Palm Beach Florida Trust Indenture and Agreement between John Naveen and Co., Inc. and Chase Manhattan Bank: The Palm Beach Florida Trust Indenture and Agreement between John Naveen and Co., Inc. and Chase Manhattan Bank outlines the terms and conditions for the Naveen Tax Free Unit Trust, Series 1140, specific to Palm Beach, Florida. This trust agreement serves as a legally binding document that establishes the relationship between John Naveen and Co., Inc. (the issuer) and Chase Manhattan Bank (the trustee) in managing the Naveen Tax Free Unit Trust. Key Responsibilities: 1. Issuer's Responsibilities: — The issuer, JohNaveenen and Co., Inc., is entrusted with managing the assets of the Naveen Tax Free Unit Trust, Series 1140 in accordance with the guidelines set forth in the trust agreement. — The issuer must ensure compliance with all applicable laws, regulations, and reporting requirements. — Regularly providing reports and statements to the trustee regarding the performance and financial status of the trust. 2. Trustee's Responsibilities: — Chase Manhattan Bank, as the trustee, holds legal title to the assets of the trust and acts as a fiduciary. — Responsible for safeguarding the trust assets and ensuring their secure custody. — Administers distributions, interest payments, and other disbursements to the beneficiaries and bondholders as outlined in the trust agreement. — Engages in periodic reviews and audits to ensure compliance with the agreed-upon terms and conditions. — Acts as a liaison between the issuer and the bondholders, ensuring effective communication and transparency. Terms and Conditions: The trust agreement typically covers the following terms and conditions for the Naveen Tax Free Unit Trust, Series 1140: 1. Trust Property: — Detailed description of the trust property, including investments, securities, and other assets held within the trust. — Specific provisions for additions or removal of assets as permitted by the agreement. 2. Bondholder Rights: — Outlines the rights, benefits, and protections afforded to the bondholders, including priority of payments, remedies in case of default, and dispute resolution mechanisms. 3. Distributions: — Specifies the frequency and methodology for distributing income, dividends, or interest earned by the trust assets to the bondholders. 4. Termination: — Procedures and conditions for the termination of the trust agreement, including the distribution of remaining assets to bondholders upon maturity or other agreed-upon events. Different Types of Palm Beach Florida Trust Indenture and Agreements Naveenen Tax Free Unit Trust, Series 1140: While the specific Naveen Tax Free Unit Trust, Series 1140, is mentioned in the given prompt, it's important to note that there may be multiple trust indentures and agreements within the Palm Beach, Florida jurisdiction, tailored to different investment purposes or series offered by Naveen and Co., Inc. and Chase Manhattan Bank. These agreements might have similar or distinct terms and conditions depending on the specific investment objectives and asset composition. The different series might be identified by a numerical or alphabetical designation (e.g., Series 1141, Series A, Series B, etc.) and may differ based on factors like maturity date, targeted yield, or investment strategy.

Palm Beach Florida Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140

Description

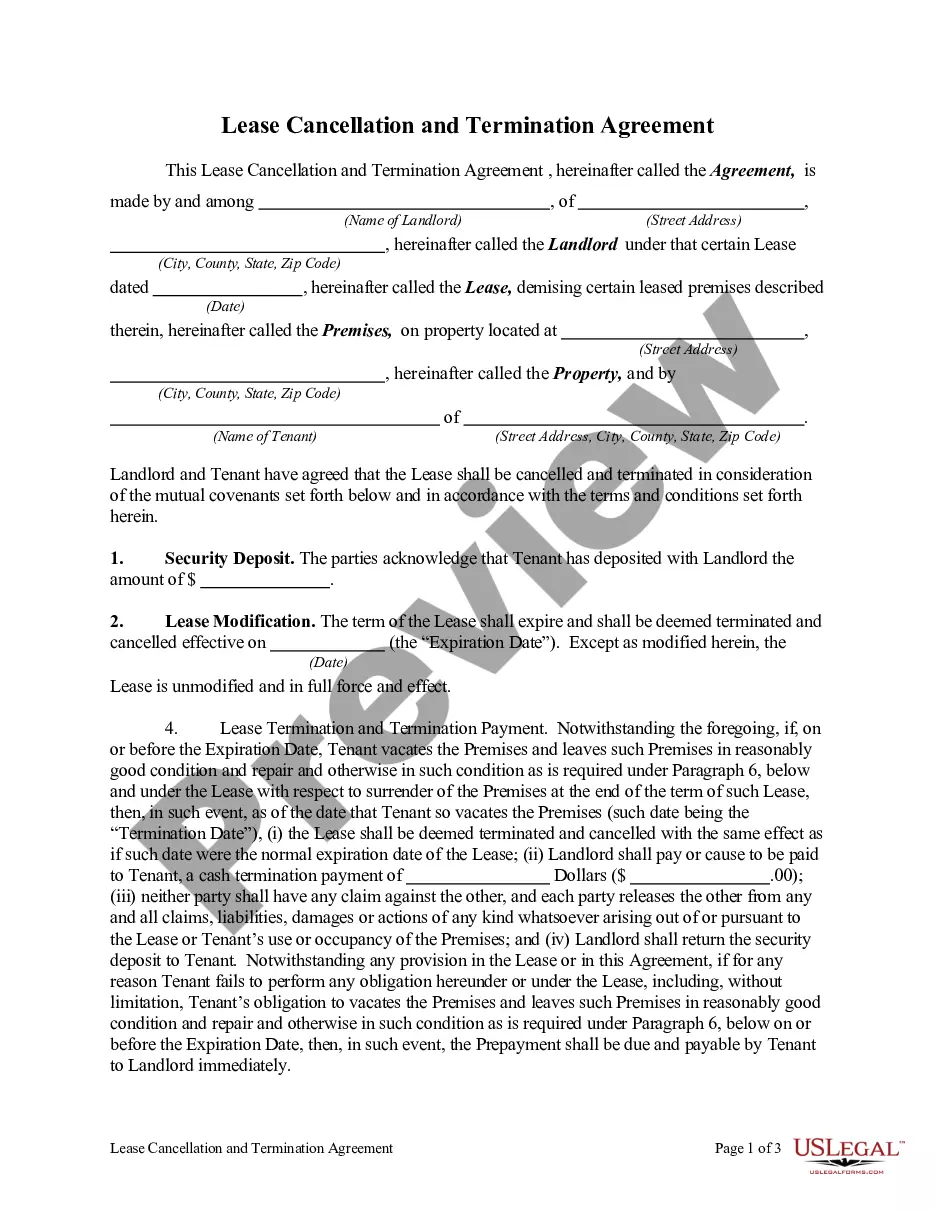

How to fill out Palm Beach Florida Trust Indenture And Agreement Between John Nuveen And Co., Inc. And Chase Manhattan Bank Regarding Terms And Conditions For Nuveen Tax Free Unit Trust, Series 1140?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Palm Beach Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any activities related to paperwork completion straightforward.

Here's how to purchase and download Palm Beach Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140.

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the legality of some records.

- Check the similar forms or start the search over to locate the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and purchase Palm Beach Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Palm Beach Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140, log in to your account, and download it. Of course, our platform can’t take the place of an attorney completely. If you need to cope with an extremely difficult situation, we advise getting an attorney to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-compliant documents effortlessly!