The Bexar Texas Shareholders Agreement is a legally binding document that outlines the rights, obligations, and responsibilities of shareholders in a company based in Bexar County, Texas. This agreement is vital for companies seeking to ensure a smooth and efficient operation by establishing rules and regulations governing shareholder interactions and decision-making processes. The Bexar Texas Shareholders Agreement covers several key aspects such as the allocation of shares, voting rights, dividend distribution, decision-making procedures, transfer of shares, dispute resolution mechanisms, and confidentiality provisions. By addressing these essential elements, the agreement promotes mutual understanding, transparency, and fairness among shareholders, helping to avoid potential conflicts and disputes. There are various types of Bexar Texas Shareholders Agreements tailored to meet the unique requirements and preferences of different companies. These include: 1. Basic Shareholders Agreement: This agreement provides a general framework for shareholders, specifying provisions related to share allocations, voting rights, and dividend distributions. 2. Veto Shareholders Agreement: This type of agreement grants certain shareholders veto power over significant corporate decisions. It ensures that specific actions cannot be taken without the consent of the veto shareholders, safeguarding their interests and influence within the company. 3. Preemption Shareholders Agreement: A pre-emption agreement allows existing shareholders to have the first right of refusal when new shares are issued or existing shares are sold. This ensures that shareholders have the opportunity to maintain their proportional ownership in the company. 4. Drag-Along Shareholders Agreement: In this agreement, minority shareholders are obliged to sell their shares if a majority of shareholders decide to sell their stakes to a third party. This provision facilitates the smooth sale of a company by minimizing obstacles that may arise from dissenting shareholders. 5. Tag-Along Shareholders Agreement: The tag-along agreement grants minority shareholders the right to join a sale of a majority shareholder's stake to a third party. This protects the interests of minority shareholders by ensuring they have the option to sell their shares on the same terms and conditions as the majority shareholder. It is essential for companies in Bexar County, Texas, to engage legal professionals experienced in corporate law when drafting or reviewing their Shareholders Agreement. These professionals can help customize the agreement to suit the specific needs and circumstances of the company, ensuring comprehensive protection for the rights and interests of all shareholders involved.

Bexar Texas Shareholders Agreement

Description

How to fill out Bexar Texas Shareholders Agreement?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Bexar Shareholders Agreement, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Bexar Shareholders Agreement from the My Forms tab.

For new users, it's necessary to make several more steps to get the Bexar Shareholders Agreement:

