In Riverside, California, Charge. Com, Inc. offers stock option agreements to its employees as a part of their compensation package. These agreements provide employees with the opportunity to purchase company stock at a specified price within a certain time frame. This detailed description will outline the key aspects of Riverside California Stock Option Agreement of Charge. Com, Inc., highlighting its purpose, terms, and benefits. A Riverside California Stock Option Agreement typically consists of several key components. First, it identifies the parties involved, namely Charge. Com, Inc. and the employee. It further states the date on which the agreement is executed and the number of shares/options being granted to the employee. The agreement outlines the vesting schedule, indicating when the employee becomes eligible to exercise their stock options. Vesting is often tied to the employee's length of service or achievement of specific performance goals. A typical vesting schedule may span over several years, incentivizing employees to remain with the company for a designated period. Additionally, the agreement specifies the exercise price, which is the price at which the employee can purchase the stock when exercising their options. This price is typically set at or slightly above the market value of the company's stock at the time the options are granted, providing employees with a favorable opportunity to benefit from potential stock price appreciation. Furthermore, the agreement outlines the expiration date for exercising the stock options. This date serves as a deadline after which the options will no longer be valid. By setting an expiration date, Charge. Com, Inc. ensures that employees exercise their options within a suitable timeframe. In Riverside, California, Charge. Com, Inc. may offer different types of stock option agreements to its employees. These may include incentive stock options (SOS) and non-qualified stock options (SOS). SOS provide certain tax advantages to employees, subject to specific IRS regulations, while SOS are more flexible but may have different tax implications. The Riverside California Stock Option Agreement of Charge. Com, Inc. serves as a valuable tool to attract and retain talented employees. By offering stock options, employees have the potential to benefit from the company's growth and success. This aligns their financial interests with that of the company, fostering loyalty, motivation, and a sense of ownership. Overall, Riverside California Stock Option Agreement of Charge. Com, Inc. plays a crucial role in incentivizing and rewarding employees within the company. It grants them the opportunity to become shareholders and share in the potential profits and growth of the organization.

Riverside California Stock Option Agreement of Ichargeit.Com, Inc.

Description

How to fill out Riverside California Stock Option Agreement Of Ichargeit.Com, Inc.?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business objective utilized in your region, including the Riverside Stock Option Agreement of Ichargeit.Com, Inc..

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Riverside Stock Option Agreement of Ichargeit.Com, Inc. will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Riverside Stock Option Agreement of Ichargeit.Com, Inc.:

- Make sure you have opened the right page with your localised form.

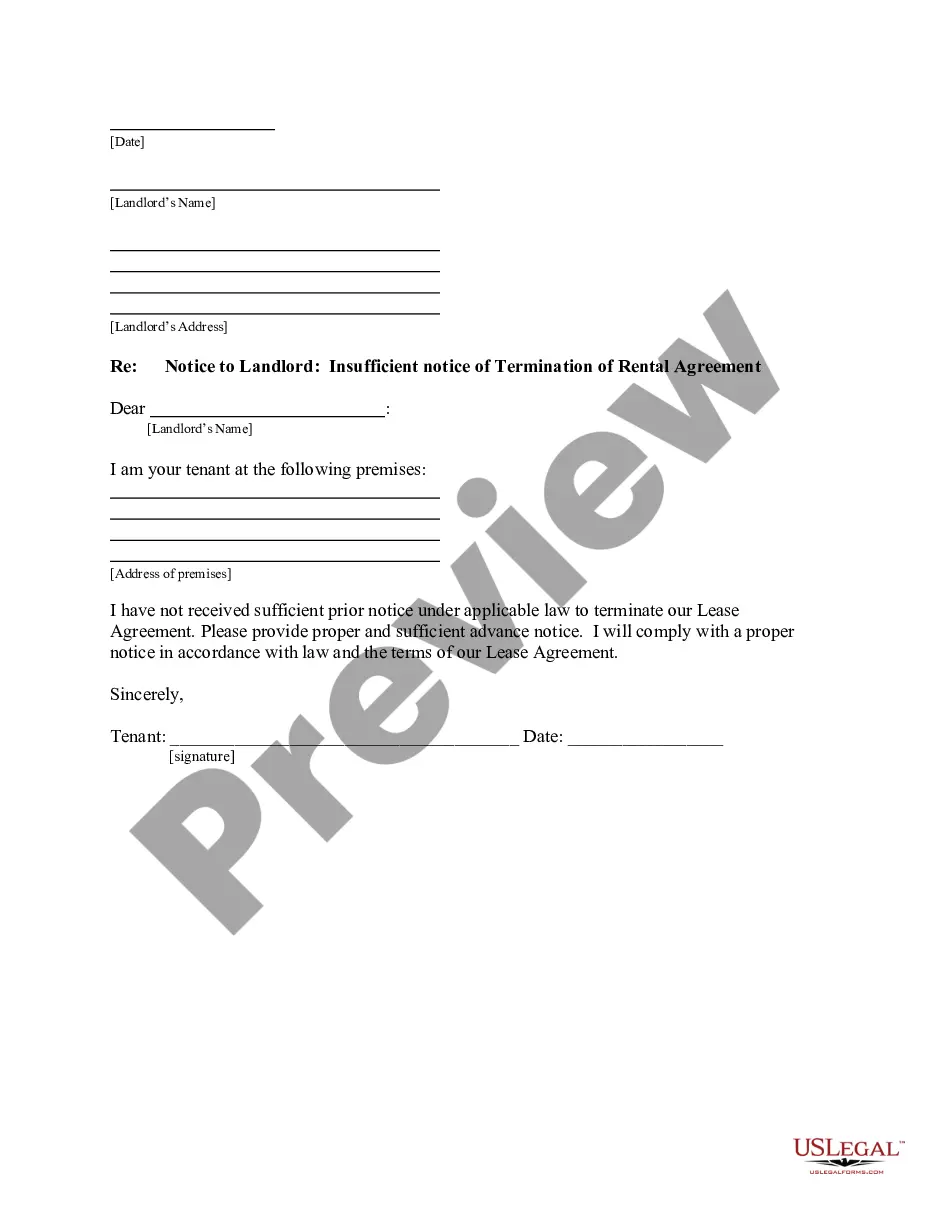

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Riverside Stock Option Agreement of Ichargeit.Com, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!