Montgomery Maryland Trust Indenture and Agreement involving John Naveen and Co., Inc. and Chase Manhattan Bank is a legally binding document that outlines the terms and conditions for the Naveen Tax Free Unit Trust, Series 1140, located in Montgomery, Maryland. This trust indenture defines the relationship between the trust or, John Naveen and Co., Inc., and the trustee, Chase Manhattan Bank, ensuring the proper management and administration of the Naveen Tax Free Unit Trust, Series 1140. Key terms and conditions addressed in the Montgomery Maryland Trust Indenture and Agreement include: 1. Trust Structure: The document elaborates on the structure of the Naveen Tax Free Unit Trust, Series 1140, specifying the rights and responsibilities of both parties involved. It defines the purpose and objectives of the trust, as well as the responsibilities related to investments, asset management, and portfolio diversification. 2. Distribution of Income: The agreement outlines the procedures and frequency of income distribution to beneficiaries. It covers aspects such as dividend distributions, interest payments, or other income generated by the trust assets. 3. Custodian Responsibilities: The trustee, Chase Manhattan Bank, is entrusted with the safekeeping of the assets held within the Naveen Tax Free Unit Trust, Series 1140. The trust indenture specifies the requirements for the custodian, including the duty to maintain accurate records and provide regular reports to the trust or. 4. Termination: The document defines the conditions under which the Naveen Tax Free Unit Trust, Series 1140, may be terminated. This includes events such as the accomplishment of the trust's purpose, expiration of the trust term, or other circumstances agreed upon by both parties. 5. Dispute Resolution: The trust indenture provides a mechanism for resolving any disputes or disagreements that may arise between John Naveen and Co., Inc. and Chase Manhattan Bank. It may establish a dispute resolution process, such as mediation or arbitration, to facilitate a fair resolution. 6. Amendment and Modification: The agreement addresses the procedures and requirements for modifying or amending the terms and conditions of the trust indenture. This ensures that any changes made to the agreement are made in accordance with the applicable laws and regulations. It is important to note that while the Montgomery Maryland Trust Indenture and Agreement between John Naveen and Co., Inc. and Chase Manhattan Bank regarding the Naveen Tax Free Unit Trust, Series 1140, is the focal point of this description, there may be variations of this agreement specific to different series or editions of the Naveen Tax Free Unit Trust. Each trust series may have its own unique terms and conditions, customized to meet specific investment objectives and legal requirements. However, detailed information regarding these specific series is not available without further data provided.

Montgomery Maryland Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140

Description

How to fill out Montgomery Maryland Trust Indenture And Agreement Between John Nuveen And Co., Inc. And Chase Manhattan Bank Regarding Terms And Conditions For Nuveen Tax Free Unit Trust, Series 1140?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Montgomery Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140 suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. In addition to the Montgomery Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Montgomery Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140:

