The Suffolk New York Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Sound view Technology Group, Inc. is a significant strategic move that aims to combine the resources, expertise, and market presence of these three entities. The merger plan holds immense potential to drive growth, enhance market reach, and create synergies in the financial and technology sectors. Suffolk New York, known for its diverse economic landscape and thriving business community, provides a fitting backdrop for this ambitious merger. With its strategic location, skilled workforce, and robust infrastructure, Suffolk New York offers a conducive environment for businesses to flourish. The merger is expected to leverage these advantages and further accelerate the growth trajectory of the newly formed entity. The Plan of Merger outlines the terms and conditions that will govern the integration of WIT Capital Group, Inc., WIS Merger Corporation, and Sound view Technology Group, Inc. It encompasses various aspects, including the valuation of each entity, the exchange ratio of shares, and the composition of the new management team. By carefully considering these elements, the plan aims to ensure a seamless transition and a solid foundation for future success. As for the types of mergers involved, the Suffolk New York Plan of Merger between the aforementioned entities could be categorized as horizontal and vertical mergers. A horizontal merger refers to the combination of two or more companies operating in the same industry, such as WIT Capital Group, Inc., and Sound view Technology Group, Inc. This type of merger often results in market consolidation and increased competitiveness. On the other hand, a vertical merger involves the integration of companies operating at different stages of the same supply chain or industry. WIS Merger Corporation, aiming to build a comprehensive ecosystem in the financial and technology sectors, assumes a crucial role in this merger plan by facilitating vertical integration between WIT Capital Group, Inc. and Sound view Technology Group, Inc. Key success factors for this merger plan include effective post-merger integration strategies, seamless coordination between different teams, and efficient utilization of technological and financial resources. By leveraging the strengths of each entity and aligning their goals, the merged organization aims to achieve operational efficiencies, enhance customer satisfaction, and drive sustainable growth in the ever-evolving financial and technology sectors. In conclusion, the Suffolk New York Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation, and Sound view Technology Group, Inc. is an exciting endeavor that holds immense potential for the entities involved. This strategic move, encompassing horizontal and vertical integration, aims to create synergies, enhance market reach, and drive growth in the financial and technology sectors. By carefully executing the merger plan and leveraging the strengths of each entity, the newly formed organization aspires to become a leading player in its industry.

Suffolk New York Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.

Description

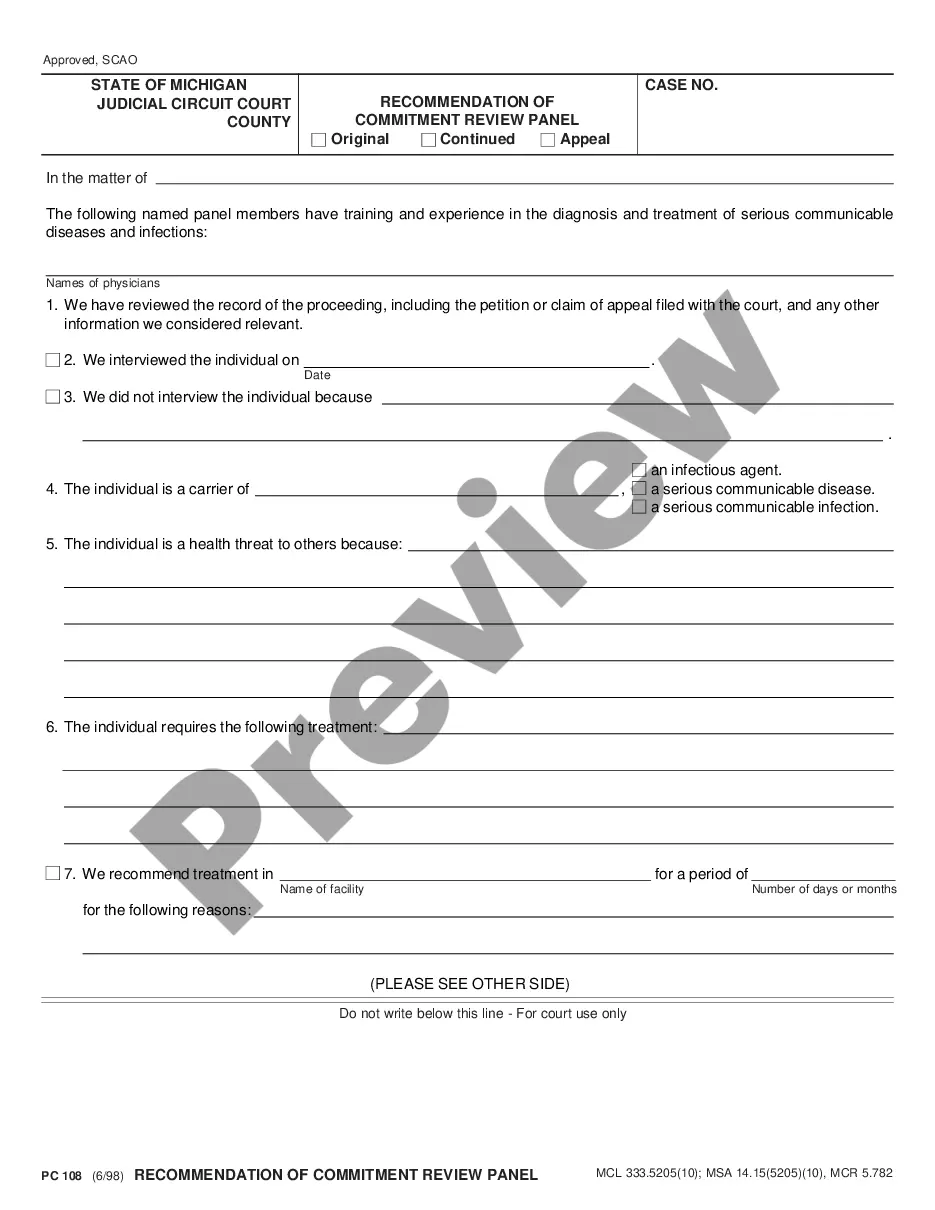

How to fill out Suffolk New York Plan Of Merger Between WIT Capital Group, Inc., WIS Merger Corporation And Soundview Technology Group, Inc.?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Suffolk Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc., it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Therefore, if you need the latest version of the Suffolk Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc., you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Suffolk Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc. and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!