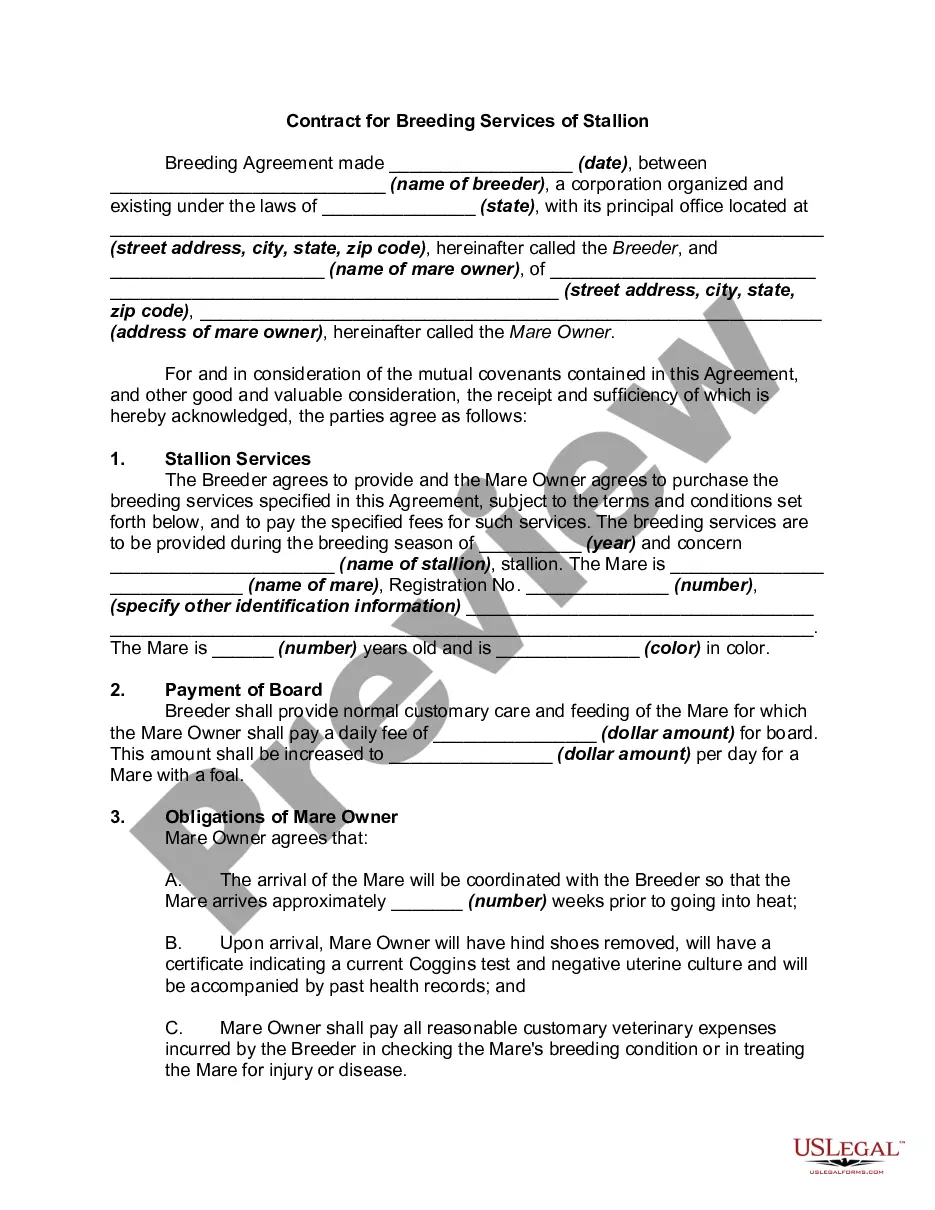

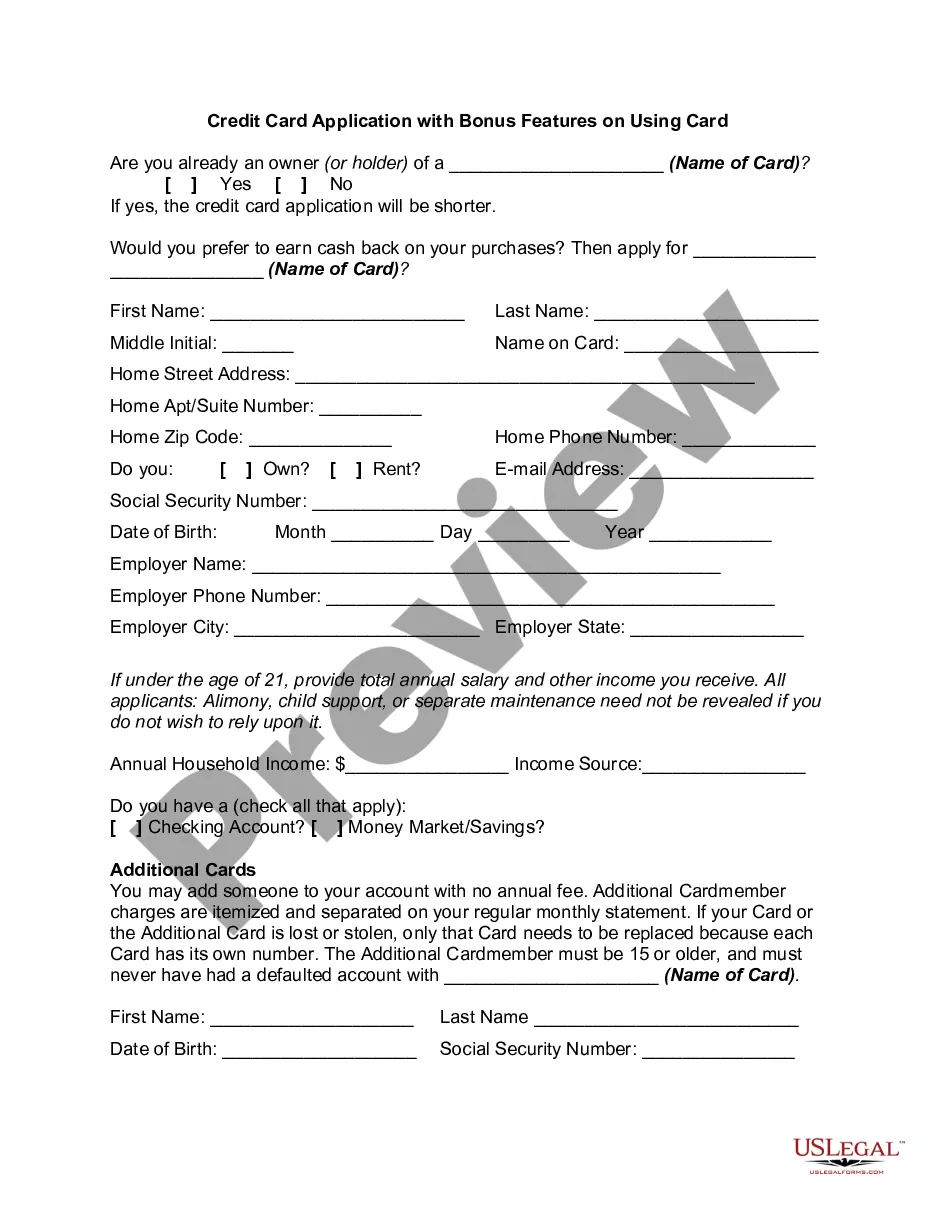

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!