Nassau New York Merger Plan and Agreement between Charge. Com, Inc. and Para-Link, Inc. The Nassau New York Merger Plan and Agreement between Charge. Com, Inc. and Para-Link, Inc. is a strategic move by both companies to merge their resources, expertise, and market presence in order to enhance their competitive edge and overall market position. This merger plan outlines the terms and conditions of the merger, laying the foundation for a successful collaboration between Charge. Com, Inc. and Para-Link, Inc. in Nassau, New York. Keywords: Nassau New York, Merger Plan, Agreement, Charge. Com, Inc., Para-Link, Inc. This merger agreement encompasses several key aspects, including: 1. Corporate Structure: The agreement outlines the new corporate structure that will be established as a result of the merger. It defines the roles and responsibilities of executives and board members in the merged entity, ensuring seamless integration and effective decision-making processes. 2. Financial Terms: The financial terms of the merger are extensively detailed in the agreement, including the valuation of each company, the exchange ratio of their shares, and any cash or stock considerations. These terms ensure fair compensation for both companies' shareholders and provide stability for future growth. 3. Intellectual Property and Technology: The agreement addresses the transfer of intellectual property rights and technology assets between Charge. Com, Inc. and Para-Link, Inc. This ensures that both companies benefit from their combined expertise, proprietary technologies, and innovative solutions. 4. Employment and Workforce: The merger plan discusses the impact on employees and outlines any retention or severance packages, transition plans, and integration strategies to ensure a smooth transition for both companies' employees. The focus is on maximizing synergies and leveraging the strengths of each workforce. 5. Market Expansion and Growth Strategy: This merger plan highlights the combined entity's market expansion and growth strategy. It includes plans for penetrating new markets, diversifying product offerings, and leveraging cross-selling opportunities to maximize revenue streams and increase market share. 6. Regulatory and Legal Compliance: The agreement addresses regulatory and legal compliance issues associated with the merger, ensuring that all necessary approvals, permits, and licenses are obtained from relevant authorities to complete the merger process smoothly and in accordance with local regulations. Types of Nassau New York Merger Plan and Agreement: 1. Horizontal Merger: A horizontal merger is when Charge. Com, Inc. and Para-Link, Inc., both operating in the same industry, combine their resources and capabilities to strengthen their market position and gain a competitive advantage. 2. Vertical Merger: A vertical merger is when Charge. Com, Inc., operating in one stage of the value chain, merges with Para-Link, Inc., operating in another stage of the same value chain. This allows for greater integration and control over the production and distribution processes, resulting in cost efficiencies and enhanced market presence. 3. Conglomerate Merger: A conglomerate merger is when Charge. Com, Inc., a company operating in one industry, merges with Para-Link, Inc., a company operating in a completely unrelated industry. This type of merger aims to diversify revenue streams and reduce risk by combining two unrelated businesses under a single entity. In conclusion, the Nassau New York Merger Plan and Agreement between Charge. Com, Inc. and Para-Link, Inc. is a comprehensive document that outlines the merger strategies, financial terms, operational implications, and growth strategies of the combined entity. The agreement aims to create a strong and competitive presence for both companies in Nassau, New York, and beyond, leveraging their respective strengths and synergies for mutual growth and success.

Nassau New York Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc.

Description

How to fill out Nassau New York Merger Plan And Agreement Between Ichargeit.Com, Inc. And Para-Link, Inc.?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Nassau Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc., you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Nassau Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc. from the My Forms tab.

For new users, it's necessary to make several more steps to get the Nassau Merger Plan and Agreement between Ichargeit.Com, Inc. and Para-Link, Inc.:

