The Bronx is one of the five boroughs of New York City, located in the state of New York. It is known for its rich cultural diversity, vibrant neighborhoods, and historical landmarks. With its own unique charm, the Bronx offers a plethora of attractions and activities for residents and tourists alike. Now, let's move on to the Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation, and Sound view Technology Group, Inc. In mergers and acquisitions, a plan of merger outlines the terms and conditions agreed upon by the involved parties. In this case, the merger plan pertains to the consolidation of WIT Capital Group, Inc., WIS Merger Corporation, and Sound view Technology Group, Inc. This merger aims to combine the strengths, resources, and technologies of these three entities operating in the financial and technology sectors. By merging, it is expected that the resulting company will create synergies, enhance financial capabilities, and improve market positioning. The plan of merger encompasses various aspects, including the exchange ratio of shares, governance structure, operational integration, and financial arrangements. It outlines the steps and procedures to be followed for a successful merger, ensuring compliance with legal and regulatory requirements. In terms of different types of mergers, there are primarily two common categories: horizontal mergers and vertical mergers. However, without explicit information on the nature of the merger between WIT Capital Group, Inc., WIS Merger Corporation, and Sound view Technology Group, Inc., it is difficult to determine the specific classification. Horizontal mergers typically involve companies operating in the same industry or market, while vertical mergers involve entities from different stages of the supply chain. Ultimately, the Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation, and Sound view Technology Group, Inc. represents a strategic move to leverage synergies, expand market presence, and enhance financial performance in the financial and technology sectors. This merger holds the potential to combine expertise, resources, and capabilities, ultimately benefiting stakeholders and contributing to the growth of the business.

Bronx New York Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.

Description

How to fill out Bronx New York Plan Of Merger Between WIT Capital Group, Inc., WIS Merger Corporation And Soundview Technology Group, Inc.?

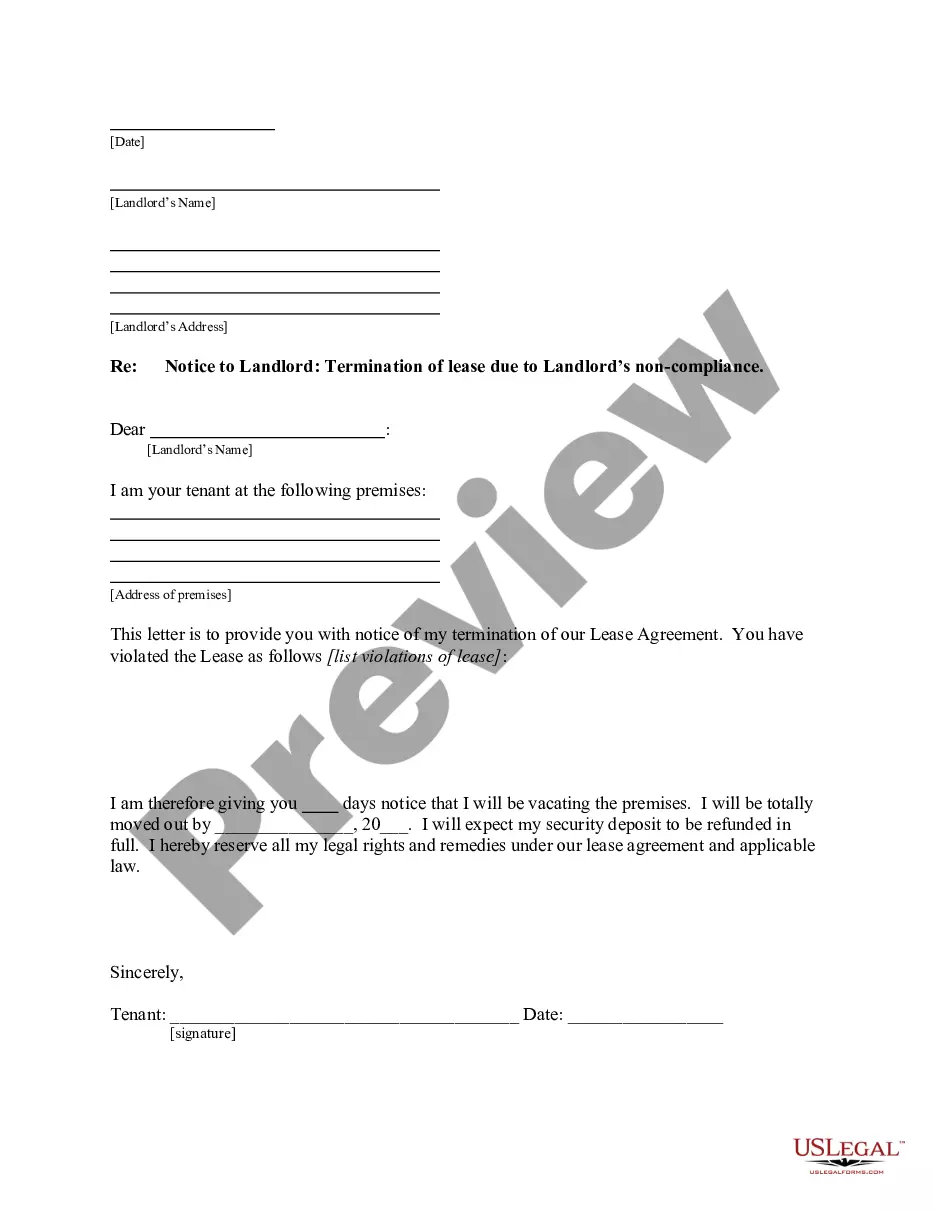

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from the ground up, including Bronx Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc., with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find detailed resources and guides on the website to make any activities associated with document completion straightforward.

Here's how to purchase and download Bronx Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc..

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Check the related forms or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Bronx Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc..

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Bronx Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc., log in to your account, and download it. Of course, our website can’t replace an attorney completely. If you need to cope with an exceptionally difficult situation, we advise getting an attorney to examine your form before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant documents with ease!