The Clark Nevada Investor Rights Agreement is a legally binding document that outlines the rights and obligations of investors who purchase Series C Preferred Stock shares in Clark Nevada Corporation. This agreement is crucial for protecting the interests of investors and ensuring transparency and fairness in the investment process. The Clark Nevada Investor Rights Agreement sets out the basic terms of the investment, such as the number of Series C Preferred Stock shares being purchased, the price per share, and the total investment amount. It also contains provisions related to the payment schedule and any preferred dividends or conversion rights that may apply. One essential aspect of this agreement is the voting rights granted to investors. It outlines the procedures for voting on matters that directly impact the Series C Preferred Stock and any other matters that require the consent of the preferred stockholders. Additionally, the Clark Nevada Investor Rights Agreement covers the transferability of the Series C Preferred Stock. It may include provisions detailing any restrictions on transferring the shares to third parties, ensuring that the company's interests are protected and preventing unauthorized transfers that could impact the company's control. If there are different types of Clark Nevada Investor Rights Agreements relating to the purchase of Series C Preferred Stock shares, they may be classified based on specific details or variations in the terms. For example, they could be distinguished by the rights and privileges granted to investors, such as conversion rights, liquidation preferences, or participation rights in future financing rounds. Furthermore, different agreements may exist to accommodate investors with varying investment amounts or levels of involvement. For instance, there may be different agreements for lead investors, strategic investors, or angel investors, each tailored to their respective needs and expectations. In summary, the Clark Nevada Investor Rights Agreement is a crucial document that safeguards the interests of investors who purchase Series C Preferred Stock shares in Clark Nevada Corporation. It establishes the rights, obligations, and restrictions applicable to the investment, ensuring transparency and fair treatment for all parties involved.

Clark Nevada Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares

Description

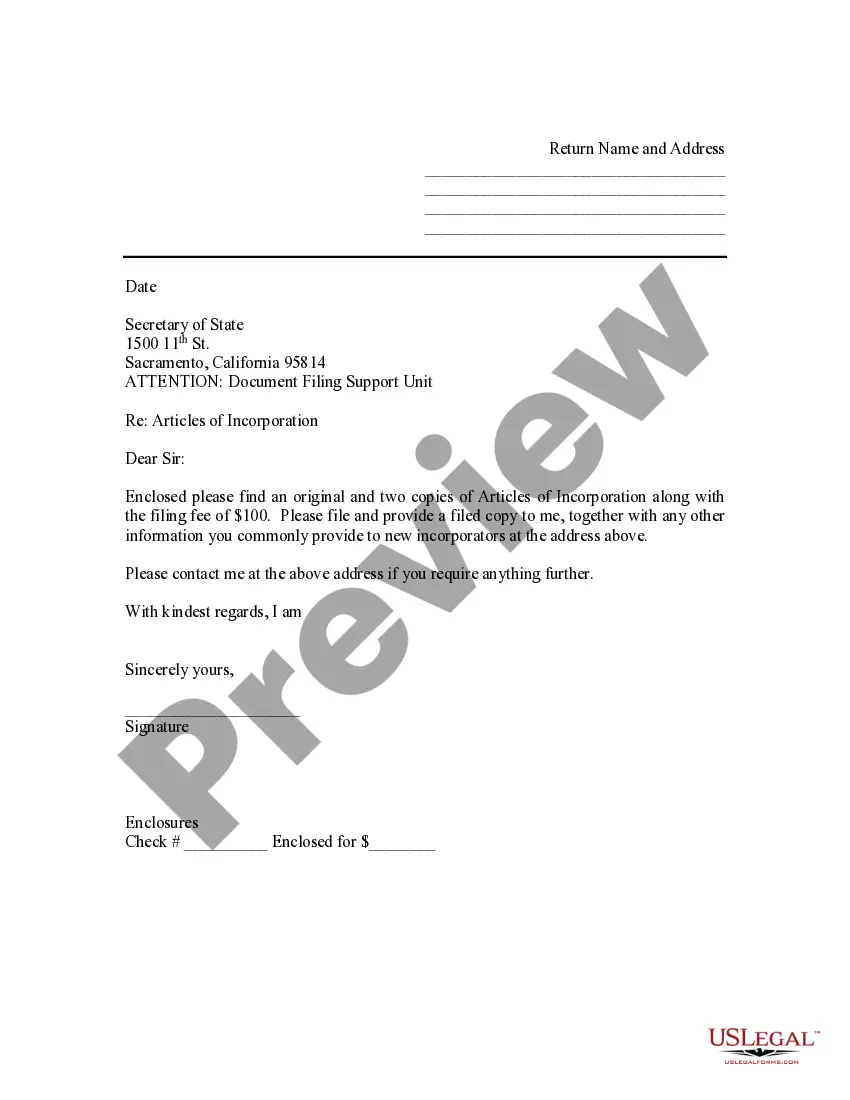

How to fill out Clark Nevada Investor Rights Agreement Regarding The Purchase Of Series C Preferred Stock Shares?

If you need to find a reliable legal form provider to find the Clark Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can select from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it easy to find and complete different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to look for or browse Clark Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares, either by a keyword or by the state/county the form is created for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Clark Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and select a subscription plan. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less costly and more affordable. Set up your first business, arrange your advance care planning, create a real estate agreement, or execute the Clark Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

At a minimum, you need to record the sale date, the name and address of the buyer, the number of shares sold and the price per share. Each stock certificate must have preferred written on it, have a unique certificate number and bear the corporate seal on the front.

Participating preferred stock is a type of preferred stock that gives the holder the right to receive dividends equal to the customarily specified rate that preferred dividends are paid to preferred shareholders, as well as an additional dividend based on some predetermined condition.

Companies typically issue preferred stock for one or more of the following reasons: To avoid increasing your debt ratios; preferred shares count as equity on your balance sheet. To pay dividends at your discretion. Because dividend payments are typically smaller than principal plus interest debt payments.

A venture capital (VC) term sheet is a statement of the proposed terms and conditions for a proposed investment. Most of the terms are non-binding, except for certain confidentiality and exclusivity rights. Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process.

An investment proposal should include the following preliminary information: Brief description of project. Sponsorship, management & technical assistance: Market & sales: Technical feasibility, manpower, raw material resources & environment: Investment requirements, project financing, and returns:

Write the Opening Recitals of the Investment Contract.Make Your "Whereas" Statements.List the Articles of the Agreement.Note the Payment Terms in the Investment Contract.Identify Any Deliverables.State the Term and Termination of the Contract.Show the Company Contacts for the Investor and Company.

An investment agreement is a contract between a company and its shareholders and an investor governing a proposed investment in the company.

The purpose of an investment agreement is to document the terms of the investment transaction. The purpose of the shareholders agreement is to set out the relationship between the company and its shareholders.

What to Include in an Investor Agreement The names and addresses of the parties. The purpose of the investment. The date of the investment. The structure of the investment. The signatures of the parties.

FCA regulation 12 CFR § 615.5230(c) requires that each issuance of preferred stock by a Farm Credit System institution must be approved by a majority of the shares voting of each class of equities adversely affected by the preference, voting by class, whether or not such classes are otherwise authorized to vote.