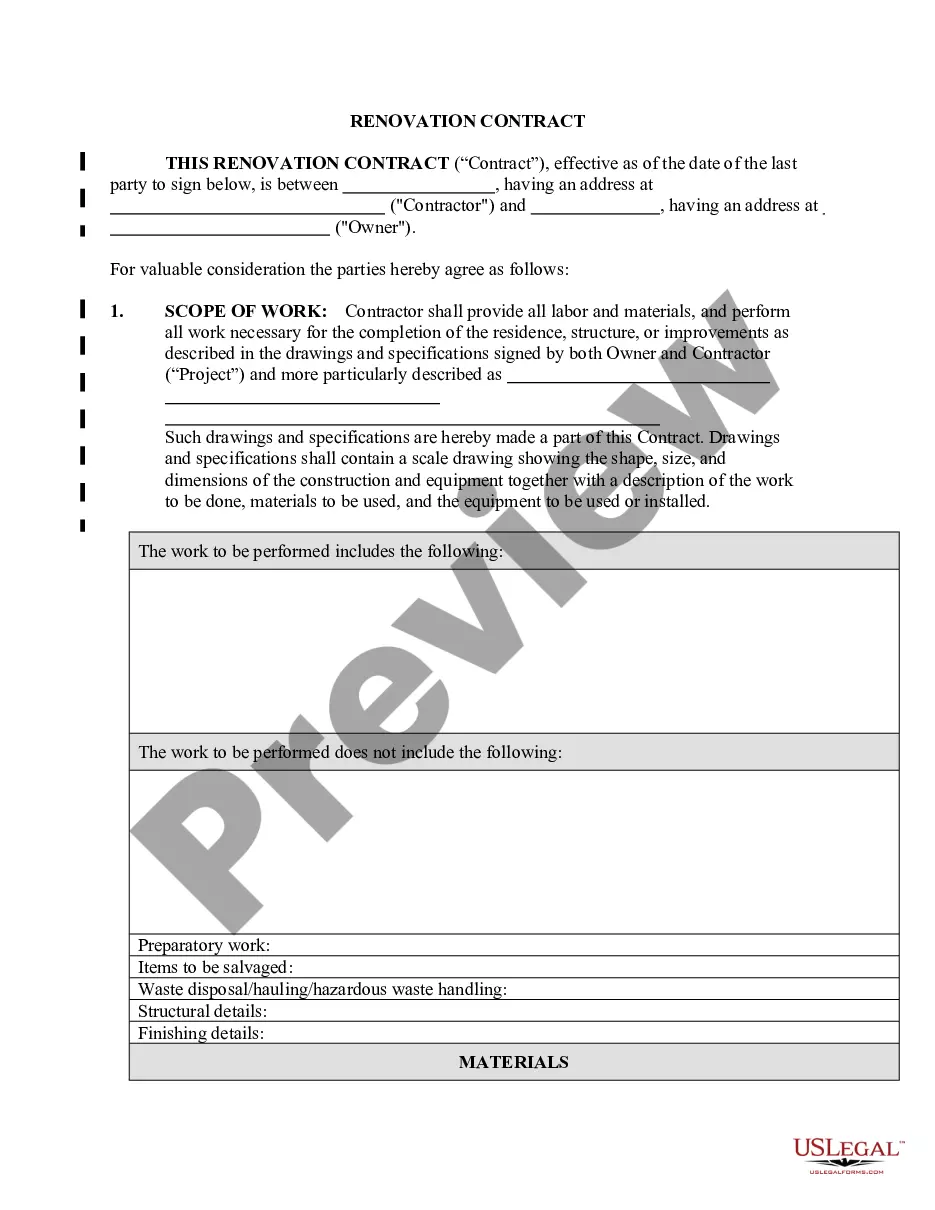

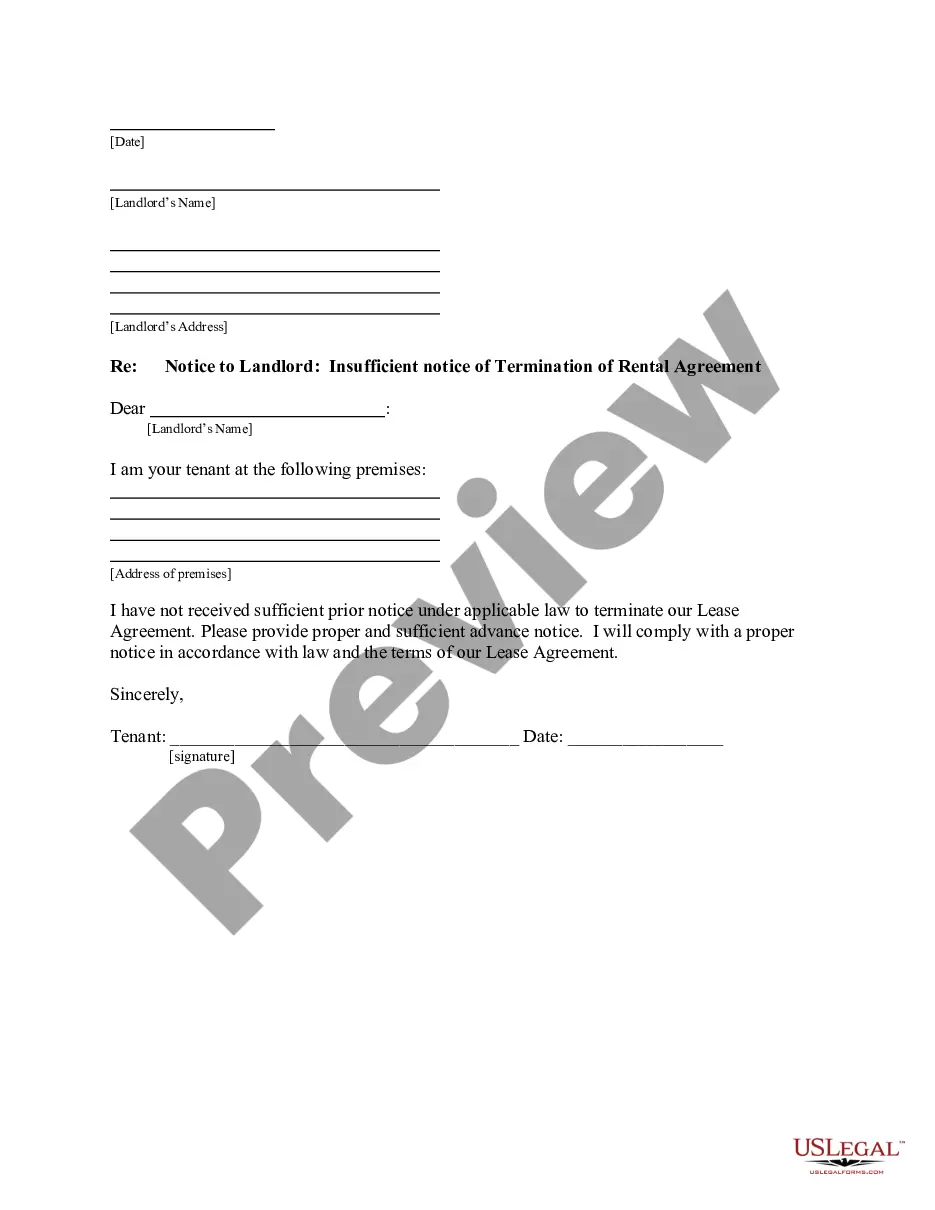

