The Salt Lake Utah Investor Rights Agreement is a legally binding document that outlines the specific rights and privileges afforded to investors who are purchasing Series C Preferred Stock shares in Salt Lake City, Utah. This agreement plays a crucial role in protecting the interests of investors while ensuring transparency and fair treatment during the investment process. The Investor Rights Agreement includes various provisions and terms that regulate the relationship between the investors and the company issuing the Series C Preferred Stock shares. It clearly defines the rights and obligations of both parties, setting the groundwork for a mutually beneficial arrangement. This document ensures that investors have a comprehensive understanding of their rights and protections prior to investing their hard-earned capital. Under the Salt Lake Utah Investor Rights Agreement, investors are granted several key rights. These rights may include, but are not limited to: 1. Board Representation: The agreement may stipulate that investors with a significant stake in the company (typically a certain percentage of preferred shares) are entitled to a seat on the company's board of directors. This gives investors a direct say in the strategic decision-making process. 2. Information Rights: The agreement may guarantee that investors have access to relevant and timely information about the company's financial performance, operational activities, and any material events that may impact their investment. This ensures transparency and enables investors to make informed decisions. 3. Preemptive Rights: Investors may be entitled to maintain their proportional ownership in the company by participating in subsequent financing rounds. This gives them the opportunity to purchase additional shares before they are offered to other parties. 4. Anti-Dilution Protection: The agreement may include provisions to protect investors from dilution. If the company conducts a new financing round at a lower valuation than previous rounds, the agreement may grant investors the right to receive additional shares to maintain their ownership percentage. 5. Transfer Restrictions: The agreement may impose certain limitations on the transfer of Series C Preferred Stock shares to protect the company's interests. This ensures that the stock is not easily transferred to competitors or outside parties without the company's consent. It's important to note that while the aforementioned points are common provisions found in many Salt Lake Utah Investor Rights Agreements, the specific terms and conditions can vary. Different versions or variations of the agreement may exist depending on the negotiating power of the parties involved, the stage of the company, and other factors. It's advisable for both the investors and the company to consult legal professionals when drafting or reviewing the agreement to ensure it meets their unique needs and objectives.

Salt Lake Utah Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares

Description

How to fill out Salt Lake Utah Investor Rights Agreement Regarding The Purchase Of Series C Preferred Stock Shares?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Salt Lake Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Therefore, if you need the current version of the Salt Lake Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares:

- Look through the page and verify there is a sample for your region.

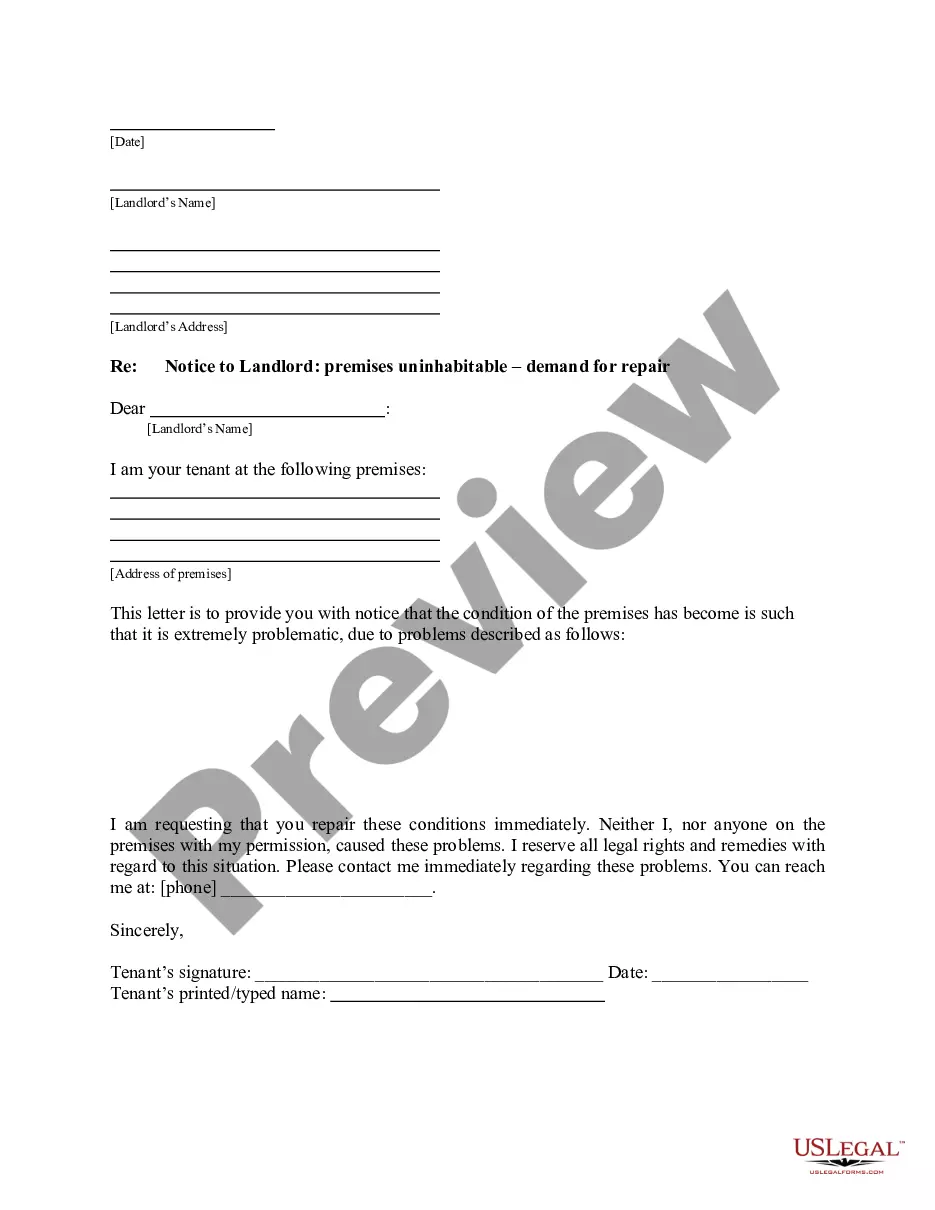

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Salt Lake Investor Rights Agreement regarding the purchase of Series C Preferred Stock shares and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!