The Chicago Illinois Merger Plan and Agreement between Charge. Com, Inc. and Para-Link, Inc. is a legally binding document outlining the terms and conditions of the merger between the two companies. This agreement aims to combine the resources, expertise, and customer bases of both organizations to drive growth and increased market presence. One key aspect of the merger plan is the integration of Charge. Com, Inc.'s innovative online payment platform with Para-Link, Inc.'s robust e-commerce solutions. This merger presents an opportunity for both companies to leverage their strengths and create a comprehensive payment and e-commerce platform that meets the evolving needs of businesses and consumers. The primary objective of the Chicago Illinois Merger Plan is to facilitate a smooth transition and ensure the successful integration of the two organizations. It outlines the timeline, responsibilities, and processes for the consolidation of various departments, including finance, operations, marketing, and human resources. The plan also addresses potential challenges and establishes mechanisms to address them effectively. Key components of the merger agreement include the valuation and exchange ratio of shares, the governance structure of the newly merged entity, the treatment of employees, and the allocation of assets and liabilities. This comprehensive plan aims to maximize shareholder value, ensure operational efficiency, and minimize any potential disruptions during the merger process. Different types of Chicago Illinois Merger Plan and Agreement between Charge. Com, Inc. and Para-Link, Inc. may include: 1. Stock-for-stock merger: This type of merger involves the exchange of shares between the two companies at a predetermined ratio. Shareholders of Charge. Com, Inc. and Para-Link, Inc. are given the opportunity to become shareholders of the merged entity, retaining ownership in the new company. 2. Asset acquisition merger: In this type of merger, Charge. Com, Inc. acquires specific assets and liabilities of Para-Link, Inc. The acquired assets could include technology platforms, intellectual property, customer lists, and physical infrastructure. This type of merger allows Charge. Com, Inc. to expand its capabilities and enhance its market position. 3. Joint venture merger: This type of merger involves the creation of a new entity, jointly owned by Charge. Com, Inc. and Para-Link, Inc. The new entity operates independently and allows both companies to leverage their respective strengths while sharing risks and profits. Joint venture mergers often aim to access new markets or combine complementary products or services. The Chicago Illinois Merger Plan and Agreement between Charge. Com, Inc. and Para-Link, Inc. provides a solid foundation for the successful integration of the two companies. By pooling their resources, expertise, and customer bases, this merger aims to create a stronger, more competitive entity that can drive innovation and meet the evolving needs of the market.

Chicago Illinois Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc.

Description

How to fill out Chicago Illinois Merger Plan And Agreement Between Ichargeit.Com, Inc. And Para-Link, Inc.?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Chicago Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc., you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Chicago Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc. from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Chicago Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc.:

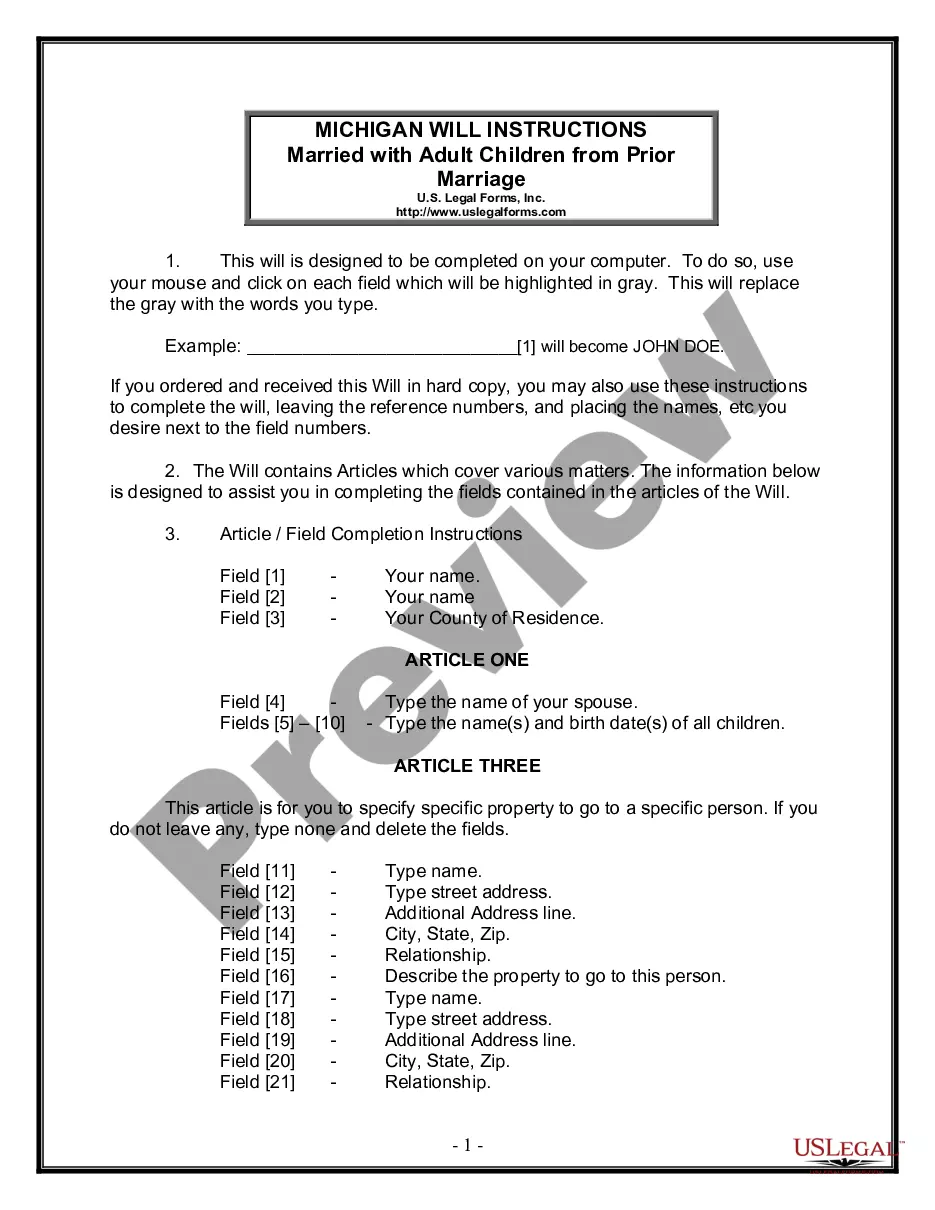

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!