The Orange California Stock Option Agreement of Charge. Com, Inc. is a legal contract that outlines the terms and conditions under which employees or other parties are granted stock options by the company based in Orange, California. Stock options are a form of compensation that allow individuals to purchase shares of the company's stock at a predetermined price, known as the exercise price, within a specific timeframe. The Stock Option Agreement typically includes various key provisions and details such as: 1. Granting of Options: The agreement specifies the number and type of stock options being granted to the recipient, which could be incentive stock options (SOS) or non-qualified stock options (Nests). 2. Exercise Price: It states the price at which the stock options can be exercised. This price is typically set at the fair market value of the stock on the date of the grant. 3. Vesting schedule: This outlines the timeline and conditions under which the stock options can be exercised. Vesting implies that the recipient must fulfill certain criteria, such as continuous employment or achieving specific performance goals, before they can exercise their options. 4. Expiration: The agreement defines the expiration date or the last date on which the stock options can be exercised. If the options are not exercised before this date, they become void. 5. Termination of Options: The circumstances leading to the termination of stock options are mentioned, such as termination of employment, resignation, retirement, or death. Each scenario may have different provisions regarding the excitability or expiration of the options. 6. Transferability: The agreement specifies whether the stock options can be transferred or assigned to others. In many cases, stock options are non-transferable, except for cases like death or estate planning. 7. Tax Implications: The agreement includes a section explaining the potential tax consequences associated with exercising the stock options. It clarifies the responsibility of the recipient to consult with a tax advisor for guidance. 8. Governing Law: This section explicitly states the governing law of the agreement, which in this case would be California law. Different types of Orange California Stock Option Agreements offered by Charge. Com, Inc. may include: 1. Employee Stock Option Agreement: This type of agreement is specifically for employees of Charge. Com, Inc. and outlines the terms and conditions for granting stock options as part of their compensation package. 2. Non-Employee Stock Option Agreement: This agreement is designed for individuals who are not employed by Charge. Com, Inc. but are granted stock options as consultants, advisors, or other non-employee roles. 3. Incentive Stock Option Agreement: This type of agreement specifically refers to stock options that qualify for special tax treatment under the United States Internal Revenue Code. It must meet certain requirements stipulated by the IRS. 4. Non-Qualified Stock Option Agreement: This agreement is for stock options that do not meet the qualification requirements of incentive stock options. Non-qualified stock options are subject to different tax treatment compared to incentive stock options. In conclusion, the Orange California Stock Option Agreement of Charge. Com, Inc. is a legally binding contract that governs the terms, conditions, and provisions for the granting of stock options to employees and other parties. It ensures clarity and fairness in the distribution of stock options within the company.

Orange California Stock Option Agreement of Ichargeit.Com, Inc.

Description

How to fill out Orange California Stock Option Agreement Of Ichargeit.Com, Inc.?

