The Cook Illinois Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation, and Sound view Technology Group, Inc. is a comprehensive strategy that outlines the process of combining these three entities into a single cohesive organization. This plan serves as a blueprint for the merger, ensuring a smooth transition and maximizing the benefits for all parties involved. Keywords: Cook Illinois Plan of Merger, WIT Capital Group, WIS Merger Corporation, Sound view Technology Group, comprehensive strategy, combining, cohesive organization, smooth transition, maximizing benefits. 1. Overview of the Cook Illinois Plan of Merger: The Cook Illinois Plan of Merger details the intentions, objectives, and steps required to combine WIT Capital Group, WIS Merger Corporation, and Sound view Technology Group into one unified entity. 2. Merger Objectives: The plan outlines the primary goals of the merger, including enhancing market presence, diversifying business portfolios, improving operational efficiency, and achieving synergies that will lead to increased shareholder value. 3. Organizational Framework: The Cook Illinois Plan of Merger establishes the structural foundations of the new entity, defining the roles and responsibilities of key individuals and outlining the management framework. It ensures a seamless integration of the workforce and clarifies reporting relationships. 4. Financial Considerations: This plan addresses the financial aspects of the merger, including an evaluation of the financial statements of each company involved and the calculation of exchange ratios for stockholders. It also determines the post-merger capitalization structure and defines the distribution of resources. 5. Regulatory Compliance: The Cook Illinois Plan of Merger outlines the necessary legal and regulatory requirements for approval of the merger, such as obtaining necessary consents from relevant authorities, compliance with securities laws, and ensuring adherence to corporate governance standards. 6. Integration of Operations: The plan addresses crucial operational aspects, including the integration of systems, processes, and technologies. It identifies potential synergies and efficiency improvements that may arise from streamlining operations, harmonizing policies, and leveraging shared resources. 7. Culture and Human Resources: Recognizing the importance of merging cultures and talent retention, the Cook Illinois Plan of Merger focuses on designing a comprehensive strategy to ensure smooth alignment, personnel integration, and effective communication during the transitional period. 8. Timeline and Milestones: This plan establishes a timeline with key milestones and deadlines for each stage of the merger process. It ensures a structured and well-managed transition, minimizing disruptions to ongoing business operations. 9. Communication and Stakeholder Engagement: The Cook Illinois Plan of Merger emphasizes the need for effective communication with all stakeholders, including shareholders, employees, customers, and suppliers. A well-executed communication plan helps manage expectations and ensures transparency throughout the merger. 10. Post-Merger Evaluation and Monitoring: Following completion of the merger, the plan defines mechanisms for evaluating post-merger performance and ensuring ongoing monitoring of key indicators. It sets the stage for continuous improvement and adjustment of strategies to maximize the expected benefits. In summary, the Cook Illinois Plan of Merger between WIT Capital Group, WIS Merger Corporation, and Sound view Technology Group is a detailed roadmap that encompasses various aspects of the merger process. By integrating these three entities effectively, it aims to create one strong, competitive organization that provides enhanced value to shareholders and stakeholders.

Cook Illinois Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.

Description

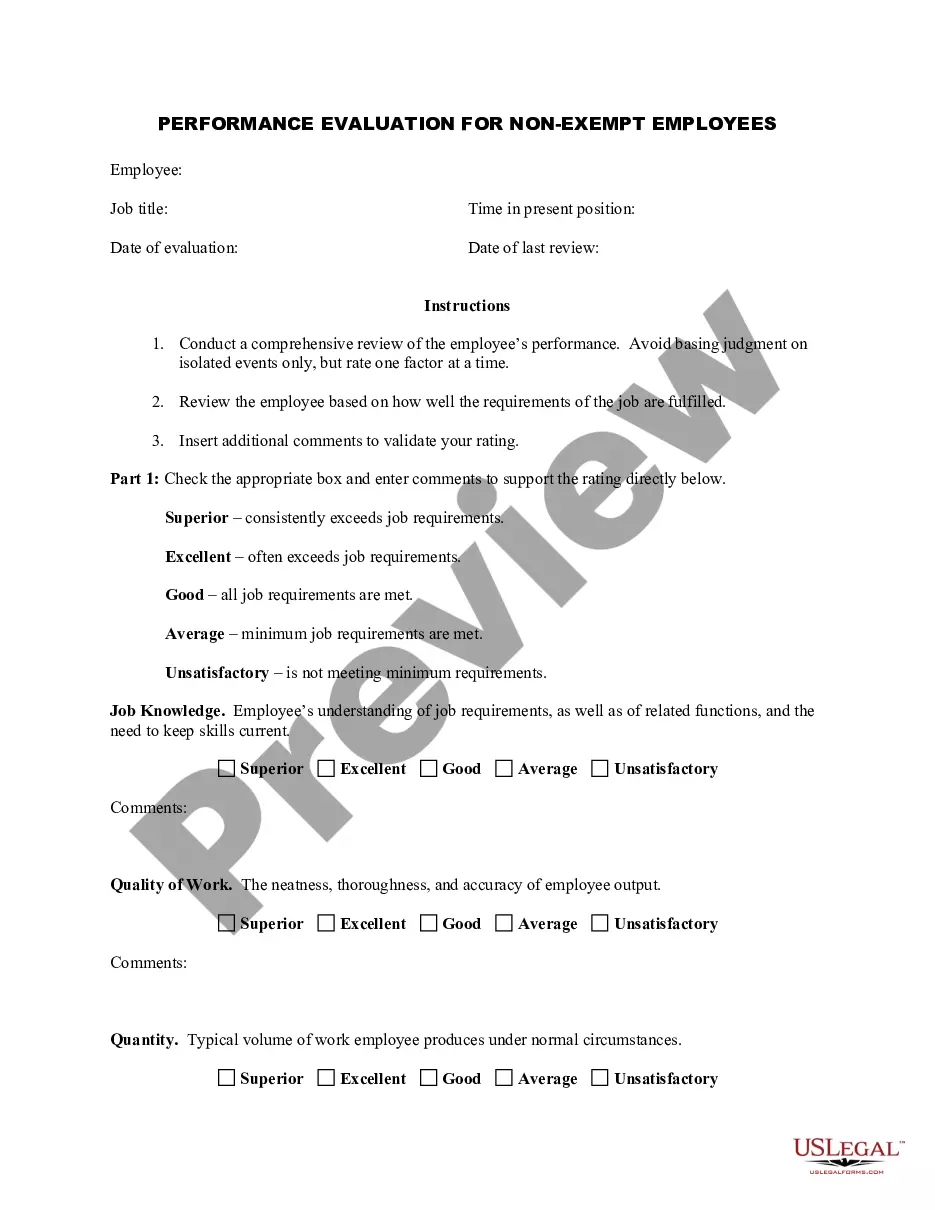

How to fill out Cook Illinois Plan Of Merger Between WIT Capital Group, Inc., WIS Merger Corporation And Soundview Technology Group, Inc.?

Whether you plan to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Cook Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc. is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Cook Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.. Adhere to the guide below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Cook Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc. in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!