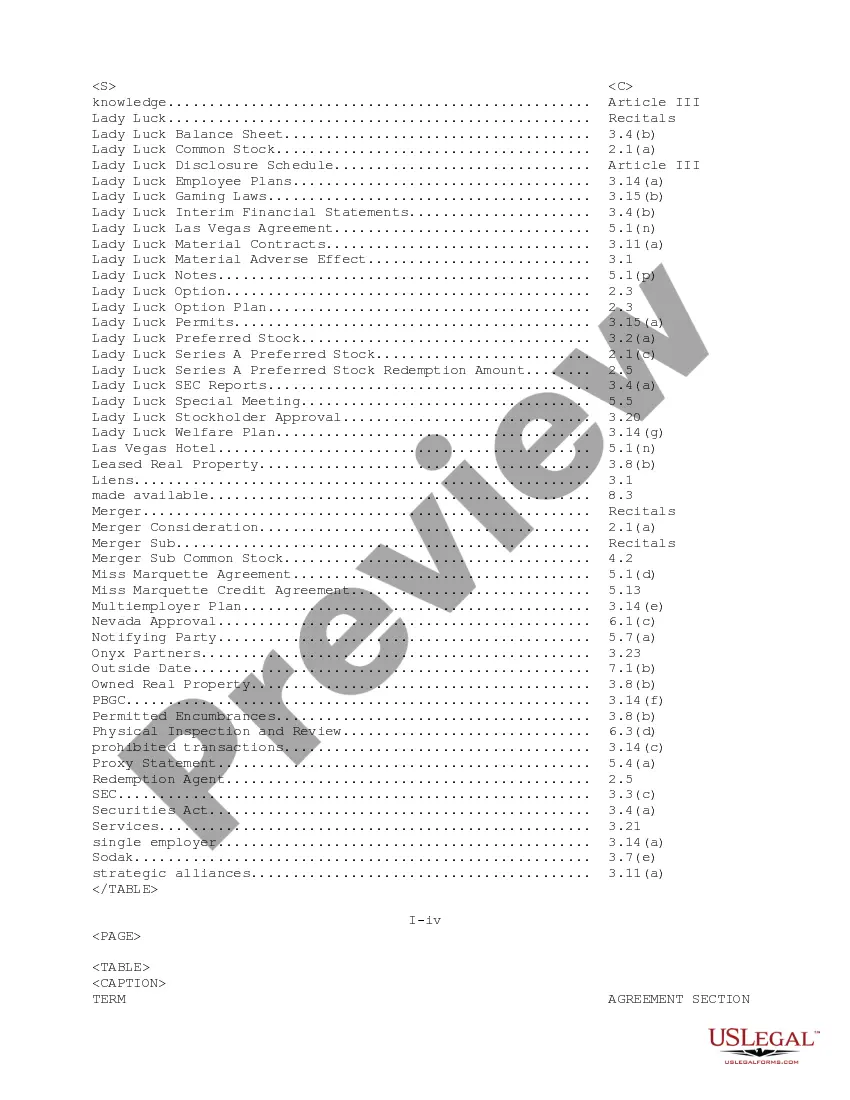

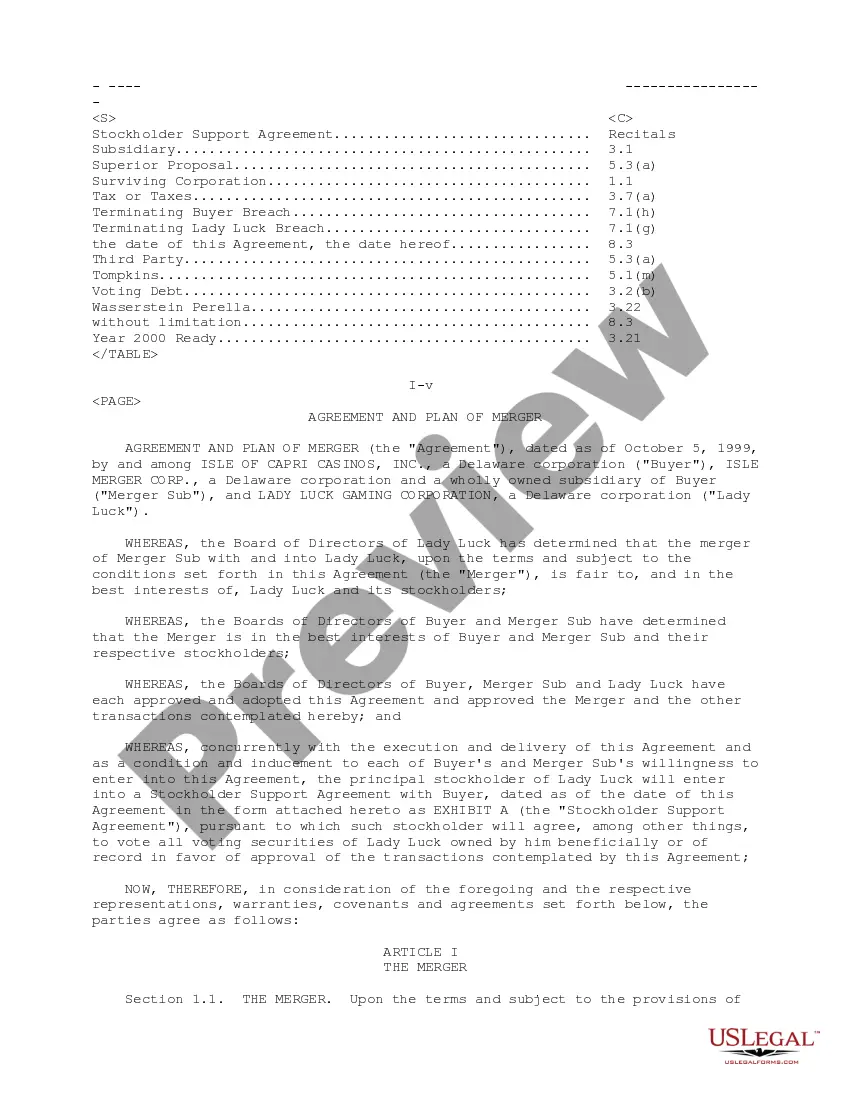

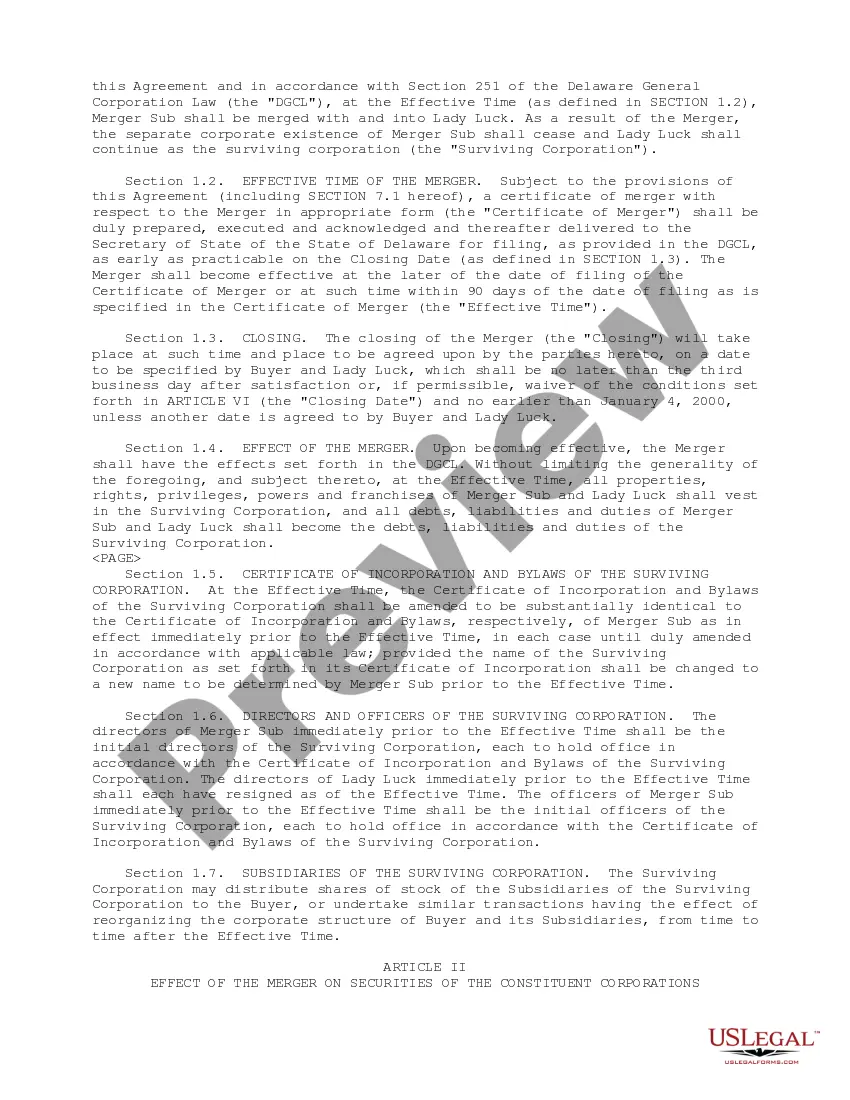

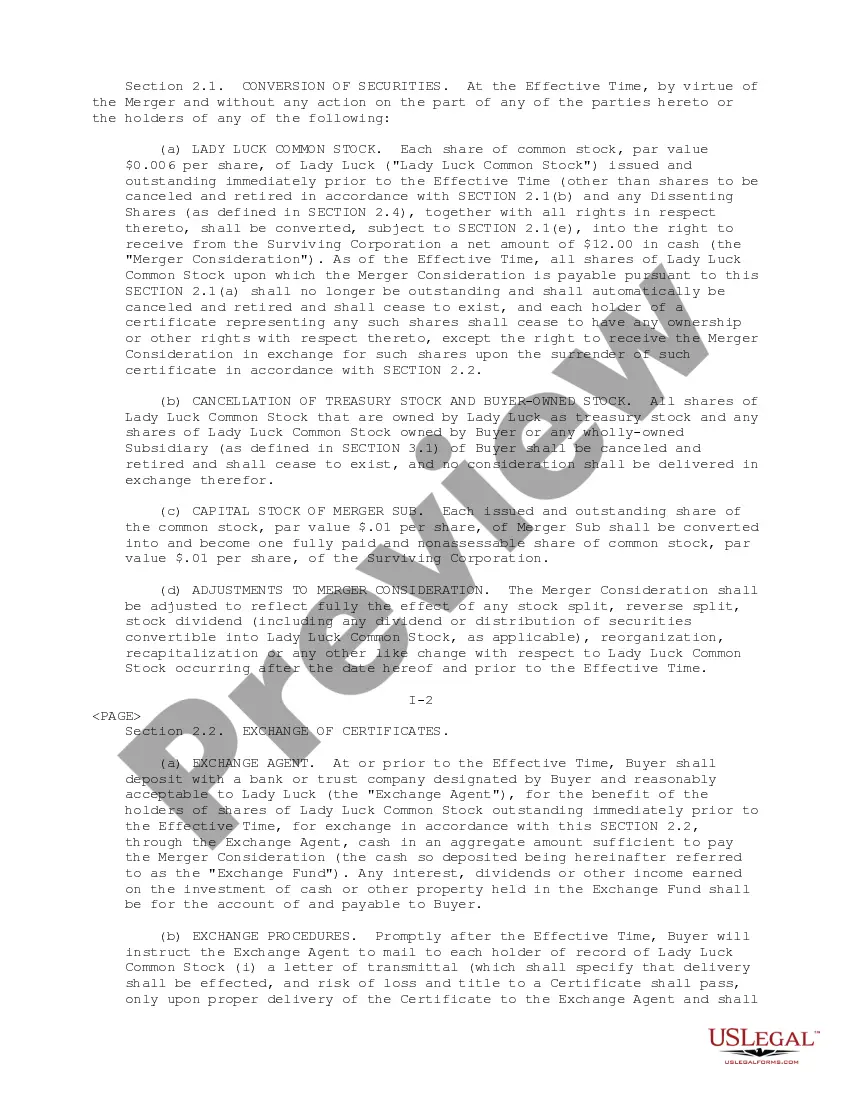

The Oakland Michigan Plan of Merger refers to a specific merger agreement that takes place between Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation. This plan outlines the legal and financial structure of the merger and provides a detailed description of the transaction. Keywords: Oakland Michigan, Plan of Merger, Isle of Capri Casinos, Isle Merger Corporation, Lady Luck Gaming Corporation. The Oakland Michigan Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation is a strategic move aimed at consolidating the operations and resources of these entities to enhance their competitive advantage and market position in the gaming industry. This merger plan encompasses all the crucial aspects involved in merging these three prominent corporations. The plan highlights the legal terms, financial arrangements, and regulatory requirements necessary for the successful execution of the merger. It lays out the framework for integrating the operations, assets, liabilities, and employees of Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation. The Oakland Michigan Plan of Merger not only addresses the legal and financial aspects but also considers the broader implications and potential benefits of the merger. It focuses on leveraging the combined expertise, assets, and market reach of the three corporations to create synergistic effects and maximize shareholder value. The plan may also outline the specific objectives, strategies, and expected milestones to be achieved post-merger. Different types or variations of the Oakland Michigan Plan of Merger between these entities may include: 1. Equity Merger: This type of merger involves the exchange of shares between the merging companies. The Oakland Michigan Plan of Merger may outline the share-swap ratios and other relevant details regarding the allocation of equity in the new entity. 2. Asset Merger: In this type of merger, one company acquires the assets and liabilities of the other(s). The Oakland Michigan Plan of Merger might detail the valuation and transfer of specific assets, such as real estate properties or intellectual property rights. 3. Statutory Merger: This form of merger occurs when one company absorbs another, resulting in the target company's dissolution. The Oakland Michigan Plan of Merger would specify the legal procedures and formalities for the statutory merger, such as obtaining approvals from relevant authorities and shareholders. Regardless of the specific type of merger, the Oakland Michigan Plan of Merger serves as a guiding document that sets forth the terms, conditions, and procedures for combining the operations and resources of Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation. It aims to ensure a smooth transition, synergies, and long-term success after the merger.

Oakland Michigan Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation

Description

How to fill out Oakland Michigan Plan Of Merger Between Isle Of Capri Casinos, Inc., Isle Merger Corporation And Lady Luck Gaming Corporation?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Oakland Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. Aside from the Oakland Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your Oakland Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Oakland Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!