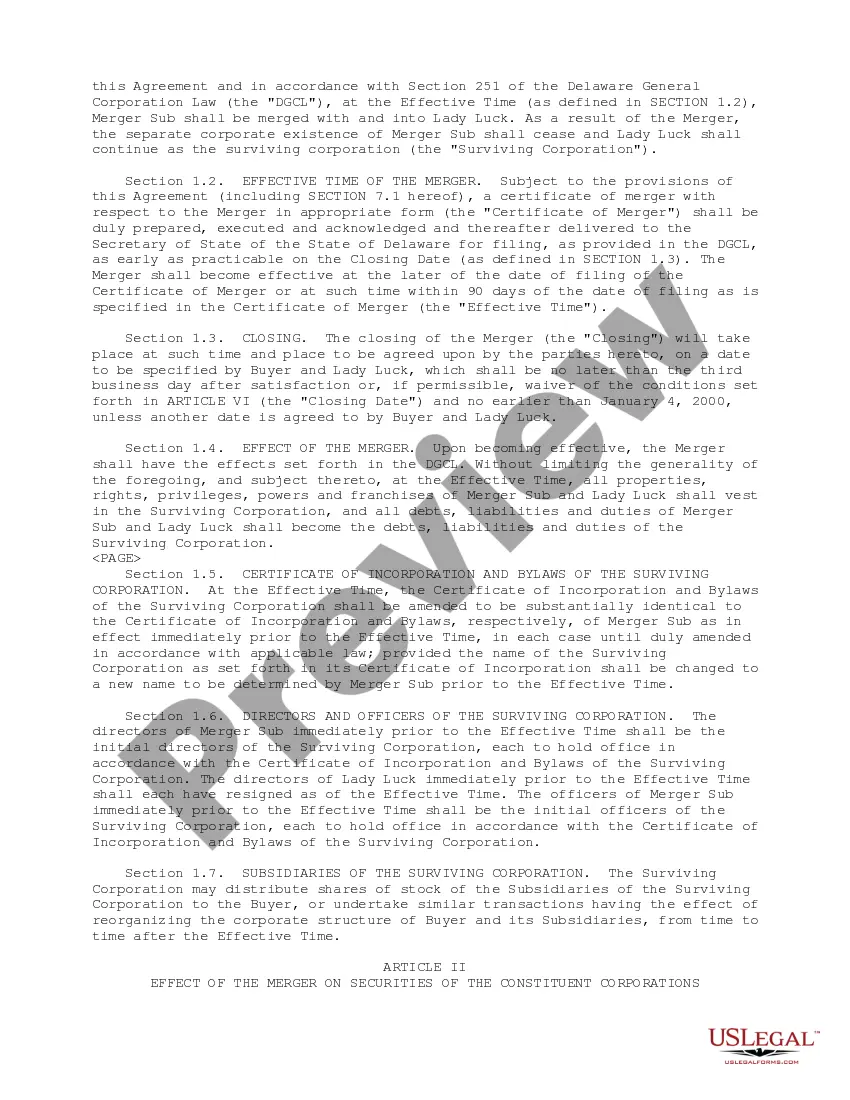

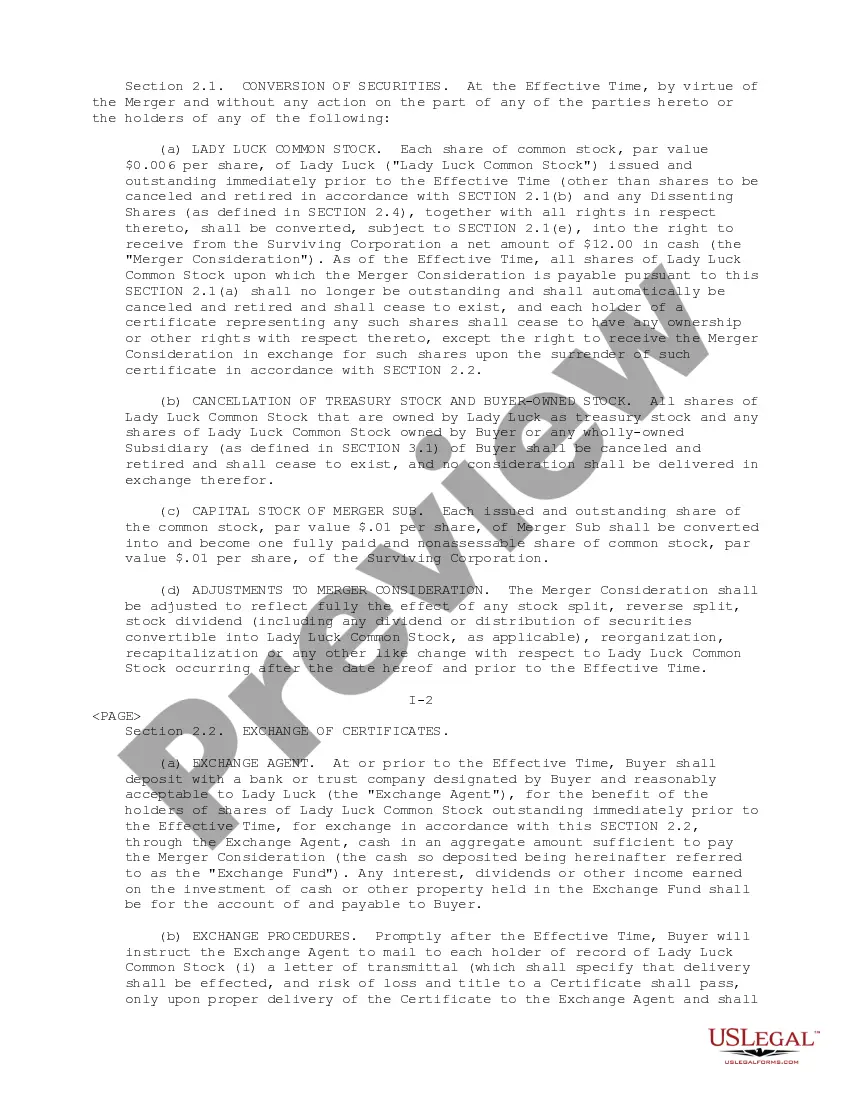

The Hennepin Minnesota Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation is an agreement that outlines the consolidation of these three entities in a strategic merger. This merger aims to combine the expertise and resources of Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation to create a stronger and more competitive gaming entity. The Hennepin Minnesota Plan of Merger involves various steps and considerations. Firstly, it entails a comprehensive evaluation and analysis of the financial and operational aspects of each company involved. This assessment helps to identify synergies and potential benefits that can be derived from combining forces. Furthermore, the plan outlines the legal and regulatory requirements that need to be met for the merger to be approved. This includes obtaining the necessary approvals from governing bodies and ensuring compliance with local, state, and federal laws. The Hennepin Minnesota Plan of Merger also encompasses a detailed strategy for integrating the operations and management of the three companies. It includes provisions for merging various departments and functions, such as finance, marketing, human resources, and technology. Additionally, it addresses any potential issues related to culture, leadership, and employee integration, aiming to ensure a smooth transition for all stakeholders involved. This plan of merger recognizes the importance of maintaining positive relationships with stakeholders, including shareholders, employees, customers, and the local community. It emphasizes open and transparent communication throughout the merger process to ensure that all parties are well-informed and have their concerns addressed. Benefits that can be achieved through the Hennepin Minnesota Plan of Merger include increased market share, enhanced economies of scale, amplified operational efficiency, and a stronger financial position. Moreover, the merger can provide the opportunity to expand into new markets and diversify the range of gaming offerings, hence fostering growth and innovation within the industry. The Hennepin Minnesota Plan of Merger is an essential strategy for Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation to combine their strengths and maximize their potential. Through this merger, they can create a unified and formidable presence in the gaming industry. Different types or variations of the Hennepin Minnesota Plan of Merger for Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation may include specific provisions tailored to the unique circumstances of each merger. For example, if the companies operate in different geographic locations or have distinct business models, the plan may need to address specific integration challenges. Additionally, there may be variations in the terms and conditions of the merger, such as the exchange ratio of shares or the appointment of key executives in the combined entity. Each merger plan is unique and tailored to the specific circumstances and objectives of the companies involved.

Hennepin Minnesota Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation

Description

How to fill out Hennepin Minnesota Plan Of Merger Between Isle Of Capri Casinos, Inc., Isle Merger Corporation And Lady Luck Gaming Corporation?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Hennepin Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find detailed materials and tutorials on the website to make any activities related to paperwork completion simple.

Here's how to find and download Hennepin Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some records.

- Examine the similar document templates or start the search over to find the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and buy Hennepin Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Hennepin Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation, log in to your account, and download it. Needless to say, our website can’t replace a legal professional completely. If you have to cope with an extremely complicated case, we advise using the services of a lawyer to check your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-specific documents with ease!