Title: Chicago Illinois Acquisition Agreement: Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Asama, Inc., and Ever ford COSEC Ltd Introduction: The Chicago Illinois Acquisition Agreement refers to a legally binding contract between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Asama, Inc., and Ever ford COSEC Ltd. It establishes the terms and conditions regarding the exchange of company stock between the involved parties. Below, we delve into the details of this agreement and explore any potential variations that may exist. 1. Key Parties: The Chicago Illinois Acquisition Agreement involves four prominent entities: a) Orient Packaging Holdings Ltd: A leading packaging and manufacturing company with global operations. b) Gamma Link Enterprises Corp: A multinational corporation specializing in technology solutions. c) Asama, Inc.: An established company focused on providing innovative business services. d) Ever ford COSEC Ltd: A reputable financial services firm specializing in securities and investment-related activities. 2. Exchange of Company Stock: The primary objective of this Acquisition Agreement is the exchange of company stock among the aforementioned entities. This transaction is designed to facilitate strategic partnerships, enhance market presence, obtain shared synergies, and create growth opportunities. The agreement outlines the specific terms and procedures for the stock exchange, ensuring fairness and compliance with all legal requirements. 3. Terms and Conditions: The Chicago Illinois Acquisition Agreement includes various crucial components, such as: a) Valuation and Exchange Ratio: The agreement specifies the valuation method to determine the stock values of each company involved in the exchange. It also defines the exchange ratio, i.e., the number of shares to be exchanged for each company. b) Consideration: The agreement details the consideration offered to the entities involved in the stock exchange. This can include cash, shares of the acquiring company, or a combination of both. c) Legal Obligations: The agreement ensures that all parties adhere to legal obligations, including compliance with regulatory bodies, shareholder consent, and confidentiality requirements. d) Transition and Integration: The Acquisition Agreement may outline the integration process after the exchange, including the role of key personnel and the assimilation of business operations. e) Dispute Resolution: It also addresses dispute resolution mechanisms in case of conflicts arising during or after the acquisition process. Potential Variations of the Agreement: Based on the specific business requirements and goals, there could be various types of Acquisition Agreements: a) Stock-for-Stock Merger: In this scenario, the agreement involves a direct stock swap between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Asama, Inc., and Ever ford COSEC Ltd, without any cash consideration. b) Cash-and-Stock Acquisition: This type of agreement includes a combination of cash and stock consideration, where one or more parties may receive a monetary payment alongside stock in the acquiring company. c) Partial Stock Acquisition: Here, only a portion of the stock of each company is exchanged, allowing the involved parties to retain partial ownership and benefit from potential synergies. Conclusion: The Chicago Illinois Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Asama, Inc., and Ever ford COSEC Ltd provides a comprehensive framework for the exchange of company stock. It outlines the terms and conditions, valuation procedures, legal obligations, and dispute resolution mechanisms. By executing this agreement, the parties involved aim to harness opportunities for growth, strengthen their market positions, and unlock shared business potential in the dynamic landscape of the global market.

Chicago Illinois Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock

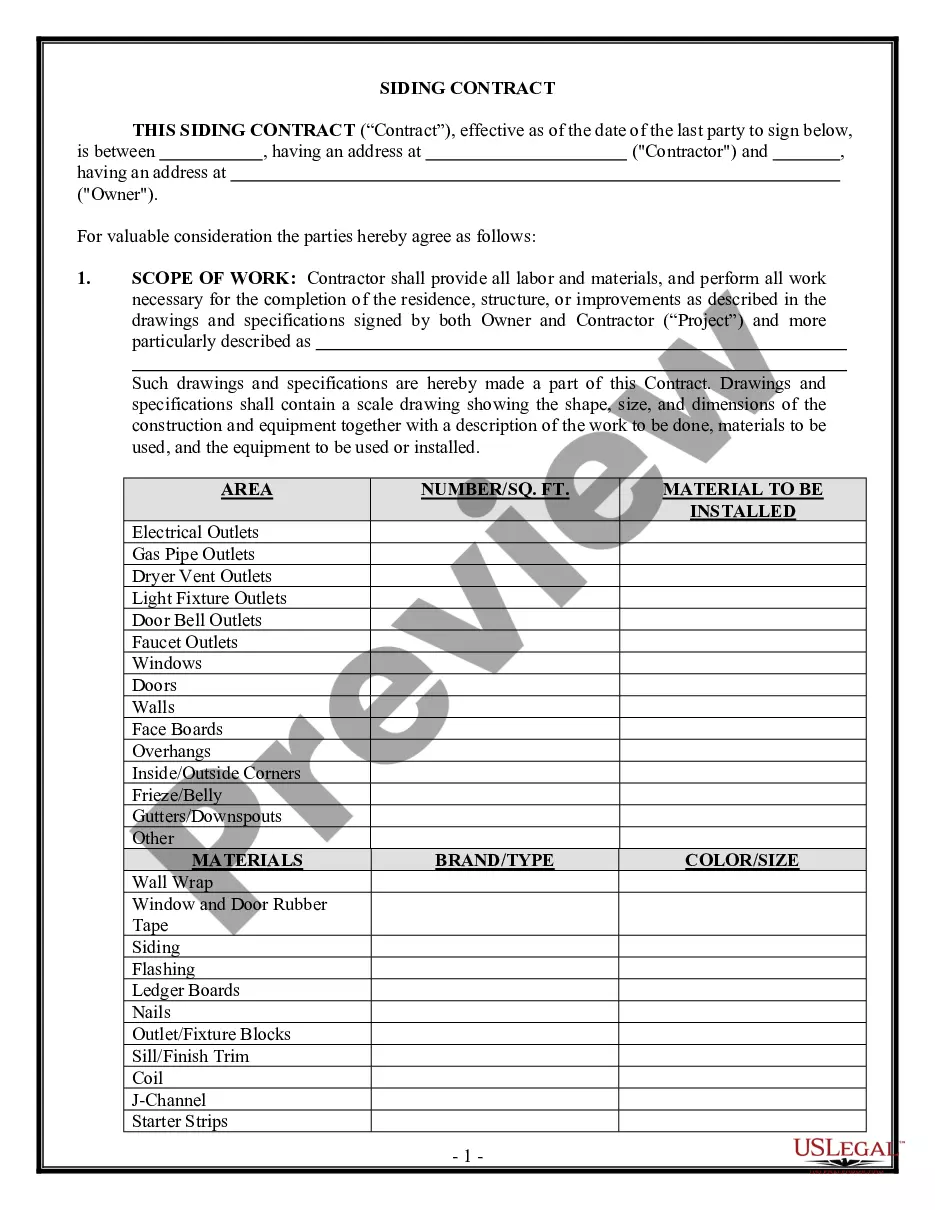

Description

How to fill out Chicago Illinois Acquisition Agreement Between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. And Everford Comsec Ltd Regarding Exchange Of Company Stock?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Chicago Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Chicago Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Chicago Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock:

- Make sure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Chicago Acquisition Agreement between Orient Packaging Holdings Ltd, Gamma Link Enterprises Corp, Acamax, Inc. and Everford Comsec Ltd regarding exchange of company stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!