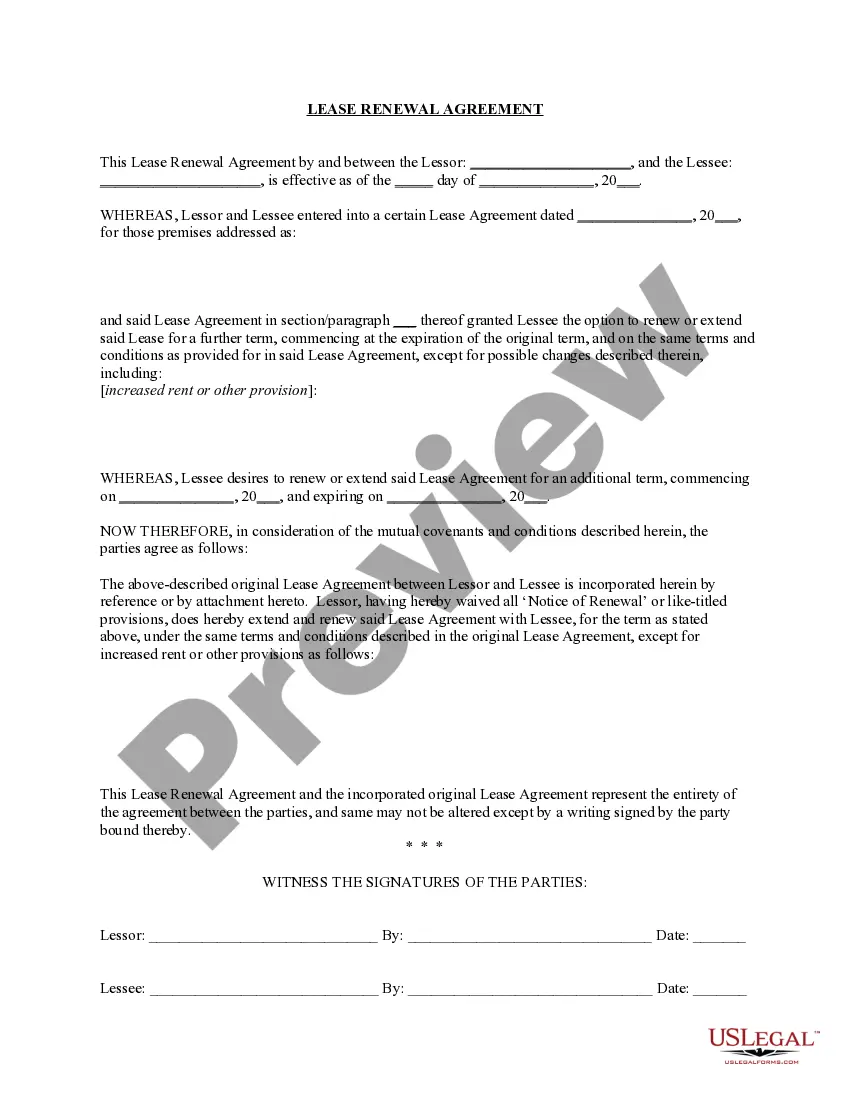

Draftwing paperwork, like Orange Stock Option Agreement of Ichargeit.Com, Inc., to take care of your legal matters is a tough and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. However, you can consider your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents crafted for a variety of cases and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Orange Stock Option Agreement of Ichargeit.Com, Inc. template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before getting Orange Stock Option Agreement of Ichargeit.Com, Inc.:

- Ensure that your form is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Orange Stock Option Agreement of Ichargeit.Com, Inc. isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our service and get the document.

- Everything looks good on your side? Click the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment information.

- Your form is all set. You can go ahead and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Basics of Option Profitability A put option buyer makes a profit if the price falls below the strike price before the expiration. The exact amount of profit depends on the difference between the stock price and the option strike price at expiration or when the option position is closed.

Typically, ESOs are issued by the company and cannot be sold, unlike standard listed or exchange-traded options. When a stock's price rises above the call option exercise price, call options are exercised and the holder obtains the company's stock at a discount.

About Stock Option Agreements Such an option, once granted to the employee, gives the employee the opportunity to benefit from increases in the company's share value by granting the right to buy shares at a future point in time at a price equal to the fair market value of such shares at the time of the grant.

With nonqualified stock options, for employees the spread at exercise is reported to the IRS on Form W-2 For nonemployees, it is reported on Form 1099-MISC (starting with the 2020 tax year, it will be reported on Form 1099-NEC ). It is included in your income for the year of exercise.

Stock options are an excellent benefit if there is no cost to the employee in the form of reduced salary or benefits. In that situation, the employee will win if the stock price rises above the exercise price once the options are vested.

When you buy an open-market option, you're not responsible for reporting any information on your tax return. However, when you sell an optionor the stock you acquired by exercising the optionyou must report the profit or loss on Schedule D of your Form 1040.

Total stock compensation expense is calculated by taking the number of stock options granted and multiplying by the fair market value on the grant date.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

For nonstatutory options without a readily determinable fair market value, there's no taxable event when the option is granted but you must include in income the fair market value of the stock received on exercise, less the amount paid, when you exercise the option.

Under APB 25, stock option-based compensation expense is based on the difference at the measurement date between the stock price and option exercise price. Because for most fixed option grants the exercise price equals the stock price at the date of grant, the expense under APB 25 typically equals zero.