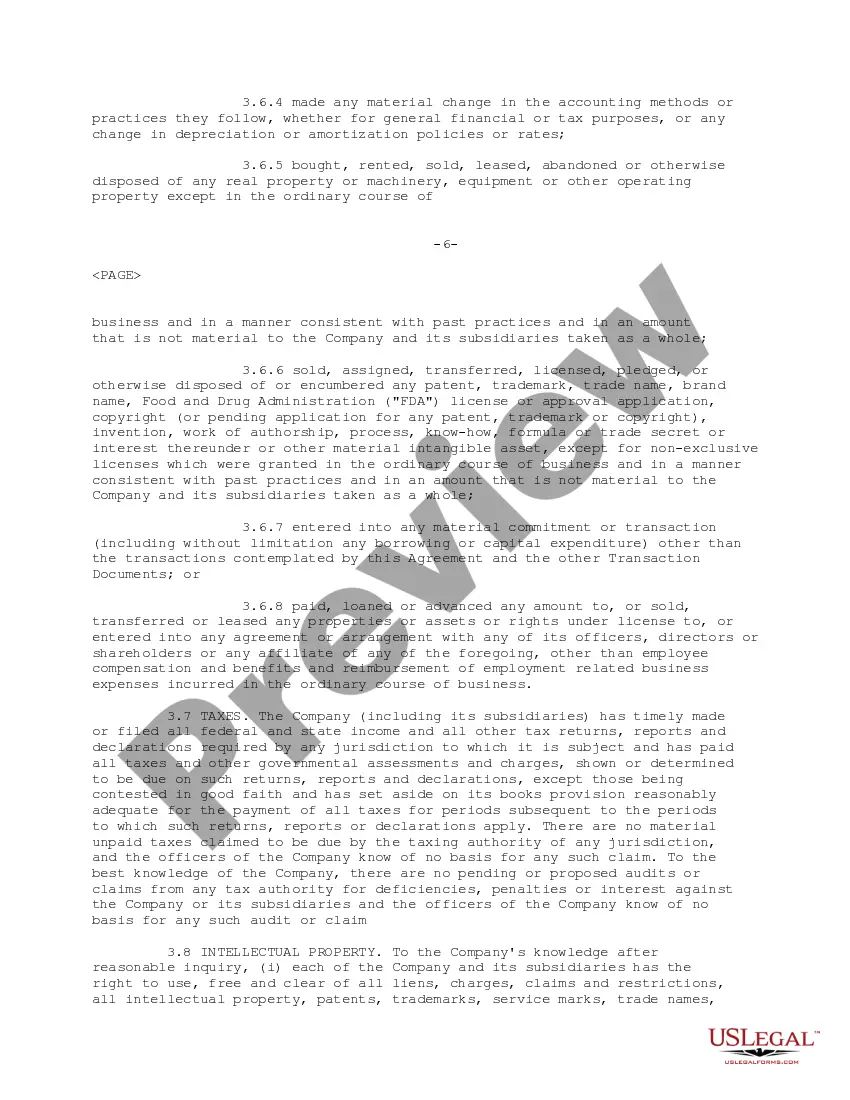

The Phoenix Arizona Sample Stock and Option Purchase Agreement between Supermen, Inc. and Abbott Laboratories, Inc. is a legally binding document that outlines the terms and conditions for the authorization and sale of securities between the two companies. This agreement is crucial for governing the purchase of stocks and options, ensuring compliance with applicable regulations and protecting the rights of both parties. Key provisions often included in this type of agreement may cover the following aspects: 1. Parties involved: The agreement will clearly identify the participating parties, Supermen, Inc. and Abbott Laboratories, Inc., establishing their roles, responsibilities, and legal representation. 2. Definitions and interpretations: The document will include a section defining various terms and interpretations crucial for understanding the agreement. 3. Authorization and sale: The agreement will detail the authorized securities to be purchased, such as stocks and options, along with their respective quantities, prices, and terms. It will also outline any restrictions or limitations on the sale or transfer of these securities. 4. Purchase price and payment terms: The agreement will specify the purchase price for the securities, their currency, and the agreed-upon payment terms, including any installment plans or conditions for upfront payments. 5. Representations and warranties: Both parties will typically provide representations and warranties related to their legal capacity, authority to enter into the agreement, accuracy of information, and compliance with laws and regulations. 6. Closing conditions: This section outlines the conditions that must be fulfilled by both parties to complete the transaction, including any regulatory approvals, consents, or shareholder approvals required. 7. Indemnification and liability: The agreement will establish the indemnification obligations of each party, addressing any potential losses, damages, or liabilities resulting from breaches of the agreement or misrepresentations by either party. 8. Governing law and jurisdiction: The document will specify the governing law under which the agreement will be interpreted and any dispute resolution mechanisms, such as arbitration or litigation, along with the agreed-upon jurisdiction. 9. Confidentiality and non-disclosure: The agreement may include provisions to safeguard the confidential and proprietary information of both parties, restricting its use or disclosure to third parties. It's important to note that the actual content and structure of the agreement may vary based on the specific needs of the parties involved, applicable laws, and industry practices. Other variations of the Phoenix Arizona Sample Stock and Option Purchase Agreement might include provisions related to convertible securities, preferred stock, or specific rights given to certain categories of stockholders. However, these variations would still generally cover similar topics as mentioned above, with the necessary modifications specific to the type of securities being dealt with.

Phoenix Arizona Sample Stock and Option Purchase Agreement between Supergen, Inc. and Abbott Laboratories, Inc. regarding authorization and sale of securities

Description

How to fill out Phoenix Arizona Sample Stock And Option Purchase Agreement Between Supergen, Inc. And Abbott Laboratories, Inc. Regarding Authorization And Sale Of Securities?

If you need to get a trustworthy legal document supplier to find the Phoenix Sample Stock and Option Purchase Agreement between Supergen, Inc. and Abbott Laboratories, Inc. regarding authorization and sale of securities, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can select from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of supporting materials, and dedicated support make it easy to get and complete different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to look for or browse Phoenix Sample Stock and Option Purchase Agreement between Supergen, Inc. and Abbott Laboratories, Inc. regarding authorization and sale of securities, either by a keyword or by the state/county the form is intended for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Phoenix Sample Stock and Option Purchase Agreement between Supergen, Inc. and Abbott Laboratories, Inc. regarding authorization and sale of securities template and check the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less pricey and more affordable. Set up your first business, arrange your advance care planning, draft a real estate agreement, or execute the Phoenix Sample Stock and Option Purchase Agreement between Supergen, Inc. and Abbott Laboratories, Inc. regarding authorization and sale of securities - all from the convenience of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

In a stock purchase, the buyer purchases the entire company, including all assets and liabilities.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

A securities purchase agreement is an agreement for the purchase and sale of preferred stock securities to be used in connection with a private equity transaction, such as a growth equity investment in a private corporation.

The Stock Purchase Agreement generally includes the following key provisions, the parties, the agreement to sell, consideration, representations, warranties, and indemnities, pre-closing covenants, conditions precedent to closing, and restrictive covenants.

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

What is included in a stock purchase agreement? Your company's name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing. The transaction's date, time and location.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

Share Purchase Agreement Signing Requirements The Share Purchase Agreement needs to be signed by both the purchaser and seller of the shares. Before you put pen on paper, you want to review all the details and provisions for accuracy and your comfort level. It is not necessary to get the agreement notarized.

The Stock Purchase Agreement generally includes the following key provisions, the parties, the agreement to sell, consideration, representations, warranties, and indemnities, pre-closing covenants, conditions precedent to closing, and restrictive covenants.

Interesting Questions

More info

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.