Title: Exploring the Phoenix, Arizona Plan of Merger between Charge. Com, Inc. and Charge. Com, Inc. Introduction: In this article, we delve into the details of the Phoenix, Arizona Plan of Merger between Charge. Com, Inc. and Charge. Com, Inc. A merger is a significant event for any company, indicating growth, expansion, and potential benefits for stakeholders. By comprehensively discussing the plan, its benefits, and the various types of mergers associated with Phoenix, Arizona, we aim to provide a comprehensive overview of this consequential business action. Keywords: Phoenix, Arizona, Plan of Merger, Charge. Com, Inc., types of mergers, benefits. 1. What is a Merger? A merger refers to the consolidation of two or more independent companies to form a single entity through mutual agreement. It typically aims to achieve greater market share, synergy, economies of scale, improved competitive advantage, and increased shareholder value. 2. Introduction to Phoenix, Arizona: Phoenix, the capital city of Arizona, represents a thriving business hub hosting numerous corporations, startups, and entrepreneurial ventures. It offers a favorable economic climate, modern infrastructure, and a skilled workforce, making it an ideal location for mergers and business expansion. 3. Charge. Com, Inc.: Provide a brief overview of Charge. Com, Inc. as a leading company in a specific industry or sector. Highlight its strengths, accomplishments, and its position within the Phoenix business community. 4. Types of Mergers: 4.1. Horizontal Merger: Discuss how a horizontal merger refers to the amalgamation of two companies operating within the same industry or market. Analyze the benefits of such a merger for Charge. Com, Inc., including increased market share, elimination of competition, cost savings, and expanded customer base. 4.2. Vertical Merger: Explain how a vertical merger involves the merging of companies operating at different stages of the supply chain, typically a supplier-customer relationship. Discuss the potential advantages of a vertical merger for Charge. Com, Inc., including stronger integration, improved communication, reduced costs, and enhanced product development capabilities. 4.3. Conglomerate Merger: Describe the nature of a conglomerate merger involving the combination of two unrelated companies. Highlight the strategic reasons behind such a merger, such as diversified revenue streams, reduced business risks, enhanced market reach, and potential synergies. 5. The Phoenix, Arizona Plan of Merger: Provide detailed information about the specific plan of merger between Charge. Com, Inc. and Charge. Com, Inc. Discuss the key terms, conditions, and objectives outlined in the plan, such as sharing resources, expanding product or service offerings, entering new markets, or enhancing technological capabilities. 6. Benefits of the Plan: Elaborate on the various benefits the merger plan brings to Charge. Com, Inc. and its stakeholders. These may include improved profitability, increased market dominance, expanded customer base, enhanced competitive advantage, access to new resources, and potential cost synergies. Conclusion: The Phoenix, Arizona Plan of Merger between Charge. Com, Inc. and Charge. Com, Inc. represents a strategic move aimed at consolidating businesses, boosting growth, and enhancing value for all parties involved. By undertaking an in-depth analysis of the different types of mergers and their potential benefits, this article sheds light on the significance of this merger in the context of Phoenix, Arizona's business landscape.

Phoenix Arizona Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.

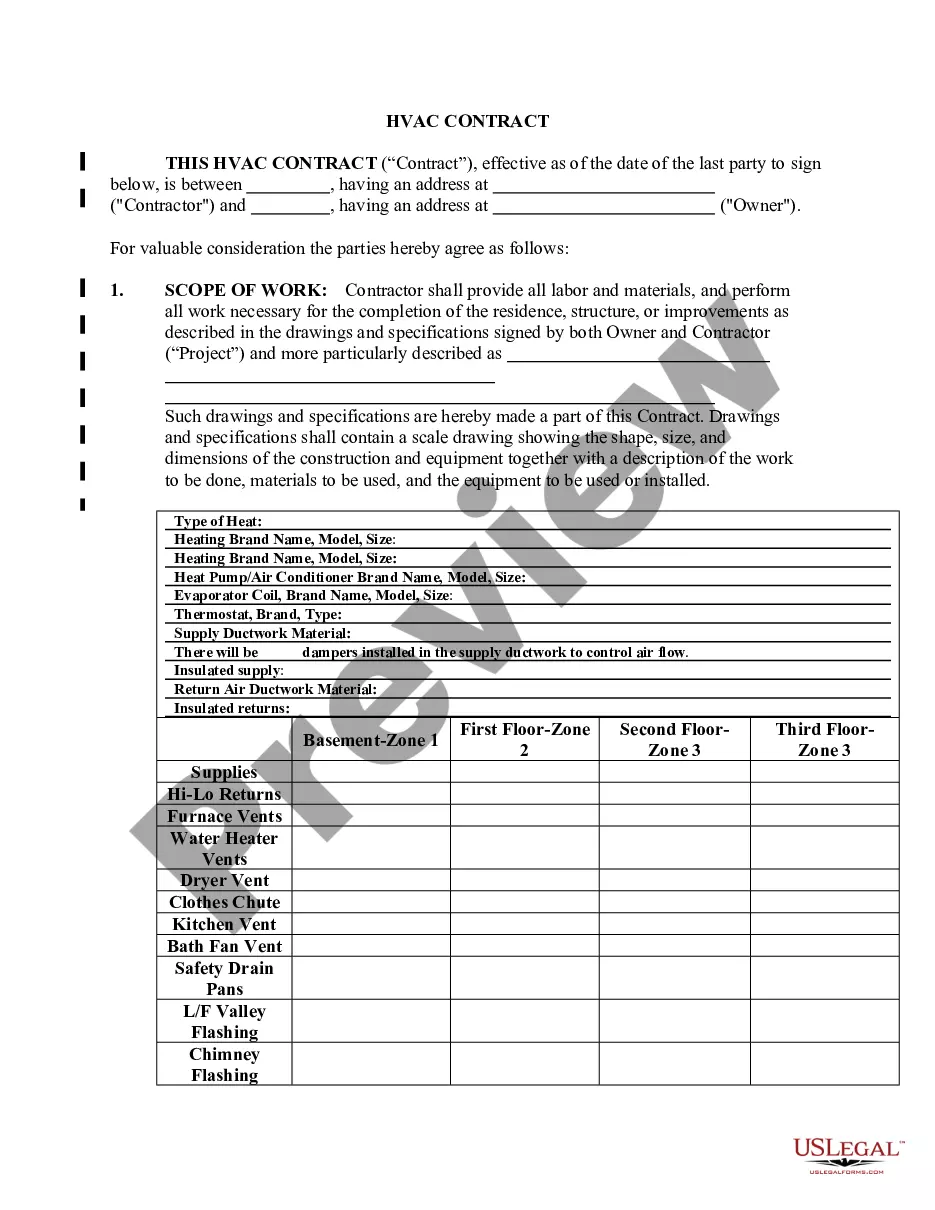

Description

How to fill out Phoenix Arizona Plan Of Merger Between Ichargeit.Com, Inc. And Ichargeit.Com, Inc.?

Whether you intend to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Phoenix Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc. is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Phoenix Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the right one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Phoenix Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc. in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!