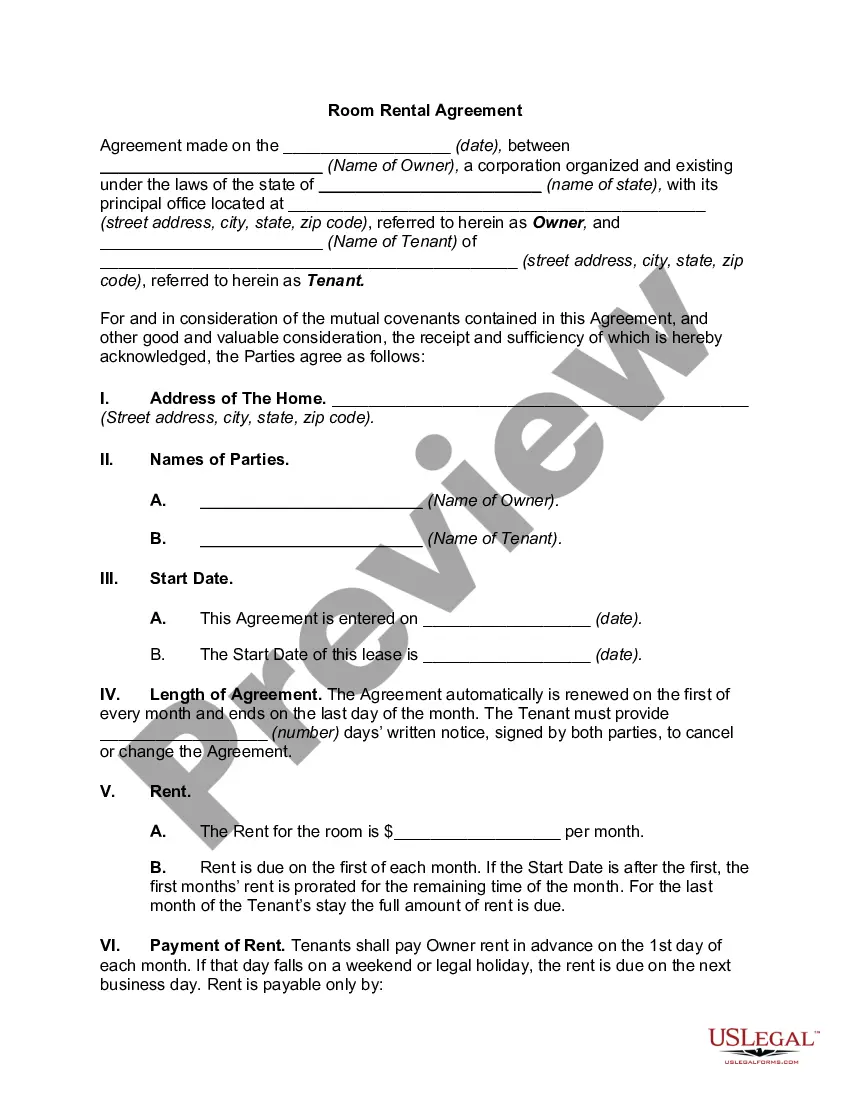

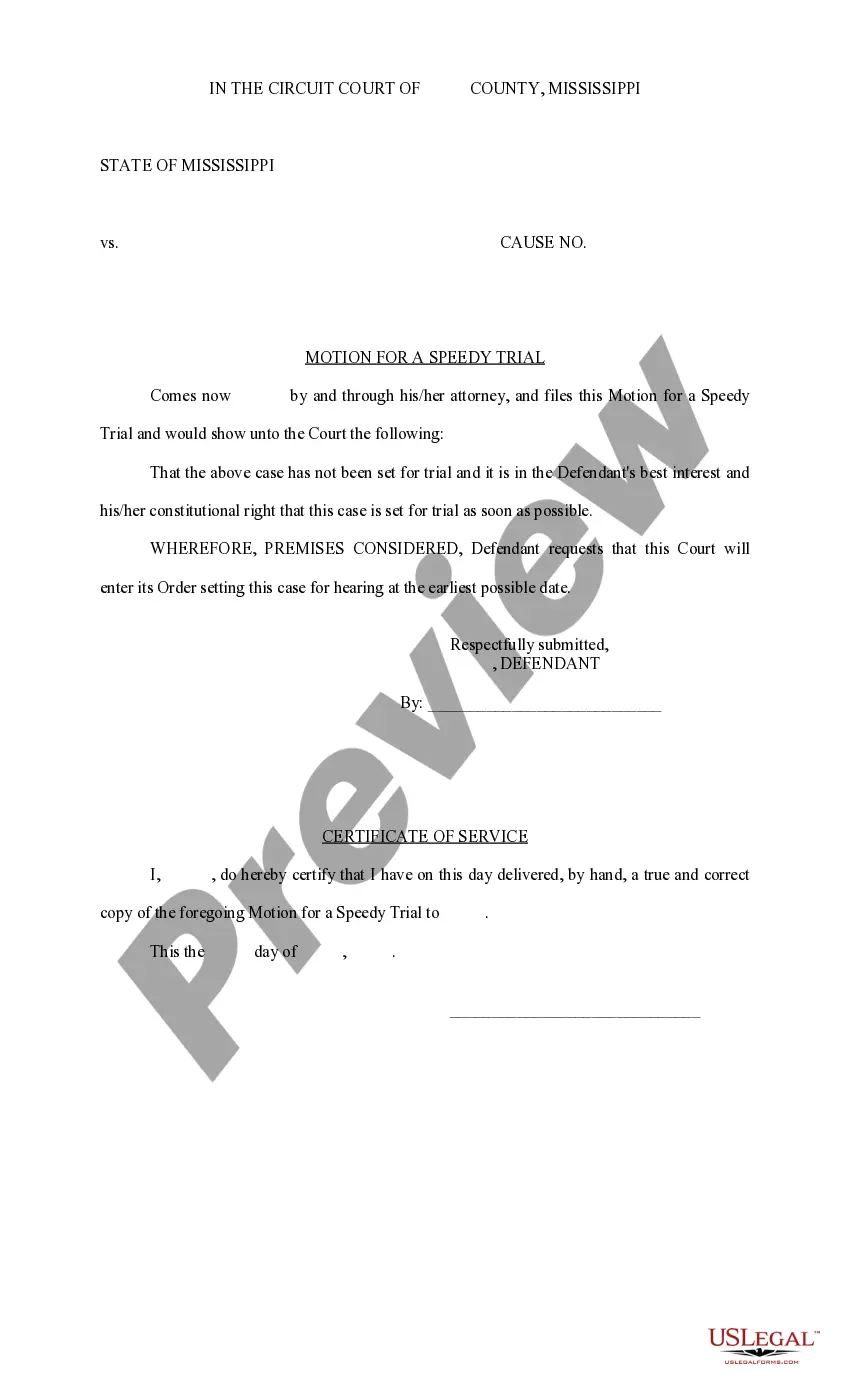

- Take a look at the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!