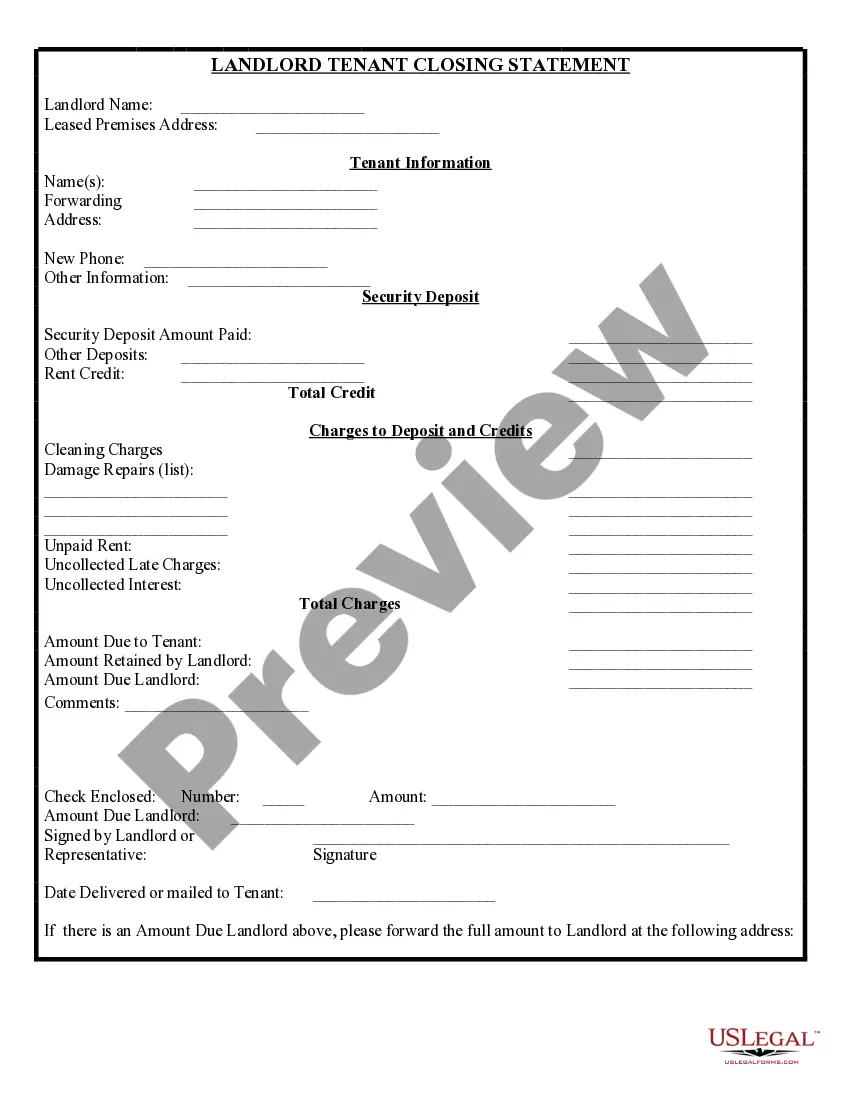

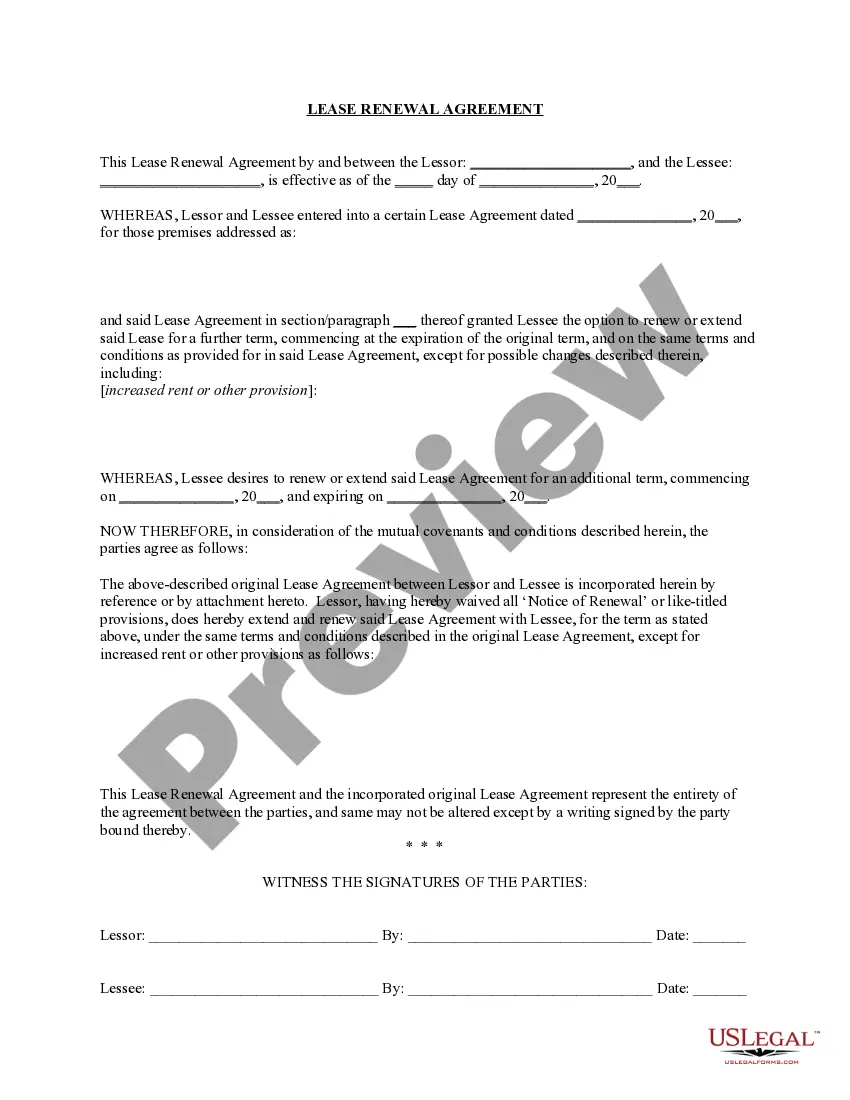

- Analyze the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!