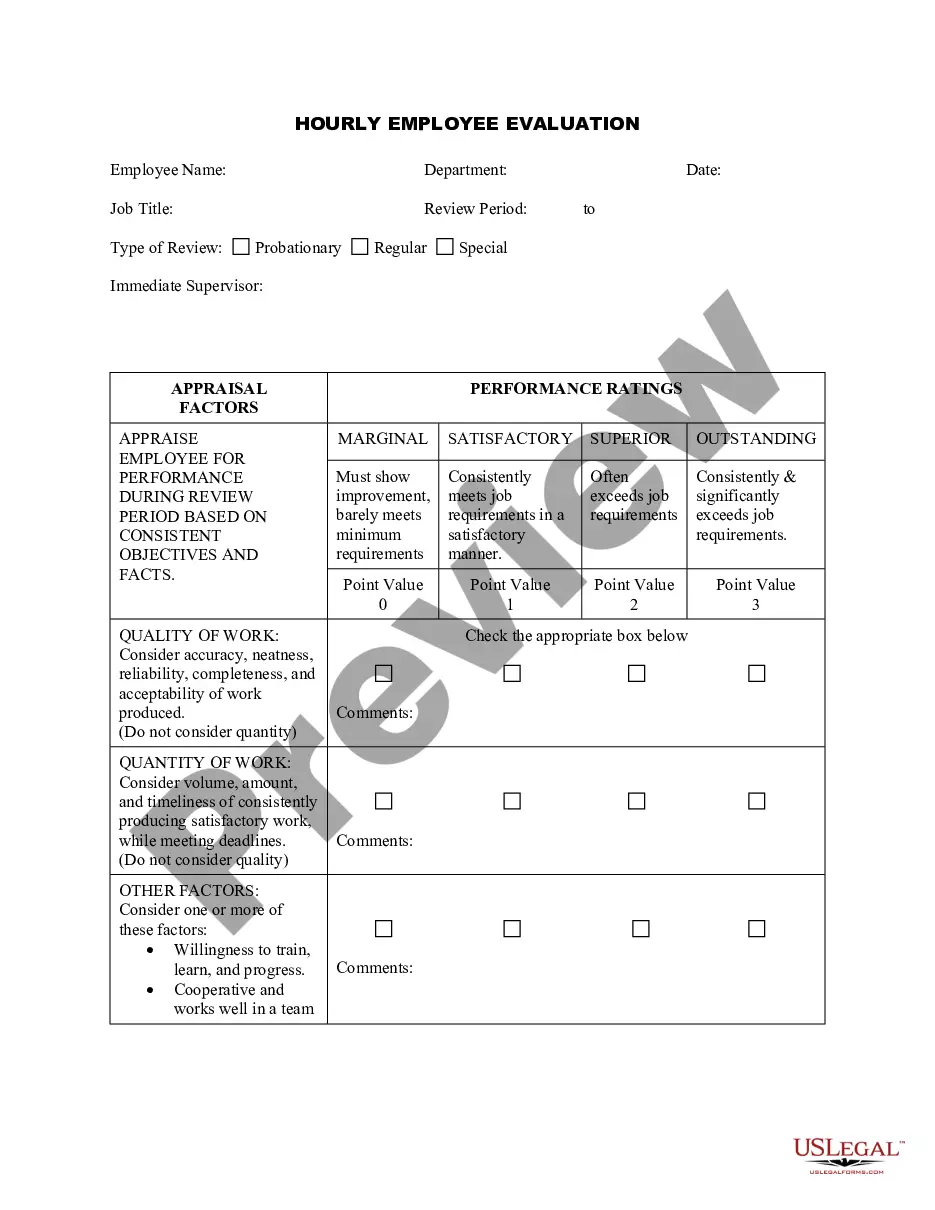

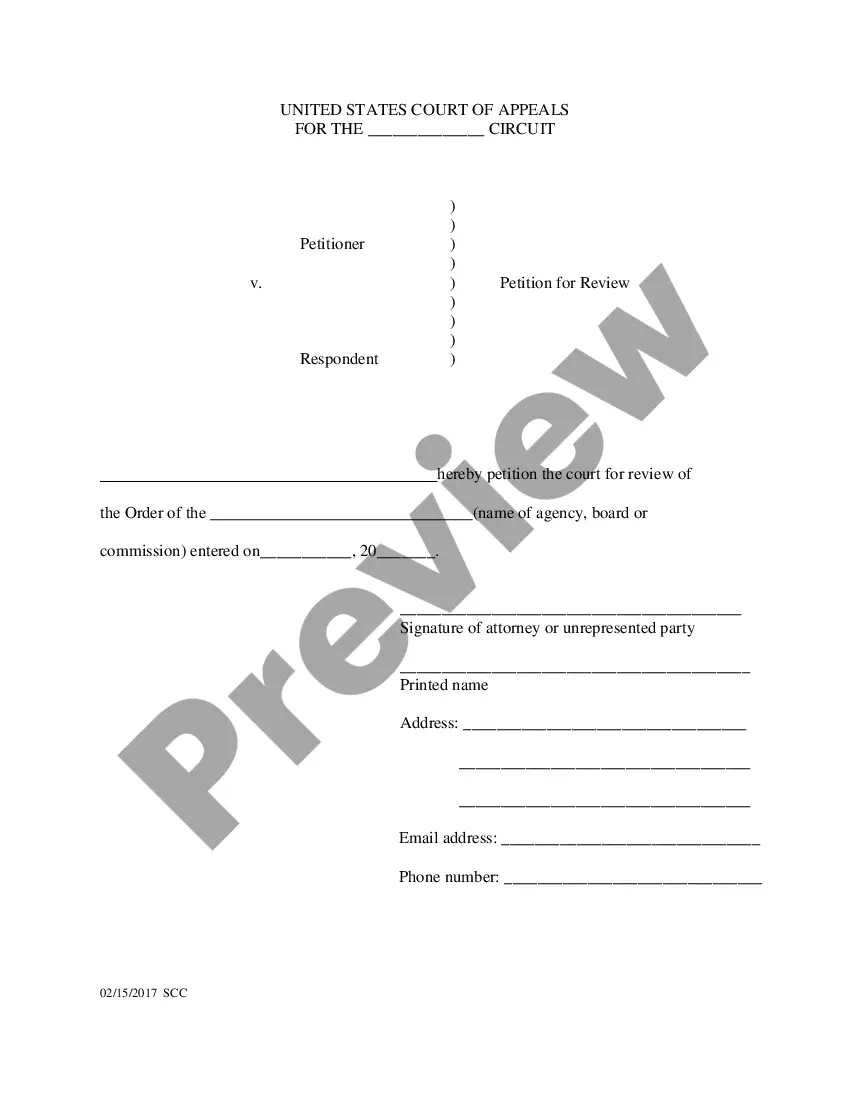

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Montgomery Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!