The Maricopa Arizona Stockholder Support Agreement is a legally binding contract between Andrew H. Tompkins and Isle of Capri Casinos, Inc., which outlines the terms and conditions for stockholder support in relation to the operations and affairs of the company. This agreement is crucial in ensuring transparency, accountability, and shareholder protection. Andrew H. Tompkins, as a stockholder, agrees to support Isle of Capri Casinos, Inc. by promoting its interests, participating in voting activities, and providing ongoing support in accordance with the provisions of the agreement. In return, the company guarantees certain rights and privileges to the stockholder. Some key elements covered in the Maricopa Arizona Stockholder Support Agreement include: 1. Shareholder Voting: The agreement may specify the stockholder's commitment to voting in favor of particular resolutions, mergers, acquisitions, or major strategic decisions proposed by the company. This ensures unity among stockholders and helps in achieving corporate objectives. 2. Board Representation: If agreed upon, the agreement may grant Andrew H. Tompkins the right to represent the stockholders' interests by holding a seat on the company's board of directors. This enables direct involvement in decision-making processes and enhancing corporate governance. 3. Non-Compete and Non-Disclosure Obligations: The stockholder may be required to agree to non-compete clauses, preventing them from engaging in activities that directly compete with Isle of Capri Casinos, Inc. Furthermore, the agreement may include strict provisions regarding the disclosure of confidential information, protecting the company's trade secrets and proprietary information. 4. Liquidation, Acquisition, or Sale of Shares: In the event of the liquidation, acquisition, or sale of shares of Isle of Capri Casinos, Inc., the agreement may outline the rights of Andrew H. Tompkins as a stockholder. This can include determining the price of shares, buyout options, or any other pre-determined conditions to safeguard the stockholder's interests. 5. Term and Termination: The agreement will specify the initial term and any renewal periods, as well as the circumstances under which it may be terminated or amended. This allows for flexibility while ensuring ongoing obligations between the parties. It is important to note that variations of the Maricopa Arizona Stockholder Support Agreement may exist, tailored to specific situations, such as different stockholder classes or specific project collaborations. However, the core purpose remains the same — to establish a mutually beneficial relationship between stockholders and Isle of Capri Casinos, Inc., promoting transparency, and protecting the rights of all parties involved.

Maricopa Arizona Stockholder Support Agreement between Andrew H. Tompkins and Isle of Capri Casinos, Inc.

Description

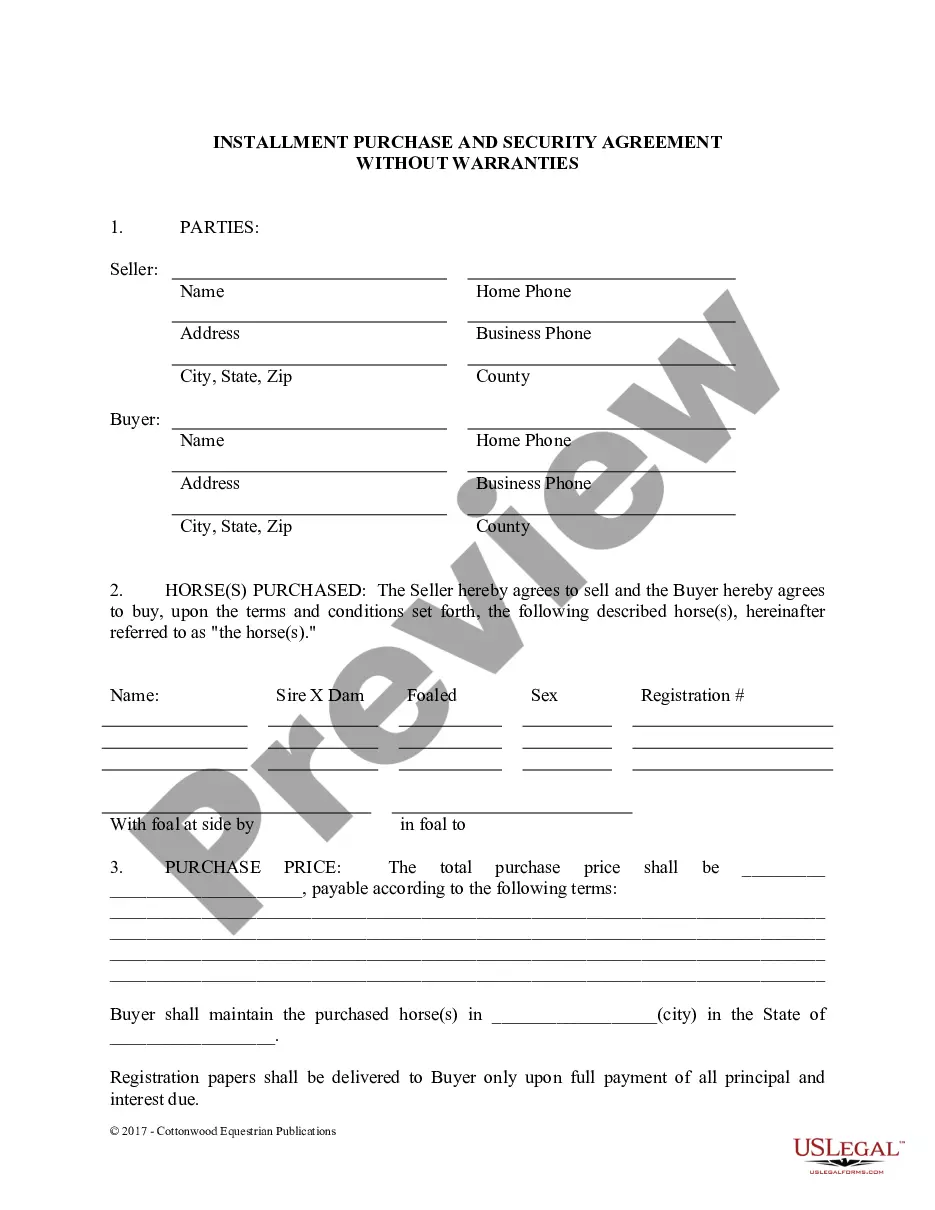

How to fill out Maricopa Arizona Stockholder Support Agreement Between Andrew H. Tompkins And Isle Of Capri Casinos, Inc.?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Maricopa Stockholder Support Agreement between Andrew H. Tompkins and Isle of Capri Casinos, Inc., it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the current version of the Maricopa Stockholder Support Agreement between Andrew H. Tompkins and Isle of Capri Casinos, Inc., you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Stockholder Support Agreement between Andrew H. Tompkins and Isle of Capri Casinos, Inc.:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Maricopa Stockholder Support Agreement between Andrew H. Tompkins and Isle of Capri Casinos, Inc. and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!